Via AdventuresInCapitalism.com,

Over the years, I’ve avoided talking much about US politics unless it directly impacts the markets. Longtime readers will know that I’m socially liberal and economically libertarian. As for politicians, I find them all to be liars; playing off human emotions for their own gain. I hate both main parties equally, as I don’t see either party representing what I believe in. With that out of the way, I feel compelled to speak about politics and how it’s about to affect the market.

Let’s start with our Stock Pumper n’ Chief. I had high hopes for Trump. Besides cutting my taxes, he’s accomplished very little. I guess I should have expected that outcome, as our political system exists to perpetuate inertia on key issues. Besides, Trump hasn’t exactly gone out of his way to build up coalitions. In fact, he’s mostly done the opposite. However, my main expectation for Trump, was that he’d be good for the stock market. Even my optimism was too conservative in this regard. For three years, he’s barely let a day go by, without reminding people to buy stocks. He’s met every selloff with frantic tweeting and cajoling of the various government branches. Fed Reserve Chairman Powell has become his piñata. Say what you will about Trump’s Presidency, he’s built one hell of a stock market bubble.

You need to go back to the Jesse Livermore era to find anyone who’s used the media and the political pulpit as successfully to pump stocks…

Now, let’s turn to the upcoming Democratic Party primary.

One of these candidates needs to win this thing and then compete against Trump for President. That’s how the system works. Looking through the list, some are worse than others for the market. Not one of the leading contenders talks about the market in a positive light. In fact, quite a few of the candidates are openly hostile to the market.

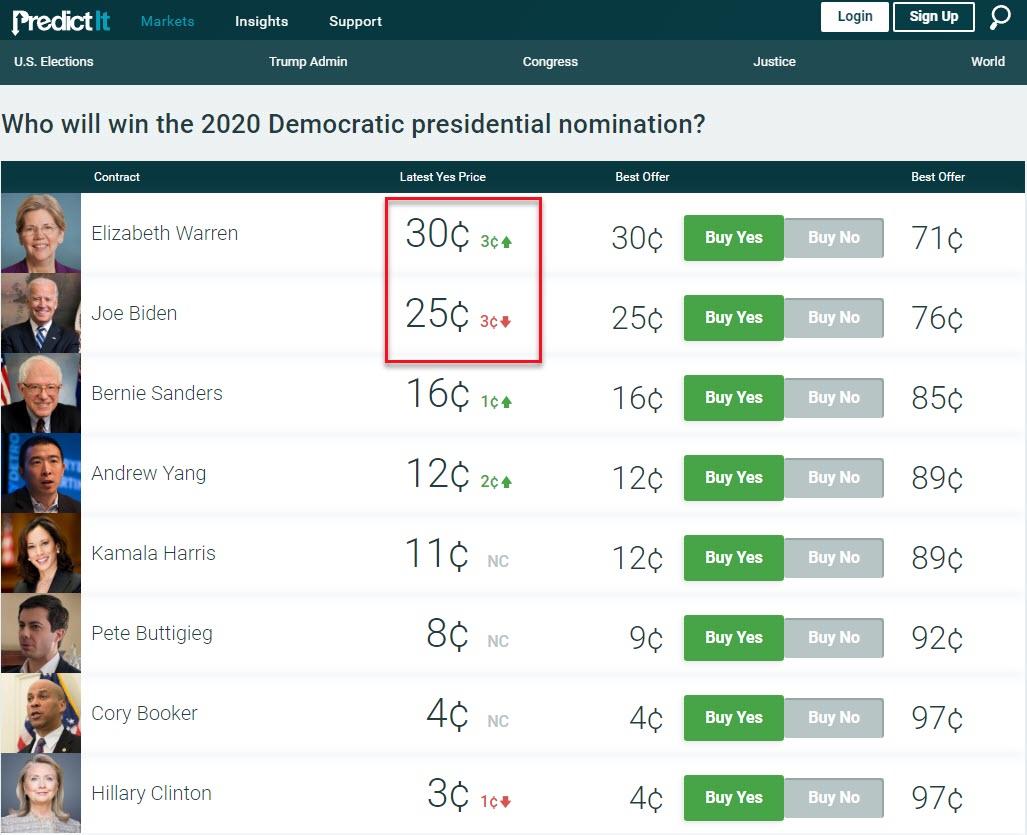

My guess at who wins? It looks increasingly likely that Elizabeth Warren will be the candidate.

Why do I say that? I’m simply looking at the current betting odds.

Using basic Kuppy logic; Bernie just doesn’t seem to have it this time (I don’t know why). Not a day goes by where Biden doesn’t seem to fumble and say or do something dumb. He’s likely a bit too senile to hold it together. No one else is really close in the running. Sure, it’s still early and someone could come from behind and clean up, but that hasn’t been how the last few of these primaries worked once you’re this far into the process. Usually, one of the top contenders goes all the way and the rest of the pack falls further behind.

Could Warren beat Trump in the presidential election? It’s far too early to know. I do know that as we start getting closer to that date, there will be polls. Some of these polls will show her winning. Then chaos will break out in the markets. If Argentina’s stock market could drop by half as the socialist candidate pulled ahead in the primary, why can’t ours? Even the polls showing her ahead in the Democratic Party primaries ought to scare the hell out of the market. This is one of those black swans that no one is talking about, yet it’s increasingly coming into sight.

I don’t want to get into the politics of Warren vs. Trump. I see good and bad policy plans from both. What I want to point out is that Trump is the greatest stock promoter of our generation and Warren is openly hostile to the stock market. When polls show them sort of close, what do you think the market will do? I suspect the market wants to crash anyway. Will Trump blame the crash on Warren – putting this all further into the spotlight?

I’ve spoken a lot about avoiding shorts over the years, but for the first time in a decade, I bought a decent slug of long-dated index puts over the past two weeks – enough to cover all of my long exposure (and then some). Most of my longs are “long-shorts” but experience tells me that if the market drops substantially, my “long-shorts” will drop too – then roar – much as they did in 2009 to 2012. First, I want to be protected for any potential market collapse.

We’re looking at an imploding global economy, combined with a US election that will have major implications for the equity markets. Meanwhile, valuations are at all-time highs, yet our Stock Pumper n’ Chief seems to have lost control of the narrative. This sure seems like the setup for a crash. Watch those predictor polls; a Warren presidency sure isn’t priced into anything.

I don’t like being short, I don’t like watching my puts slowly bleed theta. I always avoid these things. However, investing is about recognizing when there are exceptions to your own rules. I think the market is about to crash. I sure as hell want protection.

* * *

If you enjoyed this post, subscribe for more at http://adventuresincapitalism.com

via ZeroHedge News https://ift.tt/2U3qRgp Tyler Durden