With little on the calendar this week, some may expect a quiet last few days to the summer. They will be disappointed.

As the summer holidays start to draw to a close, next week will see a number of key highlights for markets. As DB’s Cair Nicol writes, data releases to watch out for include Euro Area inflation for August, Germany’s Ifo survey, and from the US there’s the second estimate of Q2 GDP and the Conference Board’s consumer confidence indicator. As the Jackson Hole summit concludes we have a number of other central bank speakers, along with a policy decision from the Bank of Korea. This weekend saw a torrid G7 summit in France, while analysts will also pay close attention to the ongoing government formation process in Italy which may result in the anti-establishment Matteo Salvini taking unilateral power.

The G7 summit saw world leaders gather, and allegedly make some progress beyond just scintillating photo ops such as this one…

… and this one…

… with the main theme of France’s G7 Presidency to combat inequality. There was little progress made there. A number of other leaders were present, including European Council President Tusk, Indian Prime Minister Modi and Australian Prime Minister Morrison. Most notably, the G7 has confirmed it is now a farcical organization as it could not even draft a final communique at the end of the summit to which everyone would agree, and follows the previous year’s G7 summit where the summit ended in disagreement between the US and the other nations present.

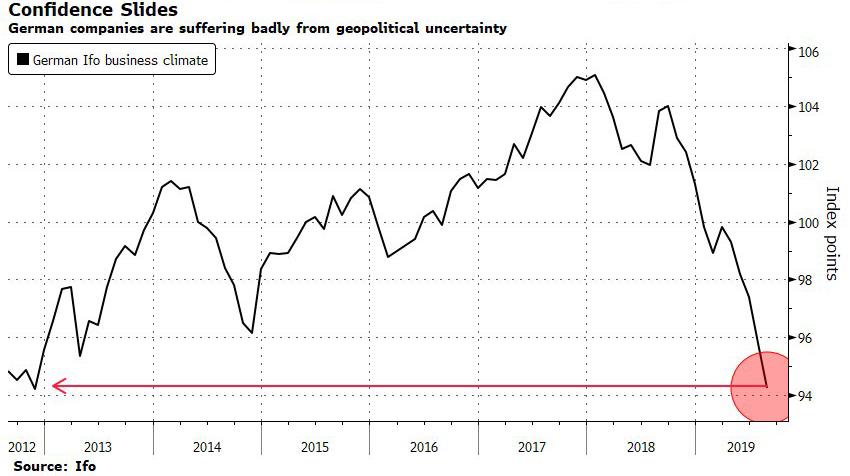

In terms of data releases next week, Monday kicks things off with August’s Ifo survey from Germany, which printed at a new low since the start of 2013. In July, the business climate measure fell to 95.8, and the consensus is expecting a further deterioration to 95.1. The final print was even worse: 94.3.

With the preliminary reading for Q2 GDP in Germany showing a 0.1% contraction, it’ll be worth keeping an eye on whether the Ifo readings do decline further or whether there are any signs of stabilisation. Also with Germany, on Thursday we’ll get the preliminary CPI reading for August, with harmonised inflation expected to rise to 1.2%, from July’s 1.1%, which was the lowest since November 2016.

The other main readings from Europe this week are August’s inflation print, which is expected to come in at 1.0%, in what would be the lowest figure since 2016. There are now less than 3 weeks until the next ECB meeting, so it’ll be worth paying attention. Market expectations of inflation also remain subdued, with five-year forward five-year inflation swaps at 1.2650% at time of writing, some way below the ECB’s target of “below, but close to, 2%”. Also of note are the European Commission’s confidence indicators for August. In July, the economic sentiment reading fell to its lowest level since March 2016, at 102.7, and a further decline to 102.4 is expected.

Turning to the US, one of the main data highlights will be the second estimate of Q2 GDP on Thursday, with expectations for a 2.0% annualised qoq reading, a tenth below the advance estimate of 2.1%. There’ll also be the Conference Board’s consumer confidence reading, which rebounded to an 8-month high in July of 135.7. With the market expecting further rate cuts from the Fed, it’ll be interesting to see whether this rebound is sustained. The consensus expectation is for a decline to 130.0.

With central banks, the annual Jackson Hole conference in Wyoming continues, ending on Saturday. Following Fed Chair Powell’s and Bank of England Governor Carney’s speeches today, Saturday will see remarks from the Reserve Bank of Australia’s Governor Lowe. Later on in the week, Tuesday has the ECB’s Vice President de Guindos and the BoE’s Tenreyro speak, Wednesday has Richmond Fed President Barkin and San Francisco Fed President Daly, and Thursday sees the BoJ’s Suzuki. The Bank of Korea will be making their latest policy decision as well on Friday, where the consensus expectation is for the Base Rate to remain at 1.50%, following the decision last month to cut rates by 25bps.

Finally, other things to watch out for include the continued process of government formation in Italy, which is expected to continue well into the week. The anti-establishment Five Star Movement and the centre-left Democratic Party will be discussing whether a government can be formed that would keep the League’s Matteo Salvini out of power. Monday is a bank holiday in the UK, making dismal market liquidity even more terrible.

Summary of key events in the week ahead:

- Monday: It’s a light start to the week with Spain’s July PPI and Germany’s August IFO survey due in the morning. In the US, there’s July’s Chicago Fed national activity index, preliminary July durable and capital good orders, and August’s Dallas Fed manufacturing activity index.

- Tuesday: Data releases for the day include Japan’s July services PPI, China’s July industrial profits, Germany’s final Q2 GDP and France’s August confidence indicators. Meanwhile in the US, we get Q2 house price index, June FHFA house price index and S&P CoreLogic house price index along with August Richmond Fed manufacturing index and Conference board confidence indicators.

- Wednesday: It’s another light day for data with releases of note being Germany’s September GfK consumer confidence, the Euro Area’s M3 money supply and in the US, we have the latest weekly mortgage applications. Aside from the data, the Fed’s Barkin and Daly are due to speak.

- Thursday: It’s a busy day for data with releases including preliminary August CPI in Spain and Germany, France’s final Q2 GDP and July consumer spending, the Euro Area’s August confidence indicators and Germany’s August unemployment report. In the US, we are due to get July advance goods trade balance, retail inventories, wholesale inventories and pending home sales along with the latest weekly initial and continuing claims data. The BoJ’s Suzuki will also speak overnight.

- Friday: It’s another busy day for data with key releases of note being preliminary August CPI in France, Italy and the Euro Area, along with July’s core PCE in the US. We are also due to get Japan’s July retail sales and industrial production, France’s July PPI, Italy’s final Q2 GDP and the Euro Area’s July unemployment rate along with the UK’s August GfK consumer confidence and July consumer credit, mortgage approvals and money supply data. In the US, we are due to get July personal income and spending data along with August MNI Chicago PMI and final University of Michigan survey.

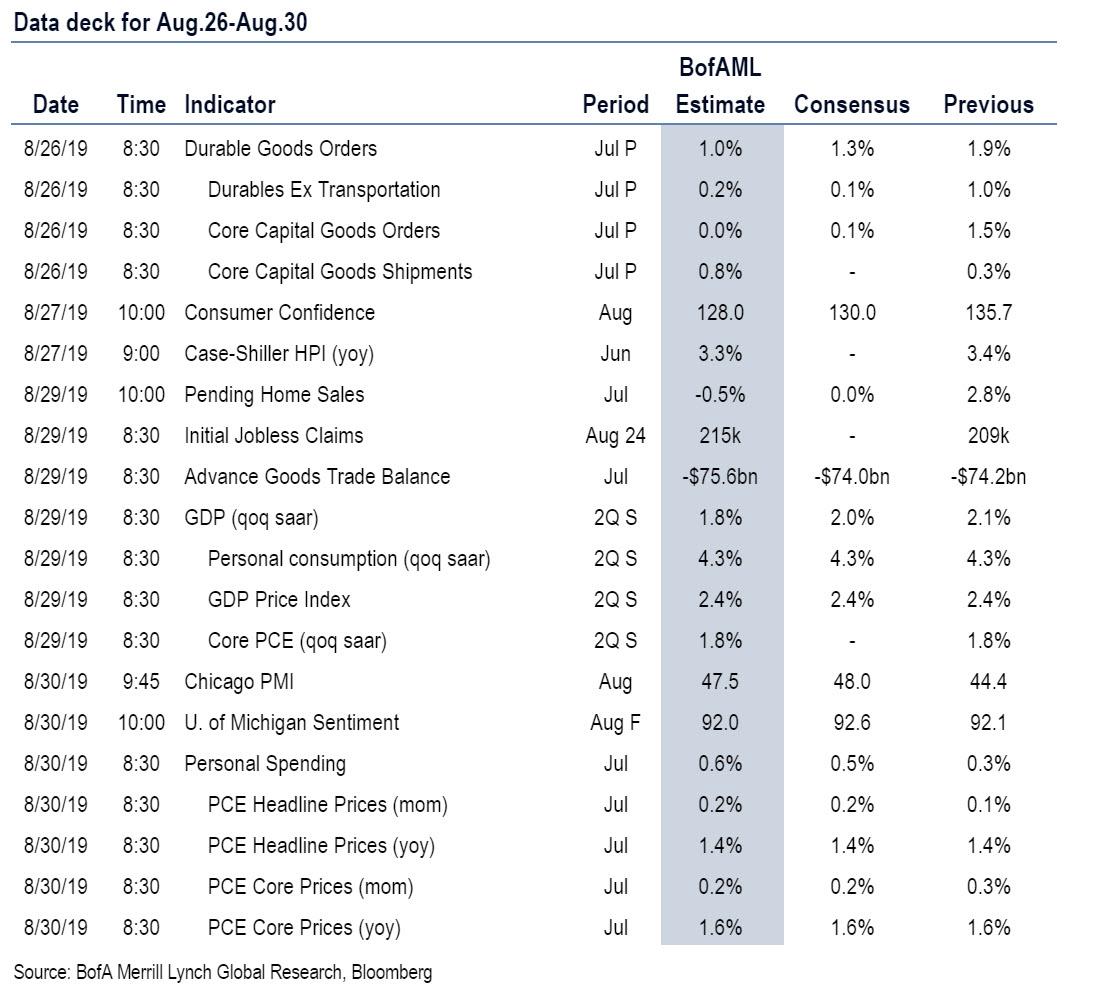

Finally, looking only at the US, Goldman notes that the key economic data releases this week are the durable goods report on Monday, the second vintage of Q2 GDP on Thursday and the PCE report on Friday. There are two scheduled speaking engagements from Fed officials this week, both on Wednesday.

Monday, August 26

- 8:30 AM Durable goods orders, July preliminary (GS +1.2%, consensus +1.0%, last +1.9%); Durable goods orders ex-transportation, July preliminary (GS flat, consensus flat, last +1.0%); Core capital goods orders, July preliminary (GS -0.1%, consensus flat, last +1.5%); Core capital goods shipments, July preliminary (GS -0.1%, consensus +0.3%, last +0.3%): We expect durable goods orders rose by 1.2% in July, mostly reflecting an increase in Boeing aircraft orders. We also estimate slight declines in the core capex measures reflecting weakness in global manufacturing and regional surveys.

Tuesday, August 27

- 09:00 AM S&P/Case-Shiller 20-city home price index, June (GS +0.2%, consensus +0.1%, last +0.1%); We estimate the S&P/Case-Shiller 20-city home price index increased 0.2% in June, following a 0.1% gain in May. Our forecast reflects the modest appreciation in other home price indices such as the CoreLogic house price index in June.

- 09:00 AM FHFA house price index, June (consensus +0.2%, last +0.1%)

- 10:00 AM Richmond Fed manufacturing index, August (consensus -4, last -12)

- 10:00 AM Conference Board consumer confidence, August (GS 128.0, consensus 129.0, last 135.7): We estimate that the Conference Board consumer confidence index declined by 7.7pt to 128.0 in August, retracing most of its July increase and reflecting lower stock prices and weakness in other confidence measures.

Wednesday, August 28

- 12:20 PM Richmond Fed President Barkin (FOMC non-voter) speaks: Richmond Fed President Thomas Barkin will give a speech to the West Virginia Chamber of Commerce. Audience Q&A is expected.

- 05:30 PM San Francisco Fed President Daly (FOMC non-voter) speaks: San Francisco Fed President Daly will speak on inflation targeting at a conference in Wellington, New Zealand. Audience Q&A is expected.

Thursday, August 29

- 08:30 AM GDP (second), Q2 (GS +1.9%, consensus +2.0%, last +2.1%); Personal consumption, Q2 (GS +4.2%, consensus +4.3%, last +4.3%): We expect a two-tenths downward revision in the second estimate of Q2 GDP to +1.9% reflecting expected downward revisions to personal consumption, inventory investment, and government spending.

- 08:30 AM Advance goods trade balance, July (GS -$75.5bn, consensus -$74.6bn, last -$74.2bn): We estimate that the goods trade deficit rebounded to $75.5bn in July, following an increase in inbound container traffic and a decline in outbound traffic. July was the first full month that List 3 imports ($200bn) from China were subject to a higher 25% tariff rate (from 10% previously).

- 08:30 AM Wholesale inventories, July preliminary (consensus +0.2%, last flat): Retail inventories, July (consensus +0.2%, last -0.3%)

- 08:30 AM Initial jobless claims, week ended August 24 (GS 215k, consensus 215k, last 209k): Continuing jobless claims, week ended August 17 (last 1,674k): We estimate jobless claims rebounded by 6k to 215k in the week ended August 24 after declining by 12k in the prior week.

- 10:00 AM Pending home sales, July (GS -0.5%, consensus flat, last +2.8%): We estimate that pending home sales declined 0.5% in July based on regional home sales data, following a 2.8% increase in June. We have found pending home sales to be a useful leading indicator of existing home sales with a one- to two-month lag.

Friday, August 30

- 08:30 AM Personal income, July (GS +0.2%, consensus +0.3%, last +0.4%); Personal spending, July (GS +0.6%, consensus +0.5%, last +0.3%); PCE price index, July (GS +0.20%, consensus +0.2%, last +0.12%); Core PCE price index, July (GS +0.16%, consensus +0.2%, last +0.247%); PCE price index (yoy), July (GS +1.39%, consensus +1.4%, last +1.35%); Core PCE price index (yoy), July (GS +1.59%, consensus +1.6%, last +1.60%): Based on details in the PPI, CPI, and import price reports, we forecast that the core PCE index rose 0.16% month-over-month in July, or 1.59% from a year ago. Additionally, we expect that the headline PCE index increased 0.20% in July, or 1.39% from a year earlier. We expect a 0.2% increase in personal income in July and a 0.6% increase in personal spending.

- 09:45 AM Chicago PMI, August (GS 47.0, consensus 47.9, last 44.4); We estimate that the Chicago PMI rebounded somewhat but remained in contractionary territory in August, as weak global manufacturing growth likely continues to weigh on the index.

- 10:00 AM University of Michigan consumer sentiment, August final (GS 92.6, consensus 92.3, last 92.1): We expect the University of Michigan consumer sentiment to edge higher from the preliminary estimate for August, which declined 6.3pt likely reflecting a drag from trade war escalation and stock market volatility. The report’s measure of 5- to 10-year inflation expectations edged up by one tenth to 2.6% in the preliminary report for August.

Source: Deutsche Bank, BofA, Goldman

via ZeroHedge News https://ift.tt/33Vs3ad Tyler Durden