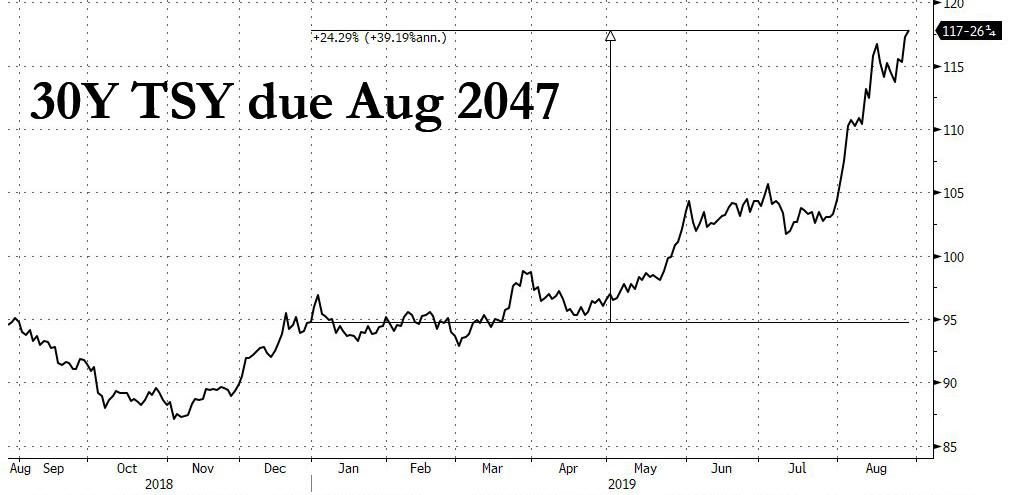

While most US traders were deep in REM sleep, at precisely 3:30am ET, we noted yet another historic moment for the US yield curve: the yield on the 30Y Treasury dropped to an all time low.

U.S. 30-YEAR BOND YIELD FALLS TO NEW RECORD LOW OF 1.90%

— zerohedge (@zerohedge) August 28, 2019

And indeed, as BMO’s rates strategy duo of Ian Lyngen and Jon Hill notes, an extension of the grinding bid for duration was the primary development during the overnight session and it was one which has brought 30-year yields to new record lows.

With 1.907% now representing the lowest rate ever for the long bond, we remain biased for a break even lower as the final week of August continues to unfold. Similarly, the local low in 10s at 1.444% is likely to be challenged given the bullish backdrop that remains well in place for Treasuries.

This, as BMO notes, bodes well for an ongoing flattening of the yield curve, which was further observed after today’s very strong 5Y auction.

But back to the outperformance of the long bond, which as Lyngen points out “has been remarkable on a number of levels and the overnight move adds even more to the bullishness.” Additionally, as has been the case for much of the past month, the strong bid emerged in Asia – as Japanese and Taiwan lifers rushed to bid up the paper – and was then extended in London, suggesting a variety of pockets of demand for 30-year Treasury yields below 2.0%.

And here an important aside: as the BMO analysts point out, the 30s are now yielding less than the S&P500’s dividend yield of 1.98% – for first time since 2009 and represents “yet another potential recessionary indicator, as if more were needed to stoke concerns of a meaningful slowdown.”

And while the move in yield may not sound like much, as a result of the convexity of the ultra long-dated paper and the massive duration, the move means that a typical 30Y bond has now returned 25% in cash terms YTD, making it one of the best performing assets in the world.

Returning to the most recent leg, BMO notes that “the bid has been accompanied by a constructive cross in stochastics which indicates there remains ample room to press the move. In addition, with overnight volumes at 1.4x the norms and an impressive 8% marketshare for 30s, we’ll suggest a 1-handle is more sustainable than a late-summer’s bounce might imply.”

So does the Canadian bank think that more gains are on deck? You bet. First, it’s the fact that the rally took place without any actual catalyst:

We’re certainly cognizant that today’s absolute dearth of economic data doesn’t offer much in the way of incremental trading direction; this is in part supportive of our logic for an extension of the flattening bid for Treasuries. Call it the path of least resistance and a world of yield inertia.

Then, there are the seasonals:

Given the relevance of the constructive seasonals thus far this summer, we’re content to anticipate the rally continues as the real challenge to this historical pattern doesn’t materialize until late-September when higher yields become the norm.

Also notable, the month-end moves, which were expected to be bond bearish, did not materialize; quite the contrary:

Let us not forget the month-end considerations; after all August did see new 10s and 30s and despite the Fed’s return to outright purchases in the Treasury market there are plenty of natural buyers needing to simply stay neutral to the benchmark.

Meanwhile, growing geopolitical concerns will only make the flight to safety more acute (even as stocks inexplicably ramp higher on what appears to be pension month end rebalancing and/or a last gasp of stock buybacks before the buyback blackout window closes):

The British question continues to plague the global economic outlook; to put it mildly. PM Johnson’s attempt have parliament prorogued (aka suspended, who knew?) from mid-Sept to mid-Oct has been seen as an overt effort to orchestrate a no-deal Brexit and was yet another reason to chase the flight-to-quality that has rebased all US rates well below 2.0% at this stage. With limited insight into the inner workings of the UK political machine; the October 31st deadline does point toward an entirely different character of our annual Día de Muertos celebration.

It’s not just Brexit: Italian politics, the trade war, a stumbling global economy, and the Fed’s ‘uncertainties’ all remain essential to the bullish underpinnings in the Treasury market, according to Lyngen/Hill.

And while the duo would like to assume there will be a resolution on one or all of these issues in the near- or medium-term, the trajectory evident in the current environment would suggest otherwise.

With this in mind, we remain very much in the buy-the-dip mode ahead of the looming month-end and suspect this proves prudent even as September gets underway.

But the biggest reason why yields are likely to keep drifting lower is that virtually all experts are either pressing their shorts, or convinced that any minute now will be the “right time to short”, which simply means that wave after wave of shorts will continue to get stopped out.

via ZeroHedge News https://ift.tt/2PjeP3J Tyler Durden