Authored by Mike Shedlock via MishTalk,

Democrat candidates are lining up with numerous radical schemes to take your money.

Cornucopia of Schemes to Take Your Money

The Democrats are competing with each other with ideas to take your money and waste it.

For example, Senator Ron Wyden proposes taxing your money before you even have it.

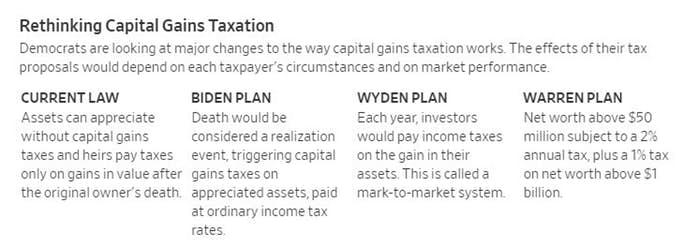

Rethinking Capital Gains

Please consider Democrats’ Emerging Tax Idea: Look Beyond Income, Target Wealth.

Biden Plan

Former Vice President Joe Biden, the candidate most prominently picking up where Mr. Obama left off, has proposed repealing stepped-up basis. Taxing unrealized gains at death could let Congress raise the capital gains rate to 50% before revenue from it would start to drop, according to the Tax Policy Center, because investors would no longer delay sales in hopes of a zero tax bill when they die.

And indeed, Mr. Biden has proposed doubling the income-tax rate to 40% on capital gains for taxpayers with incomes of $1 million or more.

But for Democrats, repealing stepped-up basis has drawbacks. Much of the money wouldn’t come in for years, until people died. The Treasury Department estimated a plan Mr. Obama put out in 2016 would generate $235 billion over a decade, less than 10% of what advisers to Sen. Warren’s campaign say her tax plan would raise.

That lag raises another risk. Wealthy taxpayers would have incentives to get Congress to reverse the tax before their heirs face it.

Wyden Plan

Instead of attacking favorable treatment of inherited assets, Mr. Wyden goes after the other main principle of capital-gains taxation—that gains must be realized before taxes are imposed.

The Oregon senator is designing a “mark-to-market” system. Annual increases in the value of people’s assets would be taxed as income, even if the assets aren’t sold. Someone who owned stock that was worth $400 million on Jan. 1 but $500 million on Dec. 31 would add $100 million to income on his or her tax return.

For the government, money would start flowing in immediately. The tax would hit every year, not just when an asset-holder died. Mr. Wyden would apply this regime to just the top 0.3% of taxpayers, said spokeswoman Ashley Schapitl.

There are serious challenges. Revenue could be volatile as markets rise and fall. Also, the IRS would determine asset increases annually, requiring baseline values and ways to measure change. That’s easy for stocks and bonds but far more complicated for private businesses or artwork.

The rules would have to address how to treat assets that lose instead of gain value in a year, and how taxpayers would raise cash to pay taxes on assets they didn’t sell. Under Mr. Castro’s proposal, losses could be used to offset other taxes or carried forward to future years.

Warren Plan

The most ambitious plan comes from Sen. Warren of Massachusetts, whose annual wealth tax would fund spending proposals such as universal child care and student-loan forgiveness.

The ultra-rich would pay whether they make money or not, whether they sell assets or not and whether their assets are growing or shrinking.

Ms. Warren, who draws cheers at campaign events when she mentions the tax, would impose a 2% tax each year on individuals’ assets above $50 million and a further 1% on assets above $1 billion. Fellow candidate Beto O’Rourke has also backed a wealth tax, and it is one of Vermont Sen. Bernie Sanders ’ options for financing Medicare-for-All.

Won’t Stop There

Expect more and more radical ideas to pay for nonsense like the “Green New Deal”, an idea that will cost an estimated $51 to $93 trillion.

Elizabeth Warren backs the Green New Deal so she is the most desperate to raise the most money the fastest.

They claim this a tax only on the wealthiest citizens. It won’t stop there. It never does.

via ZeroHedge News https://ift.tt/32dFd0C Tyler Durden