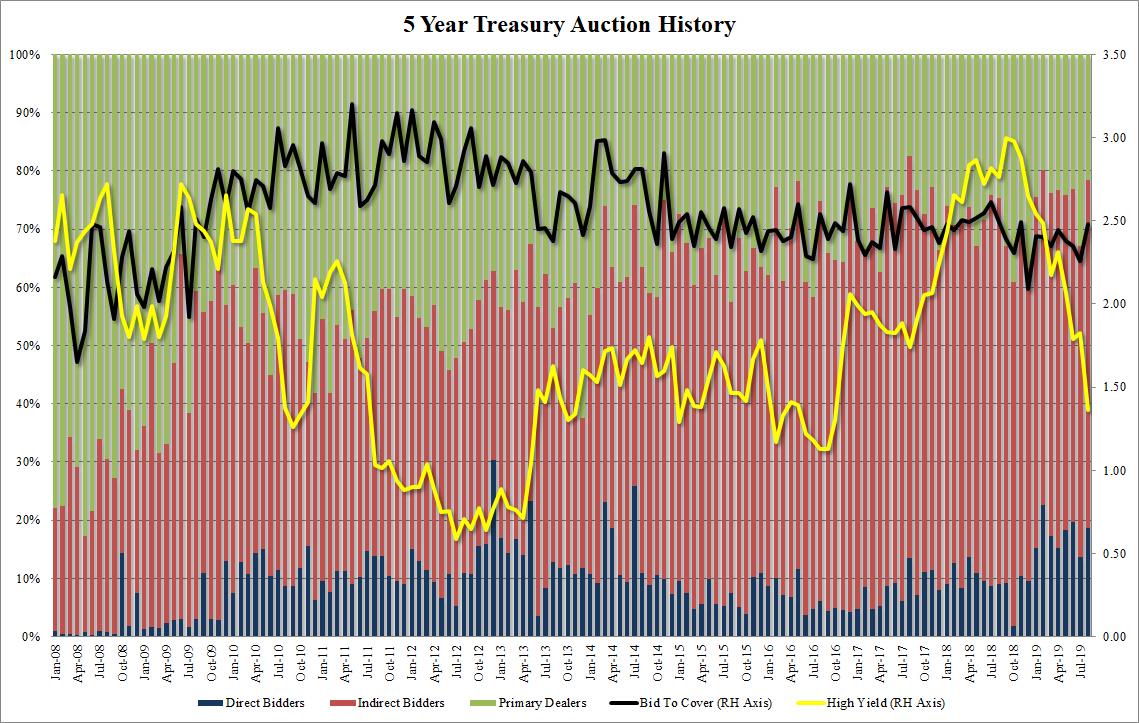

One day after the US sold 2Y Treasurys at a yield that was higher than the market yield on 10Y paper, i.e., the 2s10s yield curve inverted, for the first time since the financial crisis, the Treasury sold $41 billion in 5 Year paper, and if yesterday’s 2Y auction was a small tail, today’s 5Y auction was remarkably strong because despite the lowest yield since October 2016, at 1.365%, the demand was so acute the auction stopped 1 basis point through the When Issued of 1.375%.

The strong metric continued with the bid to cover, which rebounded from 2.26 to 2.48, the highest since August 2018, and well above the 6 auction average of 2.36. Meanwhile, the internals were sterling as well, with Indirects taking down 59.7%, a jump from last month’s 53.4%, the highest since April and above the recent average of 57.7%, leaving Directs with 18.7%, above the 17.8% six auction average, and finally Dealers left holding just 21.6%, the lowest since February.

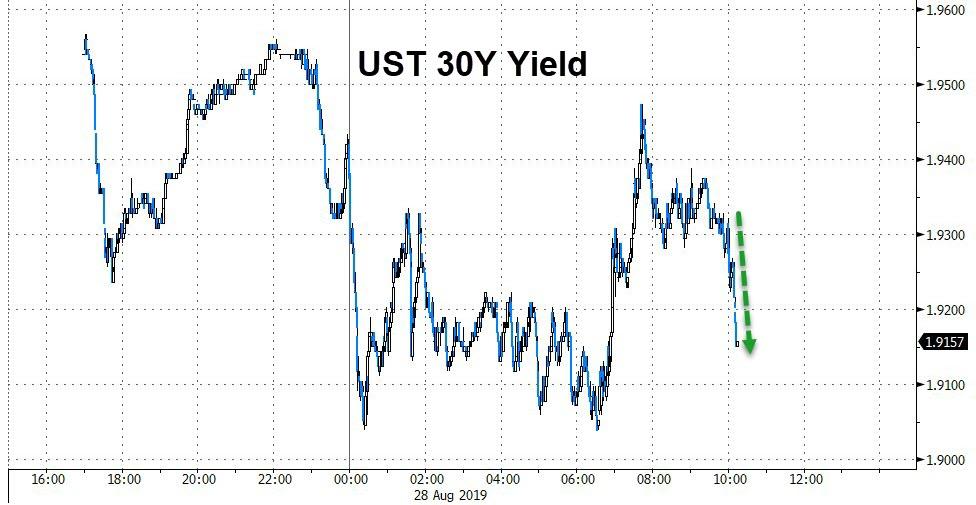

Overall, a very strong auction, with the market surprised by just how impressive demand was, in turn sending 10Y yields sliding from 1.465% before the auction some 2bps lower after, to 1.446% after, with the 30Y enjoying a similar rally, and also hitting stocks which today are trading inversely to Tsys.

via ZeroHedge News https://ift.tt/32bi7aS Tyler Durden