For years, it was conventional wisdom that the most financial challenged state in the US – whether it comes to overall debt burden, outlays, tax collections, underfunded pension and retirement obligations, or simply credit rating – was Illinois, followed closely by New Jersey.

However, at least according to New Jersey’s Senate president, conventional wisdom is wrong.

In an interview with Bloomberg, Senator Stephen Sweeney, a Democrat, said that that credit-rating companies may be underestimating the severity of the state’s financial strains by giving it the second-lowest grade after Illinois.

“We are in worse shape than Illinois,” Sweeney said. “We are not investing in education, we are not investing in the areas that we want because all the money is going to pensions and health care.”

As Bloomberg notes, these comments underscore the persistent fiscal pressure on New Jersey, a high-tax state contending with massive debts to employee pension funds after years of failing to set aside enough to cover the $212 billion of benefits that have been promised. As extensively discussed in the past, New Jersey’s retirement system had about $82 billion of assets in 2018, only 38% of what it needs to cover checks that are owed in the decades ahead. That’s lower than any other state system in the U.S., according to data compiled by Bloomberg. The state’s obligation for retirees’ health care benefits adds another $90.5 billion. The state’s solution? Raise expected pension fund returns from 7.0% to 7.5%!

Wall Street and rating companies have expressed concern that funding for state services is being consumed by the pensions, which investors have said aren’t even at the tread water level. That’s the amount that the state needs to put in each year to keep up the liabilities from growing. But with the state’s taxes already among the highest in the U.S., it’s difficult to raise new revenue.

Adding insult to injury, the state is banned from borrowing to balance its budget, and it can only issue general obligation bonds through voter approval.

The outspoken Sweeney, New Jersey’s highest-ranking state lawmaker and career ironworker, has clashed with Governor Phil Murphy, his fellow Democrat, on several issues, successfully blocking the governor’s pitches for higher income-tax rates on millionaires, a smart move in light of several prominent departures by some of the state’s richest citizens such as David Tepper, who moved to less tax burdensome pastures in recent years.

Ironically, it is Sweeney who also pushed for less costly employee benefits, a hard sell with unionized employees who were key to Murphy’s election. In 2017, Sweeney resisted a push to unseat him by the New Jersey Education Association in what campaign-finance officials aptly enough, called the most expensive legislative race in state history. In May, after Sweeney proposed a series of cost-cutting health and pension bills, the teachers union vowed to fight “a terrible trend” and work with the governor.

As a result of this ongoing financial and political chaos, and absent some form of state bailout, the worst case scenario awaits the millions of state retirees. Karel Citroen, head of municipal-bond research at Conning, said he could foresee a situation in Illinois or New Jersey where “its pension fund essentially has no assets to cover its liabilities and benefits are paid from its annual budget.”

“I wouldn’t be surprised if one of the states ended up in a situation like Puerto Rico in terms of their pensions,” he said, referring to the bankrupt island’s depleted retirement system. “The way it has been going over the last ten years clearly hasn’t worked. States have pushed out their amortization but haven’t really addressed the benefits or made real step ups in their contributions.”

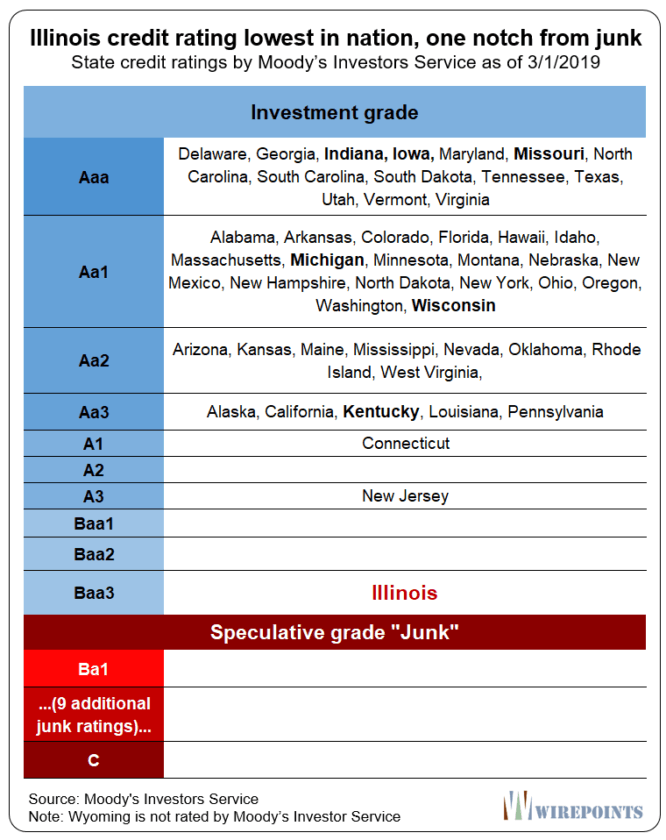

As shown in the top chart, New Jersey remains rated A3 by Moody’s, as well as A- by S&P A by Fitch. Those are the second-lowest ratings for a U.S. state after Illinois, which is one level above junk by Moody’s and S&P.

“Why am I yelling fire in a crowded theater and everyone else is saying that we’re fine,” Sweeney said. “We’re not. And it’s going to go up in flames. I would rather not go down in memory as the guy that told everyone the pension system was going to collapse and be found that I was correct.”

Well, maybe Sweeney won’t be “that” guy, but someone else will unfortunately have to deliver the very bad news to what will soon be a lot of furious retirees who learn that their retirement eggs has been suddenly cut in half… or worse.

via ZeroHedge News https://ift.tt/2zr1F9Z Tyler Durden