Authored by Steen Jakobsen via Saxobank,

Any deal on Brexit still very unlikely – highest probability is yet another delay to allow for General Election and maybe even new referendum.

As a public speaker for over 30 years I sort of know most of the questions from an international investment audience ahead of time: The classic is always: Where is Gold going? Since 2016 two new ones have appeared: Crypto-currencies and Brexit…

The answers has consistently been: up, ultimately government will use and adopt crypto to maintain power over money supply and increased control over tax but most important for this piece: Brexit: it’s a never ending story, which will see delay upon delay.

Or in more common language: “It’s a pissing contest.”

This has been my fixed and somewhat disappointing answer for this whole period – now today the UK Parliament is at it again tabling ‘a riot’ against PM Johnson and his hard exit attempt. My answer today? See above! More time spent on no incoming decision which will leave UK economy vulnerable and probably move UK very close to recession by Q4-2019 and into 2020.

Nothing will change because the division on Brexit is not only not by party line but also by age group, income bracket, geographic position and not least by feelings. Hence satisfying all those sub-components with any direction or decision is impossible, short of a solution, moving to a General Election is the only alternative and something which is not only a risk for Conservative UK, but also probably end up doing….. absolutely nothing for Brexit decision except costing more time.

Meanwhile the UK economy goes from bad to worse – but hang on! Consumer are doing fine! Yes for now, but probably more likely hoarding/spending ahead of the ever threaten dead-line for hard-Brexit.

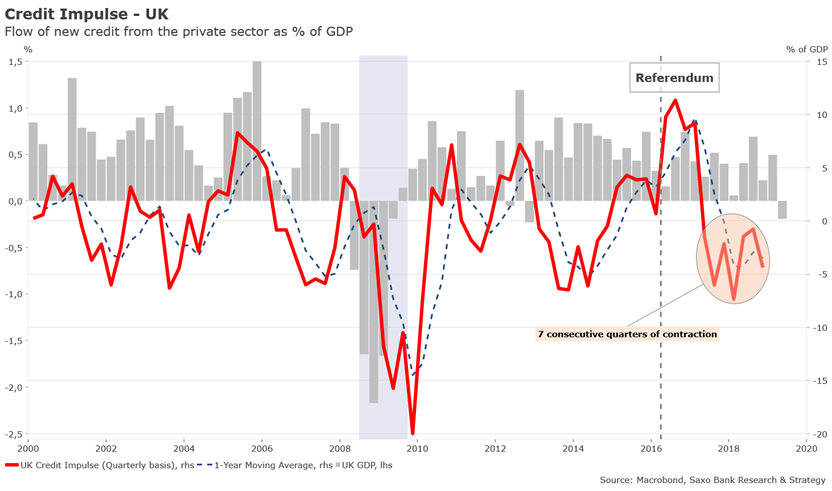

At Saxo Bank Strategy we have few rules and no religions, except… We firmly believe in a world of stimulus entirely driven by debt, the net change of credit will drive the future growth – The Credit Impulse sits center for our research and here the bad news become even more concerning as our Head of Economics, Christopher Dembik, wrote in late August:

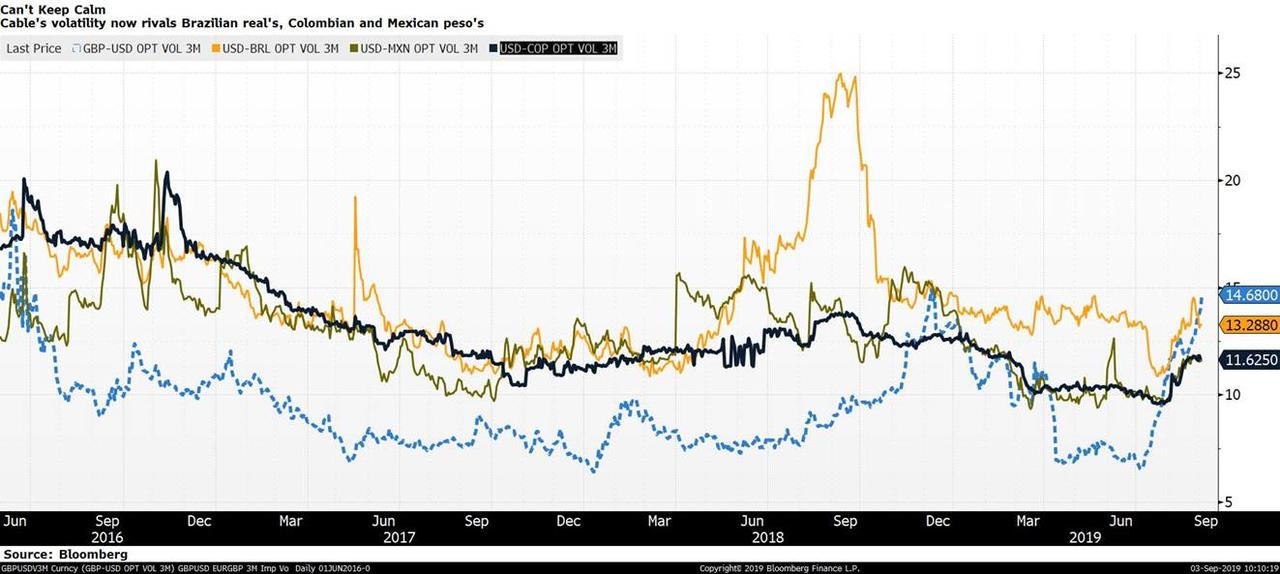

UK economy is in its SEVENTH quarter of contraction in credit!!! The credit impulse LEADS the economy by nine to twelve month, hence for the next 18 month there is no POSITIVE IMPULSE from credit coming to the Islands of Great Britain! This will leave only one tool in the box: A further devaluation of the GBP vs. USD and Europe. This position GBP, is from my travel, the most underowned position anywhere. Everyone sees “upside in GBP” – but it ignores the pure drivers of currency rates: Capital Flow, net credit and safety.

We have been underweight GBP since Q4 last year and maintain this underweight with a minimum target of 1.1000 and probably if global conditions continues to run the world short of US Dollar funding even parity. The UK is no longer a safe haven, changed tax laws, Brexit and now also a potential Communist Corbyn government scare not only investors but also future generations.

The Financial Times this weekend had lengthy piece on what a Corbyn government would mean: Jeremy Corbyn’s plan to rewrite the rules of the UK economy – Let me give you a few indications:

-

“We have to do what Thatcher did in reverse,” says Jon Lansman, founder of the Corbyn support group Momentum. “We have to take decisive steps to both achieve a significant redistribution and create a constituency of an awful lot of people with an obvious stake in a continuing Labour government.

-

At the heart of everything is one word: redistribution. Redistribution of income, assets, ownership and power. The mission is to shift power from capital to labour, wresting control from shareholders, landlords and other vested interests and putting it in the hands of workers, consumers and tenants. “We have to rewrite the rules of our economy,” says Mr McDonnell. “Change is coming.”

-

…the nationalisation of rail, water, mail and electricity distribution companies; significantly higher taxes on the rich; the enforced transfer of 10 per cent of shares in every big company to workers; sweeping reform of tenant rights; and huge borrowing to fund public investment.

We are making no projection on whether we get a General Election in October, or who wins it, but the tone is changing in European and global politics towards a further move to the left as per my Twitter this morning:

“We have strong conviction that the present policy of “more monetary stimulus” will fuel a big move to the Left politically:

We see next macro theme as a 1970s repeat: Big government, social riots, supply constraints, stagflation, breaking up of global framework and Breitner hair?“

Welcome to the EMERGING Market status UK!!!! GBP volatility higher than MXN, BRL and COP…

via ZeroHedge News https://ift.tt/2HFCSUg Tyler Durden