Apple’s Biggest Problem: Its “Buzz” Peaked Back In 2012

Apple just concluded its latest – and quite forgettable – iPhone launch presentation, where the company made the following “major” announcements (via BBG):

- Cameras, cameras, cameras: big camera updates coming the iPhone 11 and iPhone 11 Pro lines.

- Pricing: The iPhone 11 is $50 cheaper than the iPhone XR, coming in at $700. The iPhone 11 Pro prices are the same $1,000 and $1,100 as the iPhone XS and XS Max.

- The big Apple Watch updates came last year. The new models look the same, but have always-on screens.

- The iPad isn’t going to move the needle — a slightly bigger screen, but not much else.

- $4.99 is Apple’s new services price: TV+ and Apple Arcade could be worthwhile.

And while Apple’s stocks was largely unchanged following the event, it did spark a question, first addressed by DataTrek’s Nicholas Colas: how much do global consumers actually care about Apple’s product suite? This isn’t just a question of how many Apple fanboys/girls there. After all:

- AAPL is 3.8% of the S&P 500, a larger weighting than Utilities (3.4%), Real Estate (3.2%) or Materials (2.7%). Apple’s performance this week could either get the S&P closer to its all time highs (just 1.5% from here), or effectively cap US large cap returns in September.

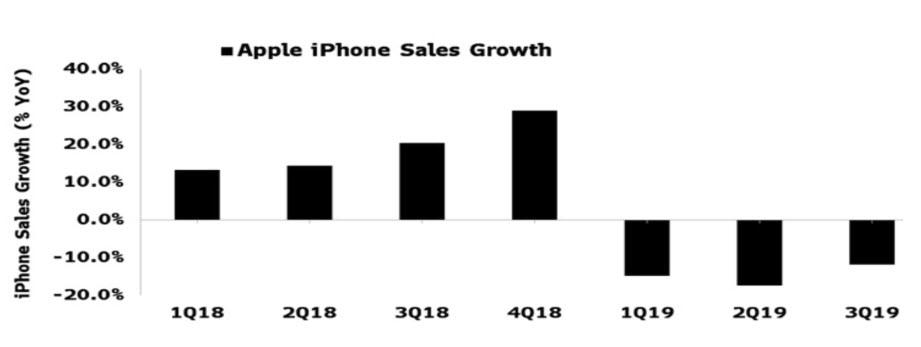

- AAPL is 16.9% of the S&P Tech sector, second only to Microsoft (19.4%). AAPL has been a drag on sector performance since the 2018 highs; MSFT has been the real source of the group’s strong 1-year performance.

To answer this question, Colas looked at the global volume of Google searches for 4 key Apple products: “iphone”, “apple watch”, “macbook” and “homepod”:

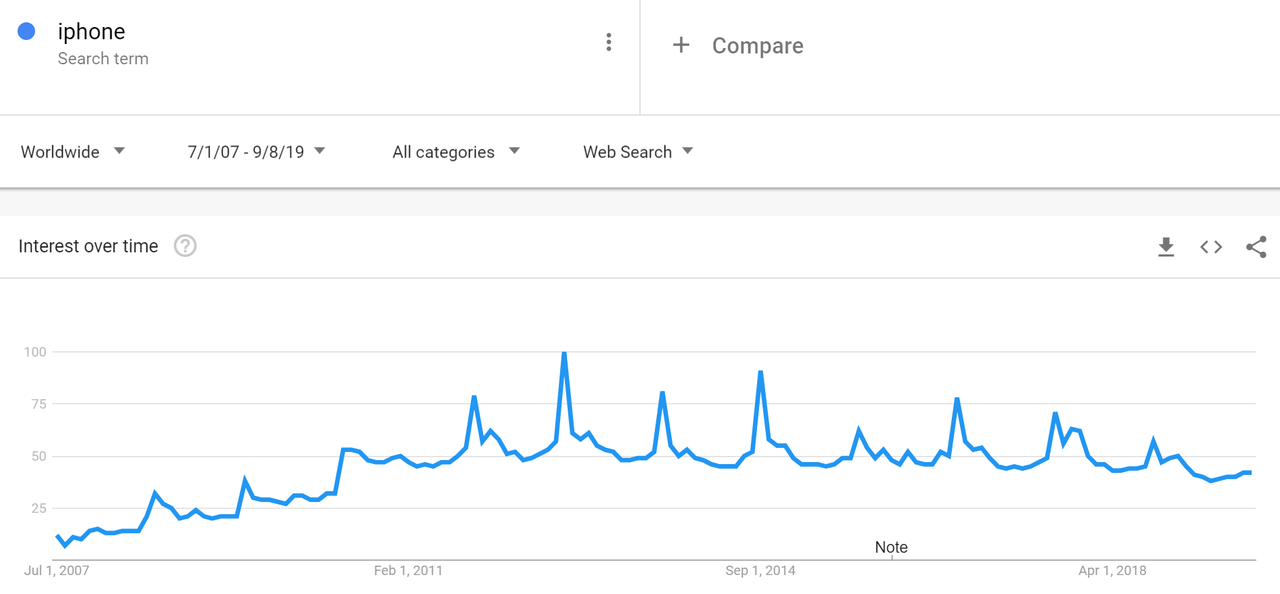

#1: Google searches for “iphone” peaked in September 2012 with the launch of the 5th model. Google searches for “iphone” last September for the XS model launch were 43% lower than that high water mark. Current search volume is at a new low back to 2010.

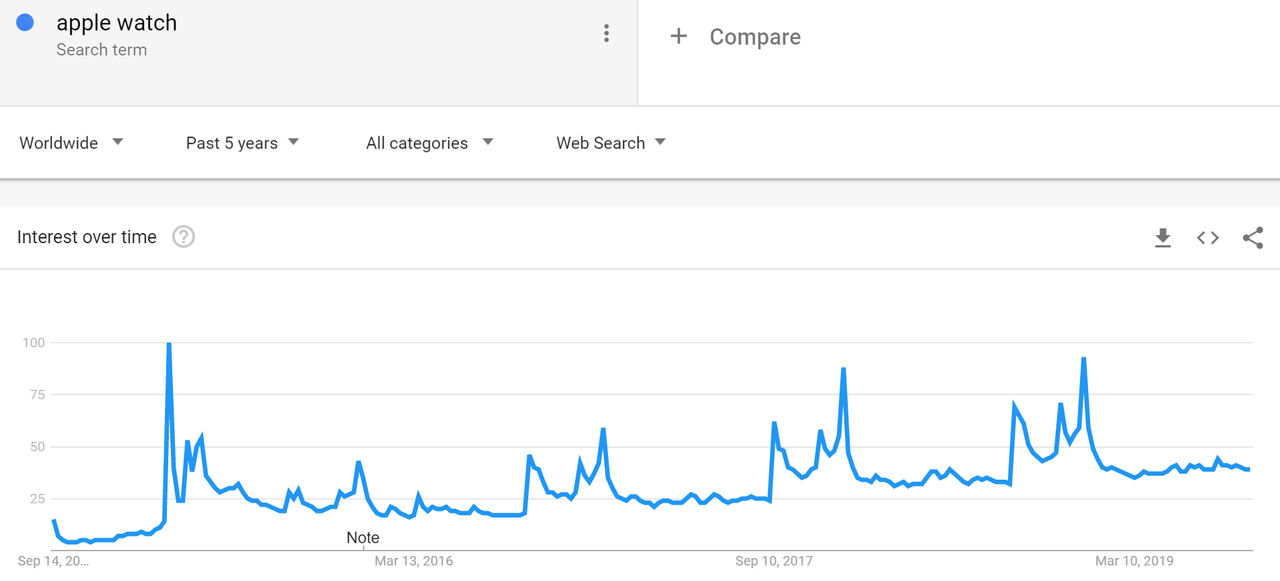

#2: Google searches for “apple watch” show a better trend, even if product updates have not created more buzz than the initial rollout. Searches through the year since the watch’s March 2015 introduction continue to grow, and peak interest often occurs during Holiday shopping seasons.

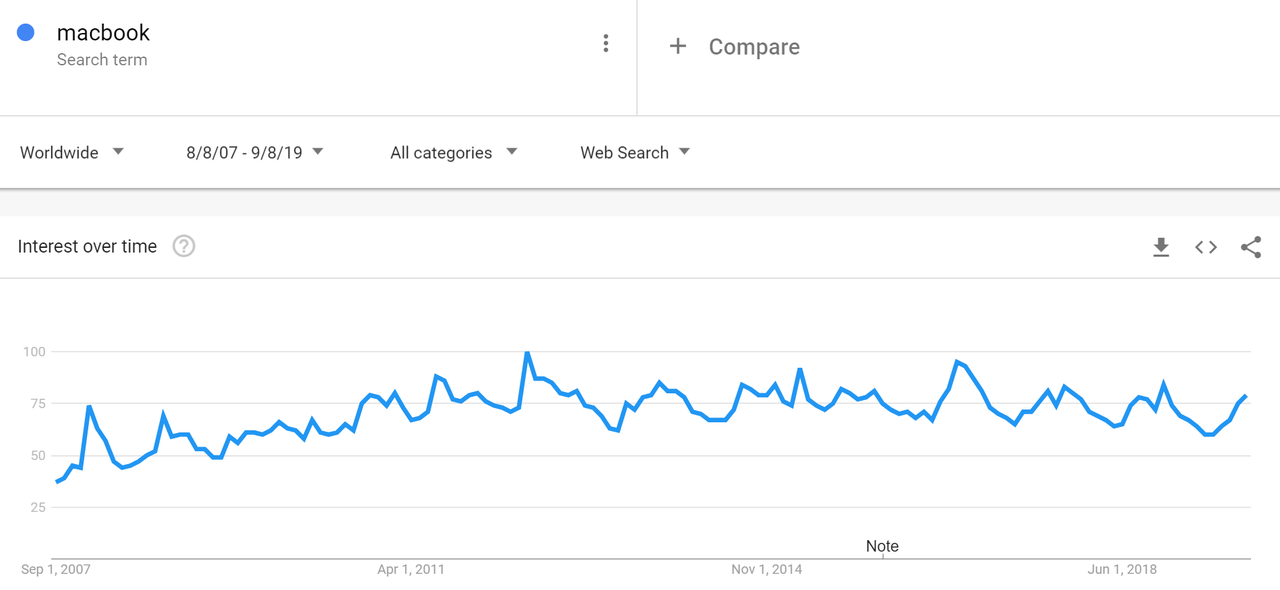

#3: Searches for “macbook”, which captures Google queries for both the Pro and Air models, peaked in June 2012. August 2019 searches were 24% below those levels.

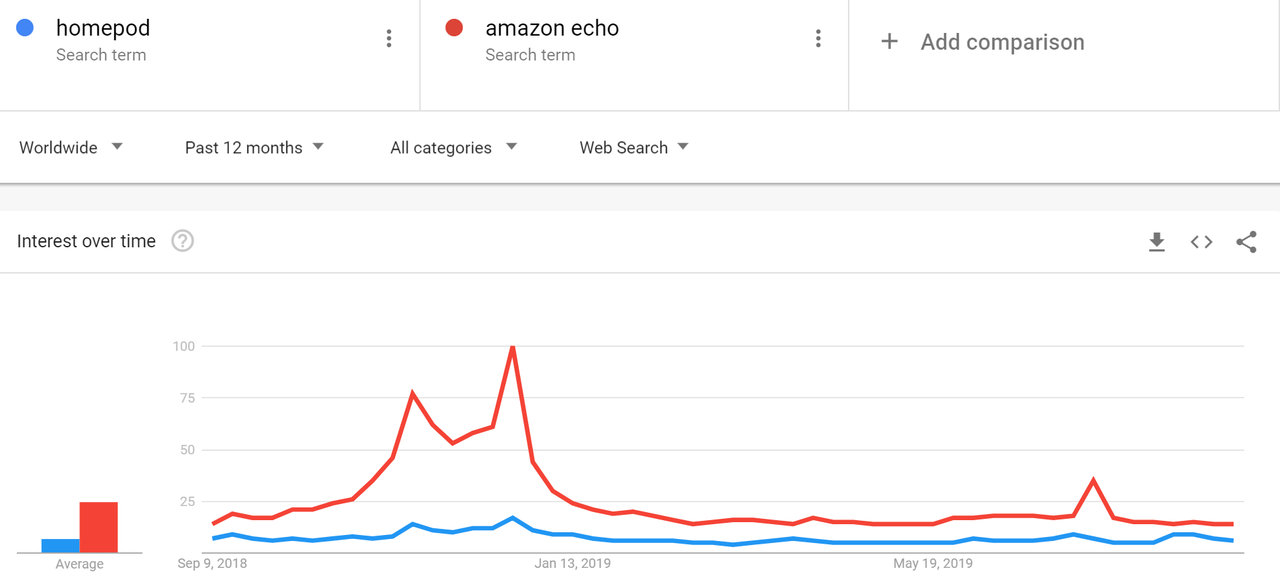

#4: Searches for “homepod” are much lower than those for “amazon echo” over the last 12 months. Holiday 2018 saw the Amazon home automation/speaker product register 5x the number of searches and the gap was 2:1 last month.

DataTrek had the following takeaways from these charts:

- Apple’s pivot to services in the music streaming, gaming and TV spaces is a necessary shift now that virtually all its hardware products are fully mature. The failure of the Homepod to best Amazon’s Echo offering is a remarkable miss in an important space.

- Since the payoff from these initiatives is uncertain, both in terms of required investment and payoff, Apple’s valuation is likely to remain below peer group averages. That is the case just now, with AAPL trading at 16.9x forward earnings versus the Tech sector at 28.6x.

- The most important catalyst for AAPL, and given its S&P weighting in US large caps as a whole, remains US-China trade negotiations. The charts show that Apple is no longer a new hardware story. Services will take time to grow. What’s left is a hope that upcoming trade talks will prove productive rather than further disrupt Apple’s China business and its global supply chain.

Colas’ bottom line: this one-time disruptor has matured and needs to transition into a company that leverages its billion-user iPhone platform to sell services. Yes, it certainly has the financial resources to do so. But it will have to go back to the disruption playbook of affordable products for a mass audience to be successful. Remember that iPhones 3-5 retailed for $199… That also means that going forward, the only announcements worth watching have to do with Services, as the hardware updates are increasingly trivial.

Tyler Durden

Tue, 09/10/2019 – 15:40

via ZeroHedge News https://ift.tt/2N6S9Sc Tyler Durden