Something Big Is Taking Place Below The Market’s Surface

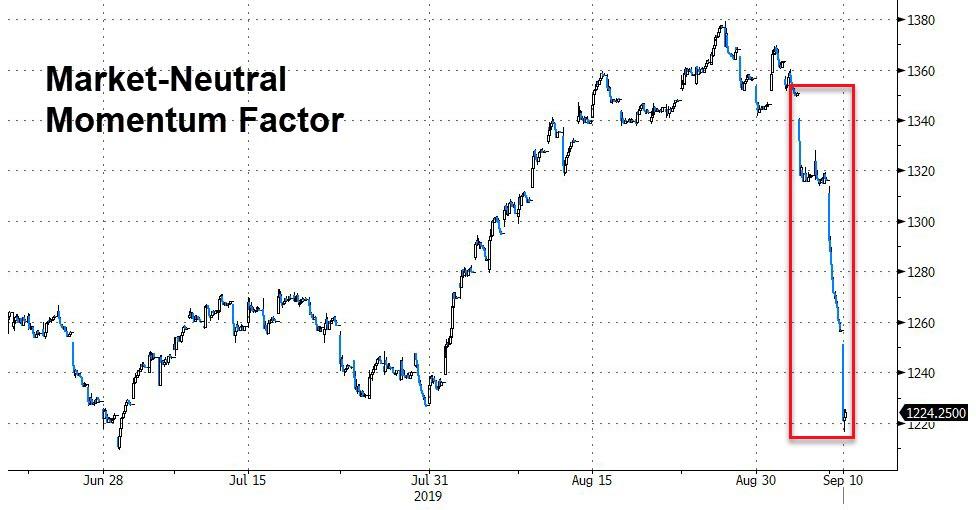

The shock of yesterday’s US Equities factor reversals will go down in infamy alongside the August 2007 “Quant Quake” and the Fed / March / April 2016 “Market-Neutral Unwind” as one of the more stunning trades in modern market history—and yet HILARIOUSLY, nobody watching financial TV or Joe Schmoe retail investor looking at just simple Index returns in isolation (or even a more sophisticated investor looking at the Vol complex yday) would have had ANY idea of the calamity occurring under the surface, as it was all about a blowout in sector- and thematic- dispersion which then acted to offset / “mask” the “top down” moves

– Nomura’s Charlie McElligott

Submitted by Nicholas Colas of DataTrek Research

Monday’s action in US equities was much like a duck floating on a pond. Up top, nothing much seems to be going on. The Dow (up 14 basis points), the S&P 500 (down 1 basis point) and the NASDAQ (down 19 basis points) all behaved like coming to work was the proverbial waste of a clean shirt.

But, below the surface, there was a lot of action. We had several client emails on this after the close, calling dramatic out moves like:

-

The Russell 2000: up 1.3%. US small caps have been laggards all year, but Monday’s move closed the YTD performance gap by 20%.

-

Large cap Financials: up 1.5%. One of the more-troubled groups in the S&P 500 this year, but Monday’s performance cut their YTD lag by 44%.

-

US Momentum stocks (using the MTUM ETF as a proxy): down 1.7%. Monday’s move cut the YTD outperformance of this style versus the S&P 500 from 357 bp to 186 bp, a 48% decline.

-

US Min Vol stocks (using the USMV ETF): down 0.9%. Like Momentum, this has been a winning approach in 2019 but Monday’s drop sliced 20% off its YTD outperformance (448 bp Friday, 363 Monday).

Without making too much from one day’s performance, these moves are still important enough to dissect for what they say about potential shifting investment narratives. Three points on this:

#1: The world’s low/negative interest rate fever may finally be breaking. We’ve written about how Treasuries were overbought several times recently, so no need to belabor that point. But here’s how this is playing out now:

-

10-year German bunds are off their record-low yields, at -0.58% Monday versus -0.70% at the start of the month. German 30-years are within sight of positive yields, at -0.03%.

-

10-year Treasuries yield 1.65% Monday versus 1.50% at the start of September. 30-years are back over 2% (2.13% Monday) versus 1.96% on August 31st.

-

This move has breathed fresh lift into European bank stocks, up 6.7% this month and 2.7% just Monday. We talked about these last month as a canary-in-the-coalmine indicator, and sure enough they have led markets higher in September.

-

This helped US Financials Monday (as noted above)… And since US Small Caps have suffered from fears over a US economic downturn, they got a lift as well.

Bottom line: the rate pendulum swung very far in August, but September’s renewed confidence in a US-China trade deal has put recession fears on the back burner for now.

#2: “Style” doesn’t mean diversification.

-

Using MTUM – an $11 billion ETF – as a proxy for momentum investing shows how concentrated this style has become.

-

39% of the fund is in the Tech sector, 77% greater than the S&P 500.

-

5 Tech names – MasterCard, Visa, Microsoft, Cisco and PayPal – are 21% of the fund. All were down Monday, led by MA and V, each lower by over 2%.

Bottom line: Monday was a zero sum game, with money flowing out of Technology and into Financials. We’re long past the days where money managers had consistent fresh inflows of new investor capital to sprinkle around. Rebalancing portfolios means a dollar-for-dollar exchange of “out with the old, in with the new”.

#3: “Min Vol” is anchored in the past.

-

The proxy here, USMV, is an ETF with $34 billion in assets. It uses historical price volatility to create a diversified portfolio of roughly 200 lower-than-average vol names with sector concentrations inline with US equity markets.

-

In principle this is a solid strategy with academic work that shows lower volatility stocks tend to outperform, even if this approach runs counter to CAPM’s concept of beta.

-

In practice, however, “min vol” will always have idiosyncratic risk when there is outsized sector/style rotation.

Bottom line: Monday’s “min vol” underperformance is one more sign that investment narratives are changing and capital is shifting accordingly. What was a low-vol stock over the last 90 days was certainly not one Monday.

In the end, the only question that matters about Monday is “Does it change anything fundamentally about important investment narratives?” Over the short term (a week or two), the answer is likely “yes”. We doubt the sell off in bonds is over, for example. That will give some groups/asset classes, like Financials/Small Caps, the chance for a further bounce.

Over the long term, however, we think it’s too early to wave the all-clear and call for what would essentially be an early-cycle shift to Small Caps/Financials/Cyclical names generally. Monday was a nice start, but just a start, and we’ll need to see continued market confidence that a 2020 recession is really off the table. Even with Monday’s action, that seems a tall order.

Tyler Durden

Tue, 09/10/2019 – 11:45

via ZeroHedge News https://ift.tt/2LmWwXk Tyler Durden