When Yields Are No Longer “High” – What Junk Bonds Are Saying Today

Authored by Hozef Arif via LinkedIn.com,

With more than 16 trillion or so of global bonds now offering negative yields and the dovish turn by the Federal Reserve this year, investors have been increasingly drawn to high yield bonds (or “junk” bonds, as they are sometimes called) issued by companies rated below investment-grade.

2019 has been a banner year so far for this riskiest segment of the publicly traded corporate bond markets, with a stellar +11.1% total return year-to-date and in the process driving yields down to 5.8%, a level not seen in HY since January 2018. HY performance also compares very favorably to +18.8% total return for the S&P500 and is nearly equal to the +11.6% total return for the Russell 2000.

This search for yield has culminated in events like issuance of an 8.5 year maturity HY bond @ 3.875% by a fast food chain owner, Restaurant Brands (ticker: QSR). This is among the lowest yield for an 8+ year maturity corporate HY bond since Ball Packaging (ticker: BLL) issued a 10-year HY bond @ 4% in the spring of 2013, right before the market got hit with a “taper tantrum” selloff in rates that summer.

While conditions were quite different at the time (no signs of yield curve inversion in 2013, for one), any number of catalysts today could trigger a selloff in rates from their current low levels – less dovish European Central Bank ? German stimulus ? Market speculating a pickup in global growth ? Fed failing to deliver rate cuts on the market’s schedule ? Hard to say and predict. Nonetheless it may be instructive to see what clues the current HY market offers in the context of history if the one-way ride lower in interest rates were to suddenly reverse. After all, falling interest rates have contributed to half the total return in HY bonds this year.

The HY bond market today is more exposed to sudden rise in interest rates than at any other time since 2013

This probably sounds like stating the obvious – after all, aren’t all fixed coupon bonds exposed to mark-to-market losses from a rise in interest rates? Rightly so, but the problem here is that more than half of HY index’s exposure to interest rates comes from the BB or higher rated portion of the market that has longer maturities and lower yields than rest of the index and is more exposed to volatility from underlying rates (in general the longer the maturity, the higher the bond’s sensitivity to interest rates).

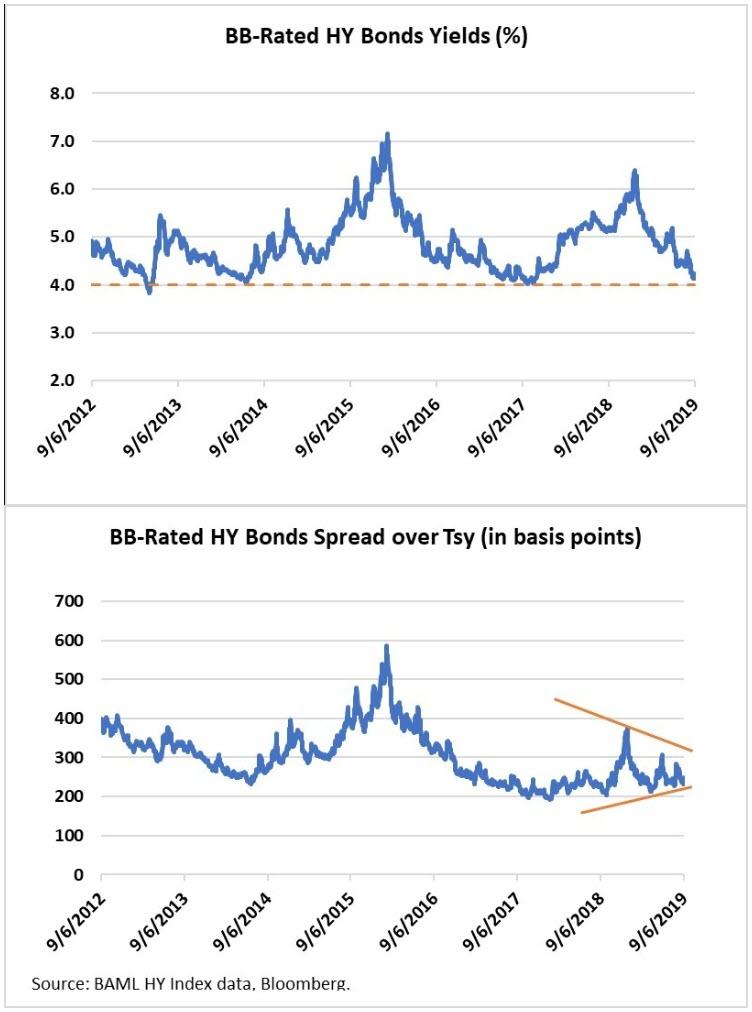

At current yields of 4.1% for the BB-cohort, the cushion against a rise in underlying treasury yields is minimal, especially when one looks at the historical chart of BB yields and what has happened every time we have touched or gone below 4% this decade. The story doesn’t get any better even if we look at excess spread over treasuries.

In addition, investors in most HY bonds are short a call option on interest rates – meaning the issuer of the HY bond has the right to pay off or refinance the bonds early at a certain set schedule before maturity – somewhat similar to consumers refinancing their mortgages when rates fall. This puts a ceiling on the price upside in most HY bonds when interest rates go down and on the flip side when rates go higher, prices drop rapidly as the “duration” or sensitivity to interest rates starts to work in the other direction. But unlike mortgage investors who generally hedge out this refinancing risk (convexity), most high yield investors hold their bonds un-hedged for interest rate risk and hence are more exposed to this sensitivity.

One ends up owning a lot of true “junk” to get to the promised high “yield” land, especially if using passive ETFs

One might say the 5.8% yield you get from the overall HY market sounds pretty good compared to getting only 1.5-1.6% in treasuries or less than 3% in the investment grade corporate bond market, especially when default rates remain below average. However, it is important to consider the sources of that 5.8% yield by taking a peek under the hood.

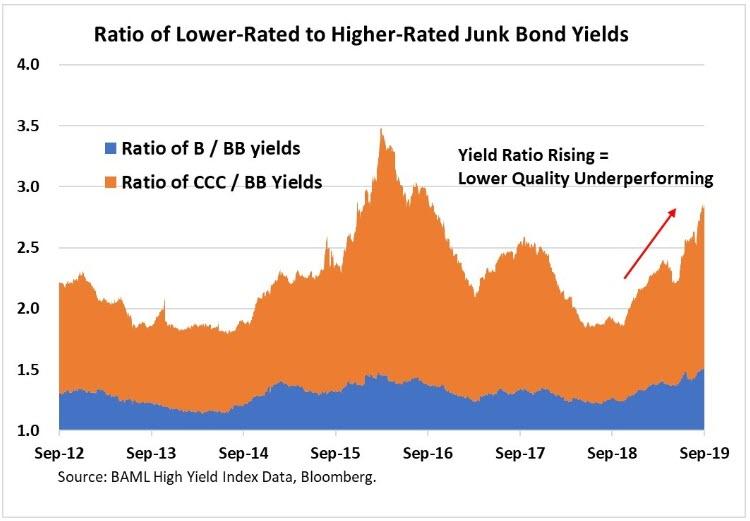

Consider the chart below which shows ratio of lower quality HY bonds (CCC, B rated) to higher quality (BB rated) over the last seven years.

Except for late 2015 / early 2016 energy sector driven default cycle, rarely have lower quality bonds traded this wide to their higher quality counterparts. This is true both for yields as well as for excess spreads (over comparable treasuries). The risk of principle loss via defaults or restructuring is magnitudes higher in lower rated bonds and the higher yields are partly a reflection of investors demanding a lot more compensation to hold that risk, especially compared to the same time last year. More on that in the next section below, but bottom line is — going from supposedly safe BBs at 4% to the full HY index yield of 5.8% comes at a meaningful cost in terms of lowering credit quality

A rising tide of growth may not be able to lift all HY boats

Does this quality-based dispersion within the HY market still mean an attractive investment opportunity exists ? Could a rally in prices of lower quality junk bonds playing “catch-up” more than offset potential mark-to-market losses in higher quality bonds from a rates selloff ? It depends. Improving prospects for global growth may not be enough this time to fix some of issues faced by meaningful swaths of the HY market.

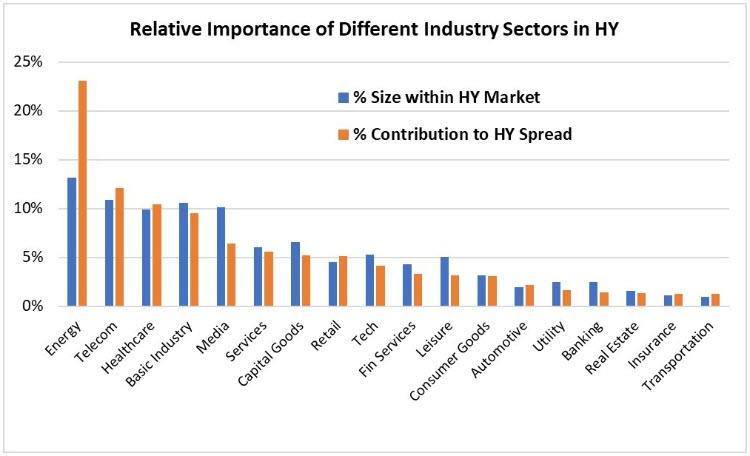

More than half of the overall spread of the high yield index comes from Energy, Telecommunications, Healthcare and Basic Industries as shown in the chart below. For example, energy sector contribution to HY spreads is nearly 2x its actual HY index weight – in rough terms, it means energy sector is perceived to be twice as risky as the average market and the wider spreads (= higher yields = lower prices) reflect that.

Energy sector’s woes are well known by now with threat of looming bankruptcies and distress despite a 25% rally in crude oil prices this year.

Healthcare has its own unique issues with several pharma companies in stress under the weight of opioid liabilities and healthcare services companies exposed to vagaries of regulatory headline risk as election cycle gets near.

Telecommunications sector is exposed to idiosyncratic issuers like Intelsat and Frontier whose fate may decide the sectors performance going forward, notwithstanding the Sprint and T-Mobile merger that seems to be largely priced in.

In conclusion – a lot of things have to go just right for high yield bonds to continue delivering meaningful total returns from here on

To be fair, rising rates against a backdrop of decreasing trade war risk and a trough in global growth may lead to improving prospects for some cyclical sectors within high yield and may also lift the dour energy sector. There is always a possibility that political overhang on healthcare sector may start to diminish. But it remains to be seen whether all that may be enough to overcome the interest rate risk and negative convexity present in tight yielding bonds that make up a majority of the HY market. On the other hand if rates rise but economic growth still fails to uplift the stressed parts of the high yield market, that could stall any further total return prospects for high yield for the remainder of the year.

To circle back to something we discussed at the beginning — how did those Ball Packaging 4% coupon 10-year HY bonds from 2013 perform in the subsequent taper tantrum rout in rates? They dropped -11 points to ~89 cents on the dollar by end of 2013 and did not recover to their original issue price of par (100) until mid-2016. Proving yet again that when investors flee crowded trades, the exit can be quite narrow given the challenged liquidity in the corporate bond market. Something worth keeping in mind as we approach another pivotal Federal Reserve meeting next week.

Tyler Durden

Tue, 09/10/2019 – 11:10

via ZeroHedge News https://ift.tt/2N6MOdR Tyler Durden