WTI Rebounds From Bolton-Drop After API Reports Big Crude/Gasoline Draw

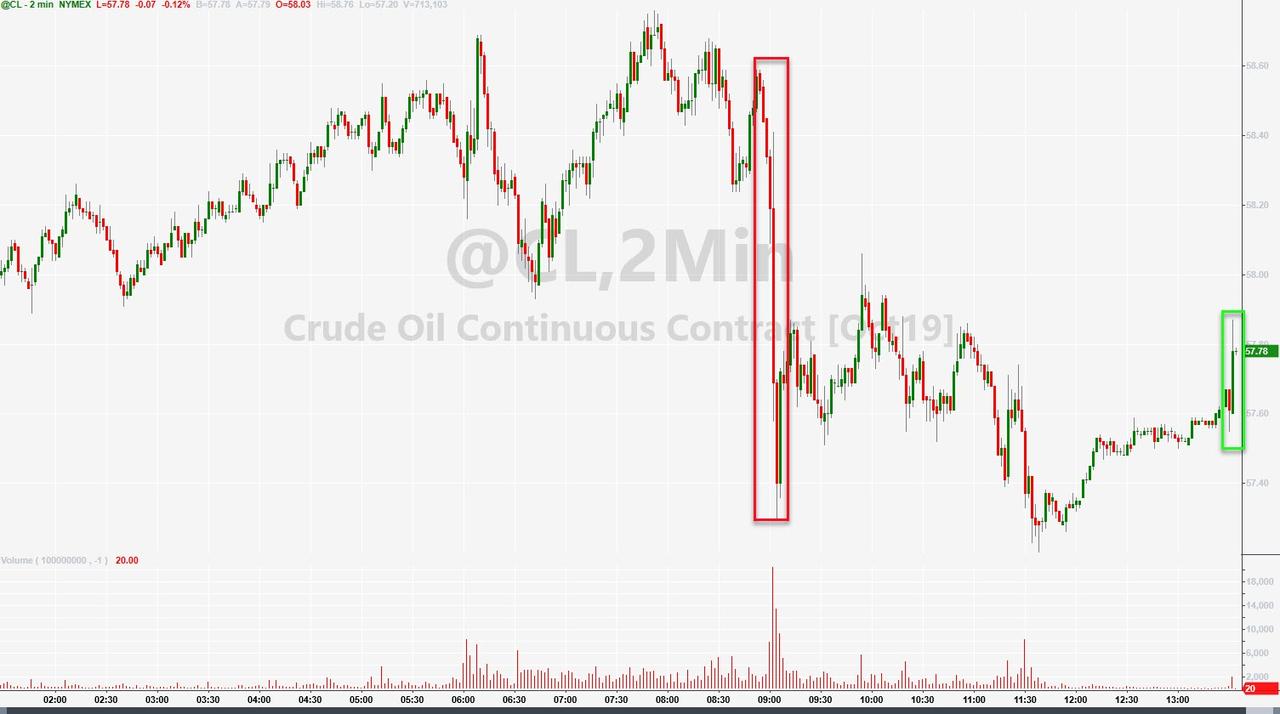

WTI tumbled today thanks to neocon warmonger John Bolton being fired (and removing some hawkish premium from the market):

“The Bolton news is bearish as Bolton is a known hawk on Iran and the market is assuming that opens the door for talks with Iran,” said Phil Flynn, senior market analyst at Price Futures Group Inc.

But all eyes are likely to pivot back to fundamentals and supply tonight and tomorrow.

API

-

Crude -7.23mm (-2.8mm exp)

-

Cushing -1.4mm (-980k exp)

-

Gasoline -4.5mm (-800k exp) – largest draw since April

-

Distillates +600k (+100k exp)

Another week, another larger than expected crude draw reported by API (and big gasoline inventory drop)

Source: Bloomberg

WTI tumbled on the Bolton headlines early on but bounced very modestly on the bigger-than-expected API-reported crude draw

Finally, while hope remains high for more OPEC action, Bloomberg reports that oil prices would have to fall to $40-$45 a barrel for OPEC to make deeper production cuts, Equatorial Guinea’s Minister of Mines and Hydrocarbons Gabriel Mbaga Obiang Lima said in an interview, while attending the World Energy Congress in Abu Dhabi.

Tyler Durden

Tue, 09/10/2019 – 16:37

via ZeroHedge News https://ift.tt/2ZSekl5 Tyler Durden