“Now Is The Time To Plan For The Next Recession,” Think Tank Urges Britain

Britain isn’t ready for a recession and must consider new innovative countercyclical buffers when it arrives, the Resolution Foundation, a think-tank, said on Monday.

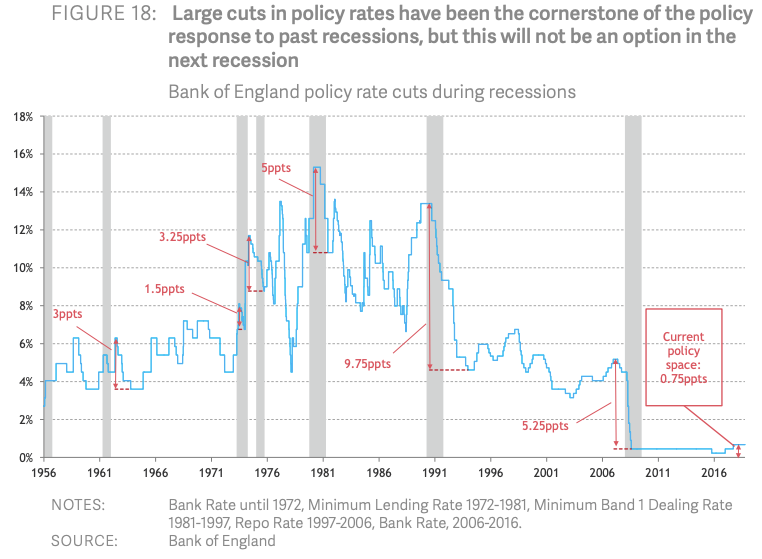

Researchers at the foundation said the Bank of England (BoE) would have difficulty fighting off a recession because interest rates are already near the zero lower bound.

In the last recession, the BoE was able to cut interest rates from 5% to near zero. Now rates are .75%, which means the next round of cuts will have minimal stimulative effects on the real economy.

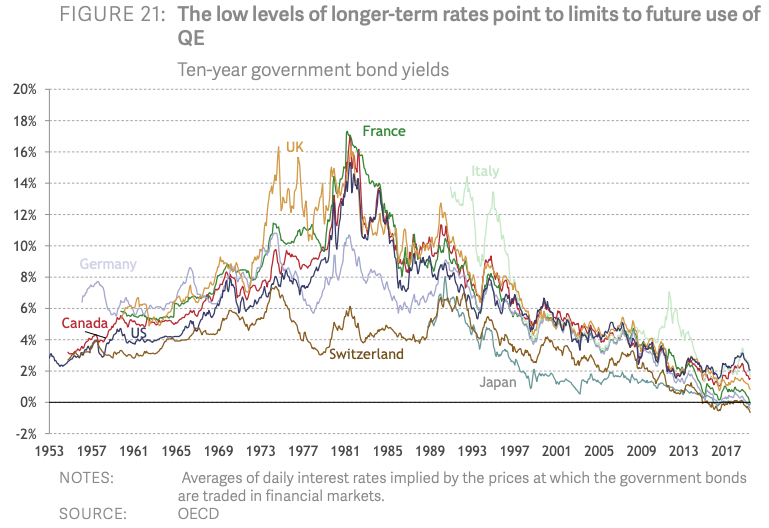

A foundation spokesperson said quantitative easing delivered about two-thirds of support to the economy during the last recession by reducing longer-term interest rates. But with GB10Y already near the zero level, quantitative easing might not be as effective as before.

“Today even long-term rates are now very close to zero, with 10-year government borrowing costs now below half a percent,” a foundation spokesperson said.

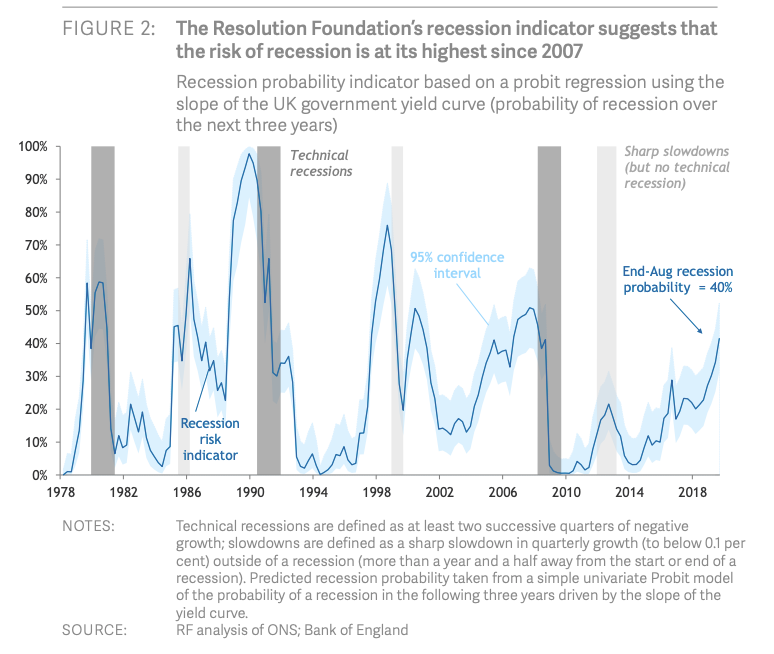

The think-tank warned that deep interest rate cuts into negative territory along with quantitative easing could have very little stimulative effects, which means the BoE currently has a depleted tool kit ahead of a recession that could strike in the near term.

The foundation said global central banks and countries are actively reviewing tools available for central banks amid the threat of a worldwide recession. It said the UK and BoE have been slow to review their policy tool kits, has called for a thorough evaluation of the available tools.

Researchers asked the government and central bank officials to review the pros and cons of a higher inflation target.

The think-tank also called for shovel-ready infrastructure projects and direct payments to households to cushion the economy during the upcoming downturn.

“Now is the time to plan for the next recession – because the one thing we know for certain is that it will happen,” James Smith, Research Director at the Resolution Foundation, said.

“The UK today faces the highest recession risk since the financial crisis, and lower-income households are now more exposed to a downturn than they were back then.”

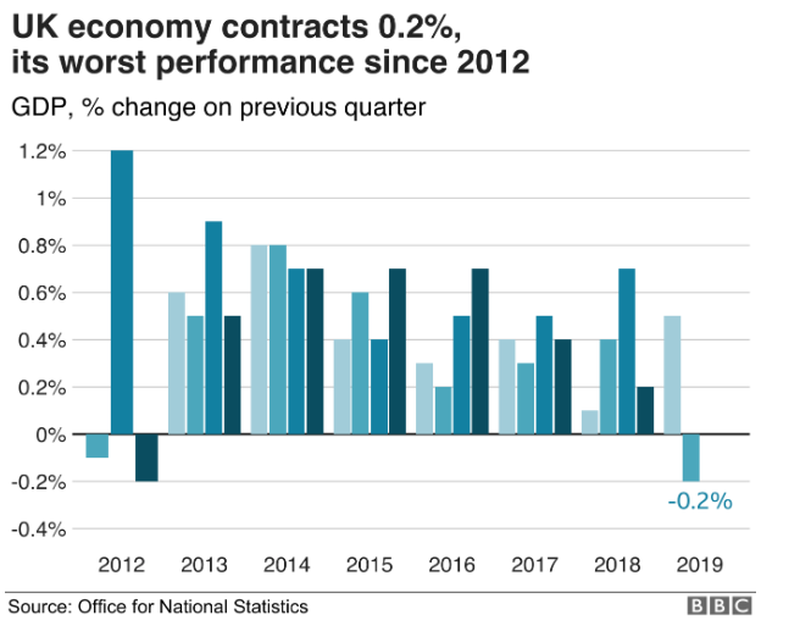

The foundation’s report comes as Britain’s economy contracted in Q2 for the first time in seven years as the cloud of uncertainty brought by Brexit discouraged business investment and prompted some consumers to put off major purchases as well.

For the three months ended June, GDP contracted 0.2% compared to the previous quarter, according to the Office for National Statistics. That’s lower than what experts had expected (they had forecast growth to be flat). The biggest drag was a drop in manufacturing output, which caused the production sector to shrink by 1.4%. Construction also weakened while critical service sector yielded no growth at all.

The contraction marks the first time the economy has shrunk since 2012.

The contraction comes amid rising fears that Britain could crash out of the European Union on Oct 31 without a deal as negotiations with the EU remain at an impasse. Prime Minister Boris Johnson has committed to leaving on Oct 3. with or without a deal, causing the economy to weaken and likely usher in a recession.

Tyler Durden

Wed, 09/11/2019 – 02:45

via ZeroHedge News https://ift.tt/2A7tDId Tyler Durden