Gundlach: 75% Odds Of US Recession Before 2020 Election

DoubleLine CEO Jeff Gundlach sees a 75% chance of a US recession before the 2020 election.

Speaking at a London event this week, the billionaire money manager reiterated his August outlook, telling the audience “We should be on recession watch before the 2020 election,” adding “We’re getting closer but we’re not there yet.”

According to Gundlach, an inverted yield curve is not the best indicator of a recession – “It’s the inversion occurring and then going away.”

He’s also neutral on gold following its latest run.

In his June public webcast, he predicted a 45% chance of recession by the end of the year amid the US-China trade war, while in August, Gundlach said that the yield curve looks “full-on recessionary” and “a lot like 2007.”

“There’s no way to sugar coat it,” he told Yahoo Finance, “When you have a 40 basis point inversion, well, then that usually leads to a problem.”

Gundlach added that we will probably start seeing the yield curve steepen, but that wouldn’t necessarily be a good sign.

“That would almost seal the fate of recession coming,” he said. “It’s not so much the inversion — the inversion is a warning that there’s one coming. But, you start to get in the imminence category once it first starts steepening out from the inversion, because, by then, the Fed has realized it’s behind the curve, the market knows it too, and everybody knows the Fed’s going to be slashing interest rates.” –Yahoo Finance

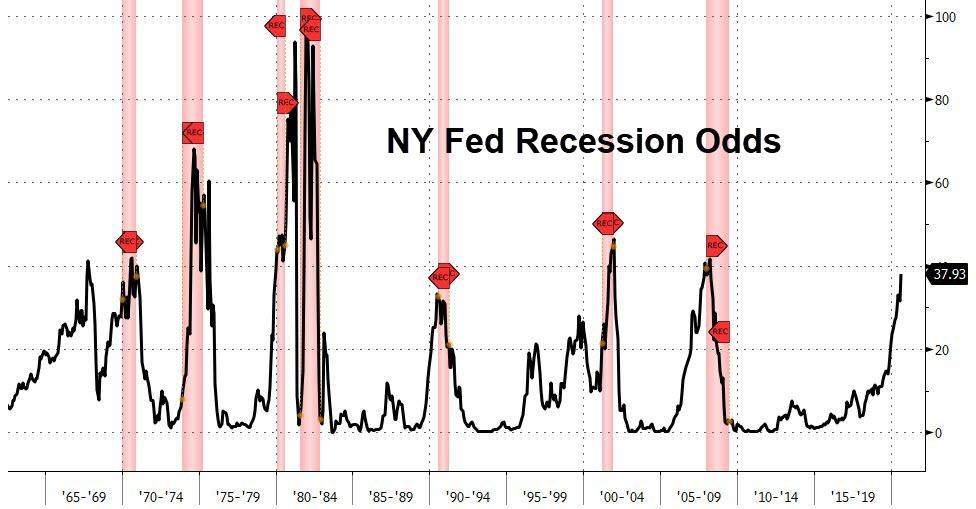

Gundlach’s forecast is roughly in line with The New York Fed:

Source: Bloomberg

Meanwhile, billionaire investor and founder of Bridgewater Associates, Ray Dalio, sees a 25% chance of recession through 2020, telling Bloomberg last week that central banks will be limited in their ability to avert it. He also loves gold, and says it could be gearing up for a big decade of returns.

Dalio thinks there are four factors that will affect the severity of the downturn, via Business Insider.

-

Effectiveness of central-bank policies

-

The wealth gap, which will affect how the next recession will look “socially, politically, and so on”

-

The 2020 elections, which he called “an issue between capitalists and socialists, or the rich and the poor”

-

The emergence of China in relation to the US

According to Dalio, central banks worldwide “have to face the fact that when the next downturn comes there will not be the power to reverse it in the same way,” and recommends that the Fed cut interest rates slowly and by small increments.

Tyler Durden

Thu, 09/12/2019 – 14:00

via ZeroHedge News https://ift.tt/2Q5jiaA Tyler Durden