Momo Meltdown Stalls As Stocks Jump On Draghi And Trump

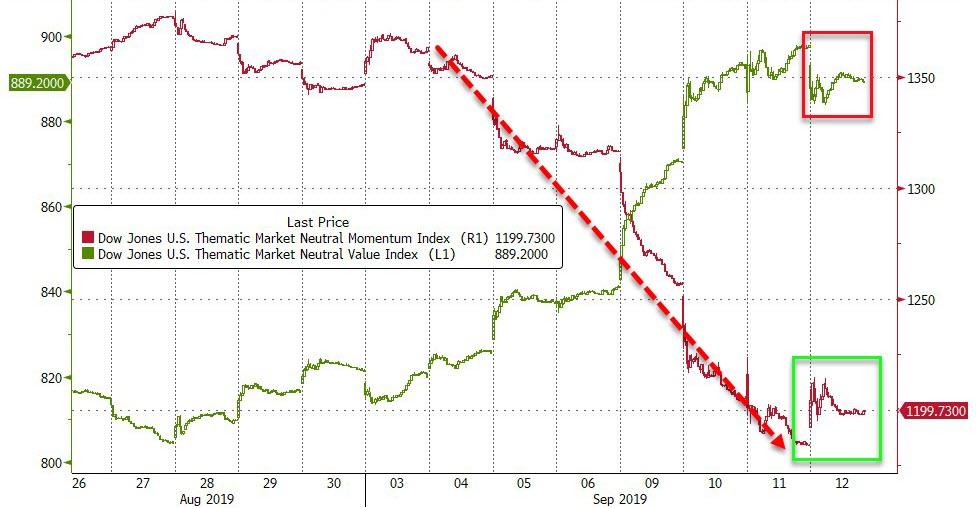

Global equity, FX, and bond markets are trading like penny stocks once again as central bank promises, leaks, and actions combine with US and China trade negotiators’ promises, leaks, and actions spark panic-buying – and manic-selling – each and every day. Add to that the biggest quant quake in a decade and “things just went just a little bit slightly turbo” today…

For the first time in a month, offshore yuan traded above its fix

Source: Bloomberg

But intraday it was chaos…

Source: Bloomberg

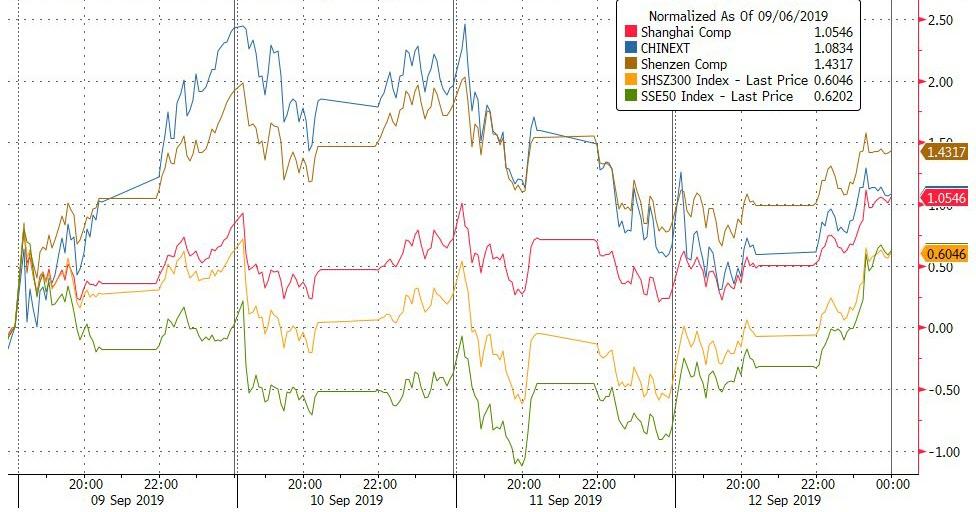

Chinese stocks lifted on the tit-for-tat de-escalation in trade rhetoric…

Source: Bloomberg

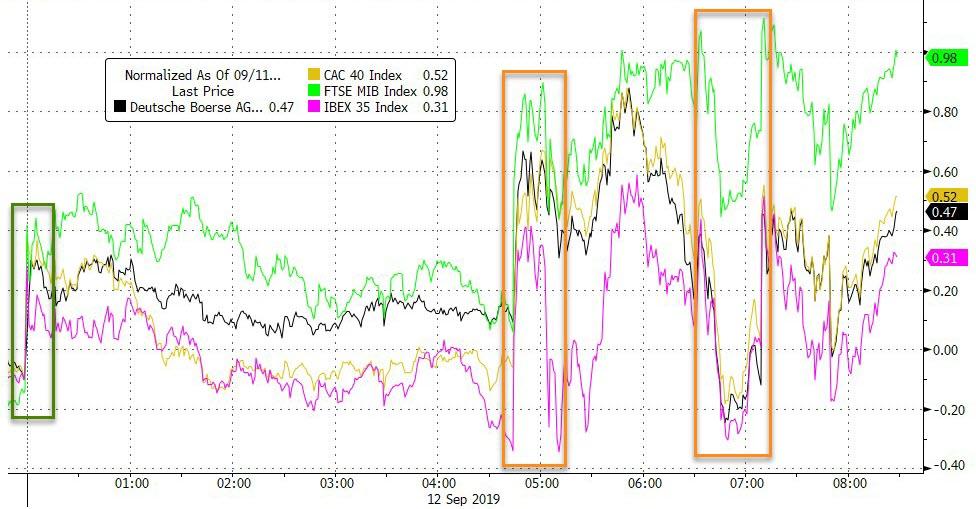

European stocks were also chaotic as Draghi unveiled his grade finale bazooka…

Source: Bloomberg

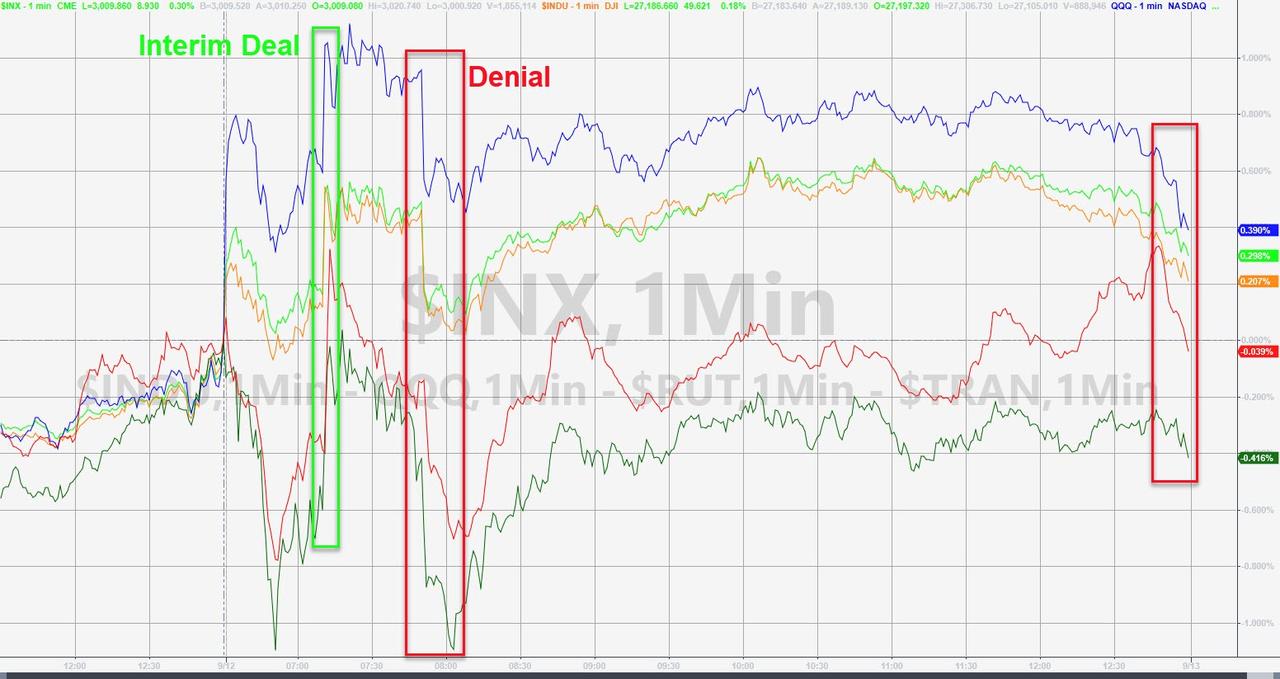

US Futures show the fun and games best as Trump delayed tariffs soon after the close, China reciprocated on soybeans, Draghi disappointed, rumors of an interim trade deal were then quickly “absolutely” denied…

NOTE – futures tested the initial tariff delay spike 7 times (and failed)

On the cash side, the short-squeeze stalled early on, Trannies ended red as Small Caps played catch-up in the afternoon but tumbled back into the fed at the close…

NOTE – for a change, some weakness into the close

US equity markets are back within spitting distance of all-time record highs (S&P 3025.86 and Dow 27359 closing high)…

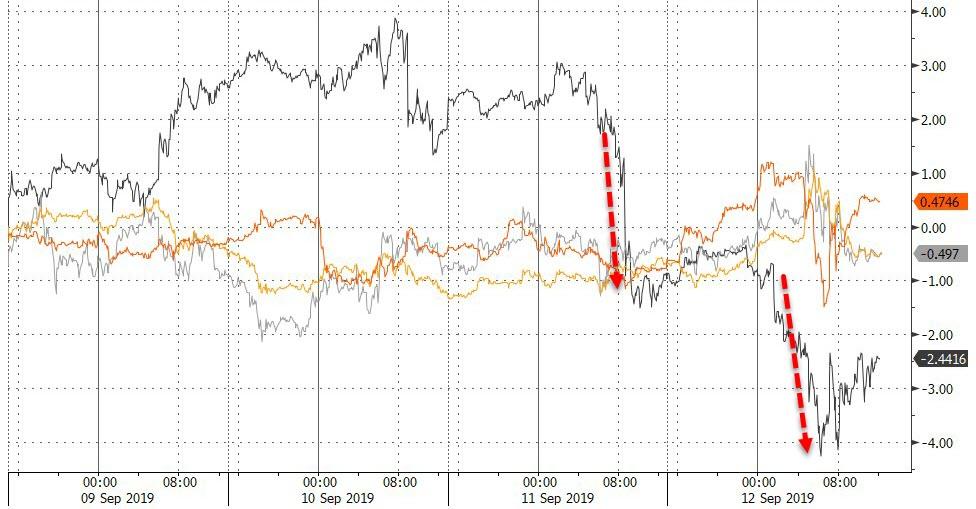

The meltdown in momentum stalled today – the best day for the momo factor since August 1st!

Source: Bloomberg

“Most Shorted” stocks trod water today as the squeezers appear to have run out of ammo…

Source: Bloomberg

No Smiles for Smile Direct Club as its ugly IPO flopped…

VIX traded with a 13 handle intraday…

Treasury yields ended higher across the curve (for the 7th day in a row) by around 5bps with massive intraday swings…

Source: Bloomberg

30Y Yields plunged 10bps before surging 14bps amid various headlines (note that 30Y ignored the denial of the interim trade deal)…

Source: Bloomberg

The yield curve continued to steepen, but 3m10Y remains notably inverted…

Source: Bloomberg

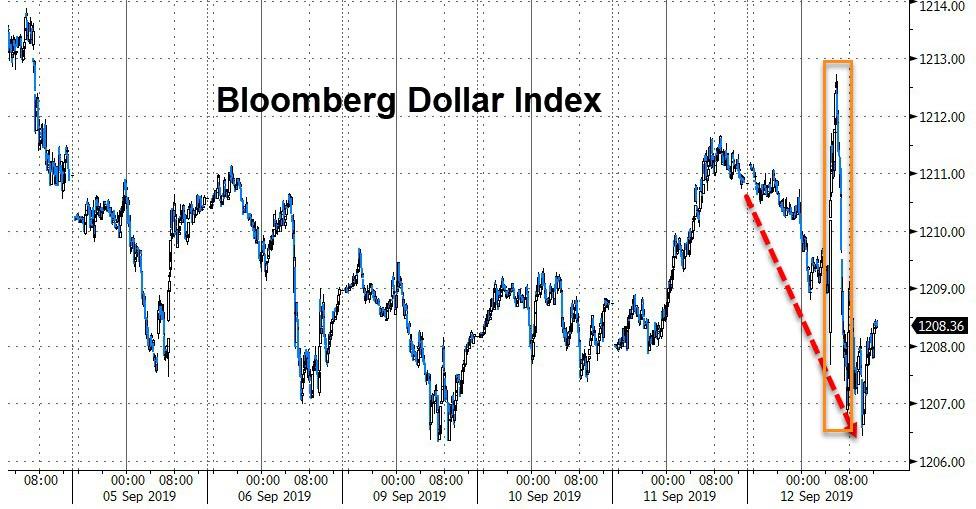

A chaotic day in FX land too as Draghi promises and White House denials pumped and dumped and pumped the euro and the dollar. The dollar ended the day lower…

Source: Bloomberg

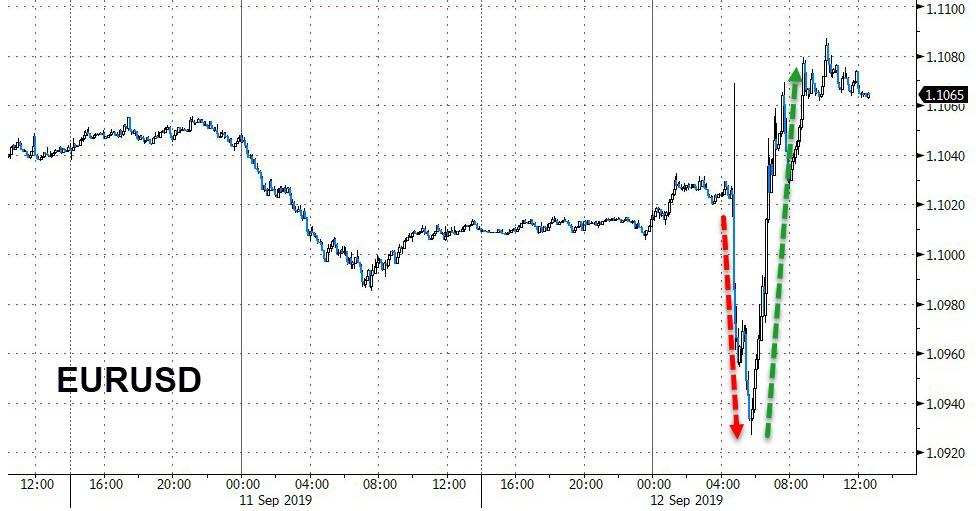

Draghi dud…

Source: Bloomberg

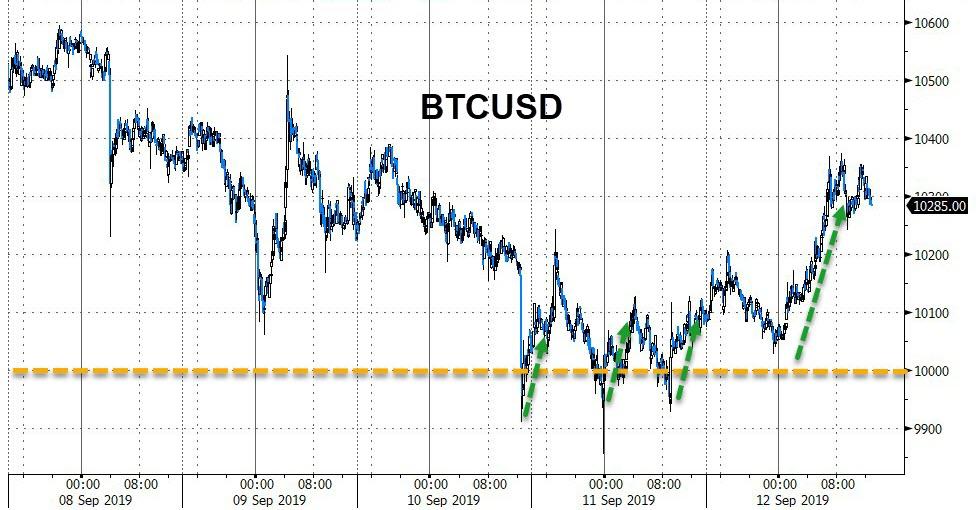

Cryptos rallied on the day with Bitcoin getting back to even on the week…

Source: Bloomberg

Bitcoin tested $10k a few times and bounced today…

Source: Bloomberg

Oil tumbled overnight – despite all the exuberance over a potential trade deal, PMs pumped and dumped around Draghi…

Source: Bloomberg

WTI tested all the way down to $54.00 before bouncing…

Gold spiked up to $1530 before fading back, but still ended higher… (silver ended lower)

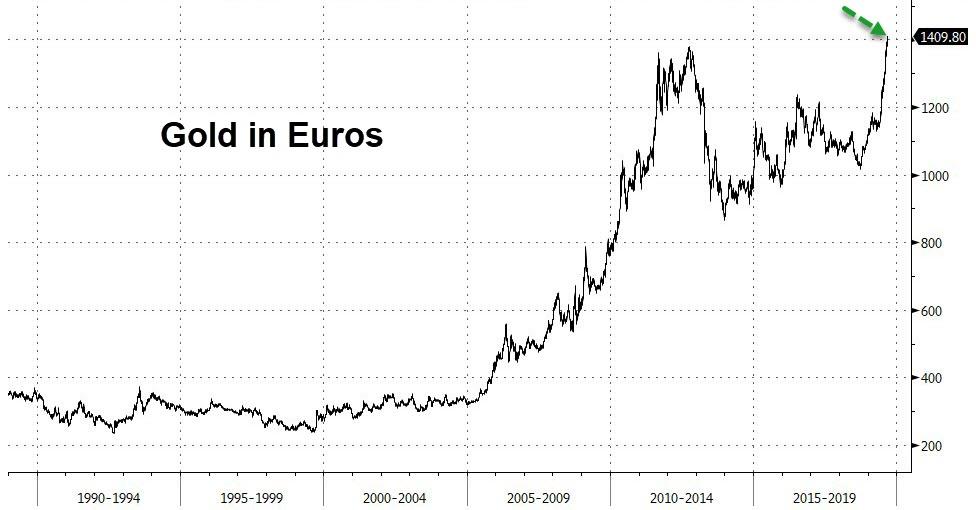

Meanwhile, the price of gold in Euros hit a record high…

Source: Bloomberg

Finally, we note that amid record high stocks, potential trade deal de-escalation, hotter than expected inflation, and soaring macro surprise data; the market is rapidly pricing out the most extreme view of Fed easing…

The last week has seen the market shift from pricing in 2.7 rate-cuts to just 2 now.

Source: Bloomberg

And then there’s Draghi who just promised to more of what’s not worked for a decade to fix everything…

Source: Bloomberg

Tyler Durden

Thu, 09/12/2019 – 16:01

via ZeroHedge News https://ift.tt/2LtRjx6 Tyler Durden