In Scramble To Save IPO, WeWork Unveils Promised ‘Governance Changes’

With its valuation in free-fall, WeWork is scrambling to make some governance changes that the company hopes will help revive investor interest, without actually diminishing the power and influence that CEO Adam Neumann has over the company, even as both of the deal’s lead underwriters – Goldman Sachs and JP Morgan – and Soft Bank, WeWork’s largest private backer, urge the company to put its IPO on hold.

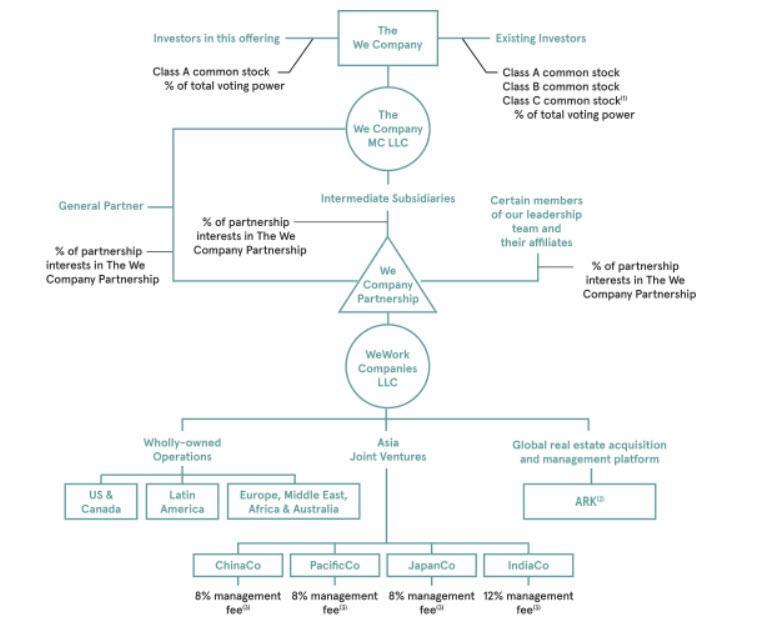

The company filed a modified prospectus on Friday that revealed its plans to list on the Nasdaq – a big win for the traditionally tech-heavy exchange – while also detailing some marginal changes to the company’s governance and org chart, which, as many will remember, looks like this:

The most significant change pertains to the top of the chart: the share classes that would have left investors in WeWork shares at the offering with no control over the company’s governance. The company is going to reduce the amount of voting power that existing investors (that is, Neumann and his family) have from 20 votes per share to 10 votes per share for holders of Class B and Class C shares.

Of course, Neumann & Co will still be left with a sizable lead, and it’s difficult to see how this change leaves investors much better off.

Neumann also revealed that he would turn over any profits from the real estate transactions that he has entered into with the company (Neumann has taken out private loans to buy stakes in buildings that have then rented space to WeWork), according to Bloomberg.

The company also promised that no member of Neumann’s family – most notably the CEO’s wife, Gwyneth Paltrow cousin Rebekah Neumann who holds dubious titles like “chief impact officer” – would sit on WeWork’s board. Neumann also agreed to limit the amount of WeWork stock he can sell per year to no more than 10% of his holdings in the company.

Oh, for any skeptics still left out there: the company has also agreed to add a woman to its board.

WeWork’s value has plunged from $47 billion during its most recent private valuation round to a low of $15 billion according to some estimates that have emerged over the past week. Are these changes material enough to make a difference?

Tyler Durden

Fri, 09/13/2019 – 08:25

via ZeroHedge News https://ift.tt/2Q4cNVo Tyler Durden