UMich Survey Shows Depressed Democrats Weighing Down Sentiment

After August’s collapse, UMich Sentiment survey was expected to bounce a little (most notably in a rebound of expectations) and a little it did.

Oddly, the headline beat expectations handily (92.0 vs 90.8 exp and up from prior 89.8), but both current and future expectations disappointed expectations (current 106.9 vs 107.8 and future 82.4 vs 85.2 exp).

Source: Bloomberg

“The data do indicate that consumers anticipate that the Fed will cut interest rates next week, with net declines in interest rates more frequently expected at present than anytime since the depths of the Great Recession in February 2009 (see the chart). These expectations are likely to diminish the impact on spending from a quarter-point rate cut, but if rates remain unchanged, it may increase negative reactions by consumers.”

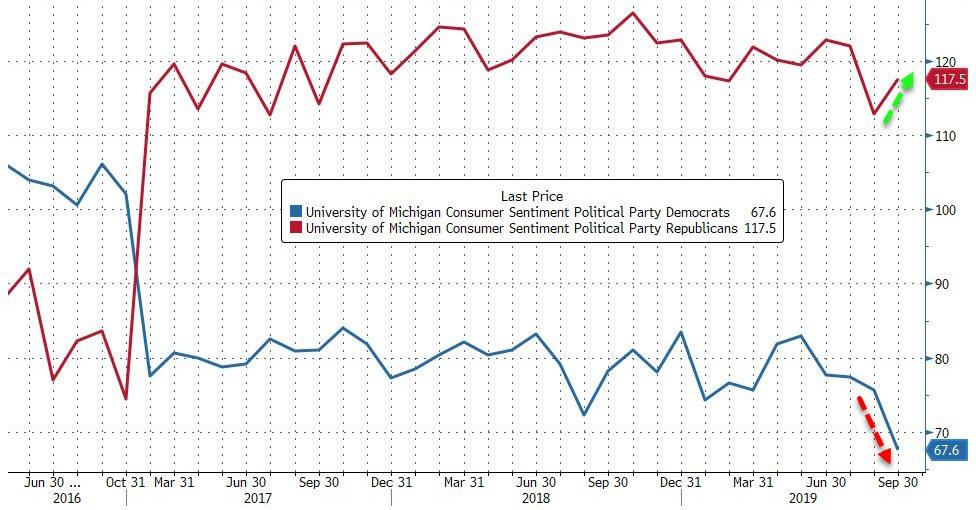

It appears the weakness is driven by Democrats (weakest since the survey began)…

Source: Bloomberg

“While a recession is not anticipated in the year ahead, neither is a resurgence in personal consumption. The outlook for consumption is for a slower but positive growth, keeping the expansion going for another year.”

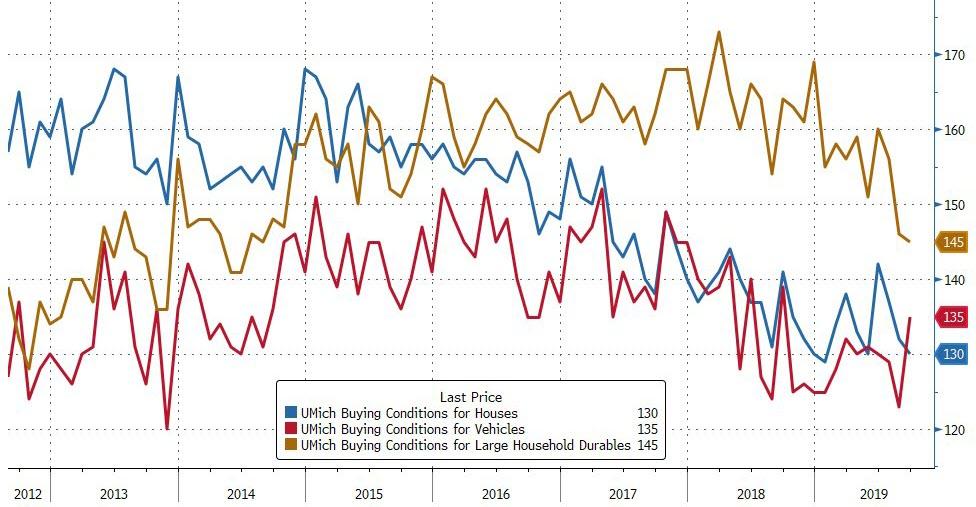

Buying Conditions for cars surprisingly jumped in preliminary September data as housing and large appliances slipped lower…

Source: Bloomberg

Consumer expectations for inflation were mixed, with price gains over the coming year seen at 2.8%, up from 2.7%, while five-year estimates fell to 2.3%, matching the lowest in records to 1979.

The reading for the first part of the month is the first since President Donald Trump increased tariffs on Chinese goods Sept. 1, expanding them to cover more consumer products as officials in Beijing retaliated with levies of their own.

Tyler Durden

Fri, 09/13/2019 – 10:11

via ZeroHedge News https://ift.tt/2Alwmh7 Tyler Durden