As The Tide Goes Out, SoftBank Has Been Swimming Naked All Along

Earlier this year, Japan’s SoftBank Group Corp. announced a $5.5 billion share buyback program as it said valuations for its technology investments continued to soar. Eight months later, and those technology investments are imploding, has since sent Softbank’s stock into a bear market.

SoftBank’s share buyback program included measures to repurchase 112 million shares worth $5.5 billion through 1Q20, or about 10% of its current outstanding shares, excluding treasury stock.

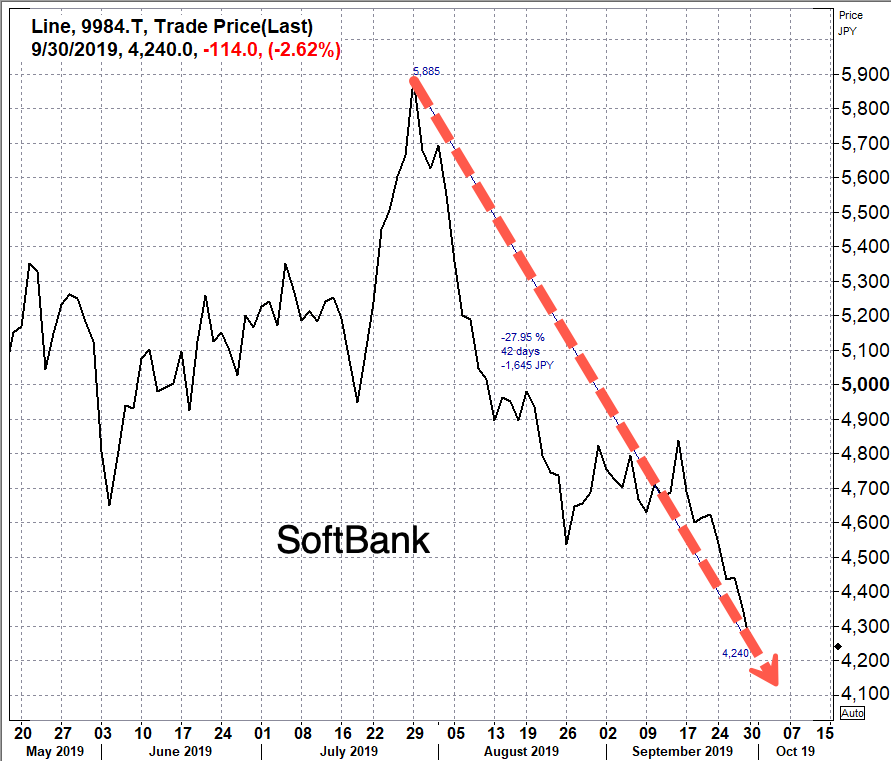

Upon the announcement of the buyback program, Softbank’s equity nearly doubled from early February to late April. Then by late summer into early Fall, SoftBank’s shares plunged 28% in the last 42 trading sessions, pressured by troubling issues with the SoftBank Vision Fund, the company’s $103 billion venture portfolio.

SoftBank Vision Fund owns significant stakes in technology companies across the world. Some of the most recent pressures have been the valuation implosion of Uber and WeWork, reported Bloomberg.

“Uber and WeWork, marquee investments by SoftBank, have both had a lamentable 2019. Uber finally went public in May, however its shares have tumbled more than 30% since then, hit by a $5.2 billion loss in its most recent quarterly earnings. Uber’s growth metrics are also starting to slow down, which is bad news for a company justifying its high burn rate on the basis of prodigious expansion.

WeWork, valued at as much as $47 billion, stumbled when it tried to go public as investors balked at its vertiginous valuation and unconventional governance practices. Chief Executive Officer Adam Neumann stepped down from the post, with Son’s SoftBank Group pushing for change. He is also tapping SoftBank Group Chief Operating Officer Marcelo Claure to help turn the company around, as WeWork faces a liquidity crunch. SoftBank Gives ‘Very Public Lesson’ to Founders in WeWork Ouster,” Bloomberg noted.

The Vision Fund also owns significant stakes in technology companies in Asia, including a 29.5% stake in Alibaba Group Holding Ltd., one company that has found itself center stage in the trade war between the US and China.

Alibaba saw its shares slide 11.4% in the last six trading sessions, with a 7.3% drop on Friday, due to new reports the Trump administration could delist Chinese companies from US exchanges.

New delays in the T-Mobile US Inc., Sprint Corp. merger have also added more woes to the fund, thus pressuring SoftBank’s stock. The fund has an 85% stake in Sprint, which SoftBank founder Masayoshi Son has been eager to see the merger close.

Son’s aggressive risk-taking in technology companies dazzled investors in the last decade — but there are concerns that he might have overlooked valuation metrics for some.

“The size and pace at which SoftBank made its investments raises issues of whether it paid close attention to the usual valuation metrics,” wrote Barry Ritholtz, a Bloomberg Opinion columnist and chairman of Ritholtz Wealth Management.

“Perhaps the Vision Fund allowed the hype to get the best of its assumptions about future growth and singular domination by these companies.”

SoftBank Vision Fund could be headed for a hard landing after valuation concerns of some of its technology holdings, could send SoftBank shares even lower, despite a $5.5 billion buyback program.

S&P Global Ratings warned in July that SoftBank’s announcement of Vision Fund 2 is “extremely aggressive growth strategy and underlying financial policy… are likely to continue to restrain its credit quality.”

It’s only when the tide goes out that we find out SoftBank’s Vision Fund, managed by Son, has been swimming naked all along. The company took on too much leveraged and paid too much for unicorns. The tide is going out, and going out quick, SoftBank is likely headed for turmoil.

Tyler Durden

Tue, 10/01/2019 – 12:45

via ZeroHedge News https://ift.tt/2nwvEem Tyler Durden