GM Labor Talks Break Down, Set To Ignite US Manufacturing Recession

One day after we reported that the ongoing UAW strike at GM – which is set to enter its fourth week – has unleashed recessionary shockwaves across the nation, chopping off $400 million in direct wages out of the US economy with half of that coming from Michigan, not to mention GM itself which analysts estimate has suffered more than $1 billion in losses so far as a result of the strike, the largest US automaker is now facing an even more acute crisis because as the AP reports that contract talks between General Motors and the United Auto Workers labor union aimed at ending the 21-day strike, collapsed after hitting a big snag over product commitments for U.S. factories, a union official wrote in an email to members.”

In a Sunday letter to union members, Terry Dittes, the UAW’s top bargainer for GM, said talks with the company had taken “a turn for the worse” in part because the union says GM reverted back to a previously rejected proposal with only minor changes, casting doubt on whether there will be a quick settlement in the contract dispute, which sent 49,000 workers to the picket lines on Sept. 16, crippling GM’s factories.

“The company’s response did nothing to advance a whole host of issues that are important to you and your families!,” Dittes wrote in the letter. “It did nothing to provide job security during the term of this agreement,” Dittes also wrote, adding that “we, in this union, could not be more disappointed with General Motors who refuse to recognize the experience and talent of our membership.”

Normally in contract talks, the union bargains for commitments from the company to build new vehicles, engines, transmissions and other items at U.S. factories represented by the union. Striking workers rely on weekly paychecks of just $250 while on strike.

In a statement, GM said it continues to negotiate in good faith “with very good proposals that benefit employees today and builds a stronger future for all of us.” The company says it is committed to talking around the clock to resolve the dispute.

But Dittes wrote that while both sides had made progress on important issues two days ago, the talks now “have taken a turn for the worse.” He said the union presented GM with a comprehensive proposal that addressed wages, job security, pensions, profit-sharing and other topics Saturday evening, only to receive the company’s counter offer Sunday morning.

A person briefed on the talks said Sunday that the union voiced concerns about GM increasing production in Mexico, where it now builds pickup trucks, small cars and two SUVs. The person, who spoke on condition of anonymity because the talks are private, said both sides are far apart on guarantees of new products in U.S. factories.

The deadlock is the latest sign the now 21-day strike at GM is likely to continue into a fourth week, extending a nationwide walkout that is already the longest at the company since 1970. The work stoppage has halted factory output at more than 30 U.S. plants, stifled production for auto-parts suppliers, resulted in temporary layoffs for thousands of non-UAW factory workers and stopped all of GM’s pickup truck production in North America.

As the WSJ notes, the biggest remaining issues on the table as of Saturday were shortening the eight-year time period it takes for a new worker at GM to reach full pay of about $30 an hour and providing enhancements to workers’ pensions and 401(k) contributions, according to people close to the talks.

The disparity in pay between veteran workers and newer hires has long upset the union, which has fought for equal pay among members working in auto factories. New hires start out at about $17 an hour and get yearly raises until they reach full pay. The need to secure jobs during the next contract period, which . Dittes called out specifically in his letter, has been among the UAW’s top demands heading into talks and since calling the strike at GM.

The company’s decision in November to indefinitely idle four UAW-represented factories—including assembly plants in Detroit and Lordstown, Ohio—early on drove a wedge between the company and union with UAW leaders criticizing GM for building vehicles in Mexico and what they described as prioritizing profits at the expense of American workers.

GM, in an offer made public shortly after the UAW called the strike three weeks ago, said it had solutions for Detroit and Lordstown, and offered wage increases and plant investments that would create thousands of new jobs.

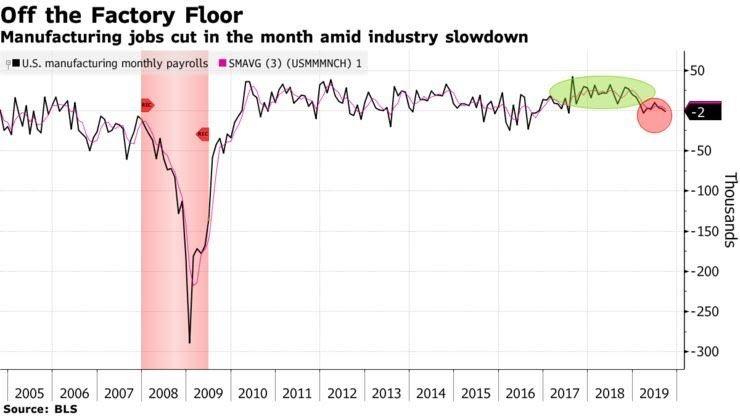

Meanwhile, as we reported previously, the three-week old strike is already sending shockwaves across the nation whose manufacturing is already in a de facto recession following several negative manufacturing ISM prints and the latest drop in manufacturing jobs.

Mike Luna, a warehouse worker and a chairman of United Auto Workers Local 652 said: “It’s a necessary strike but everyone is feeling the hurt.” Luna works at Ryder, where about 500 workers have been laid off as a result of the strikes. The semi trailers left in their parking lot consist of auto parts destined for nearby General Motors plants. And the General Motors strike has reportedly chopped $400 million in direct wages out of the US economy, with half of that coming from Michigan. Even the US treasury has lost $154 million, so far, just in payroll and income taxes.

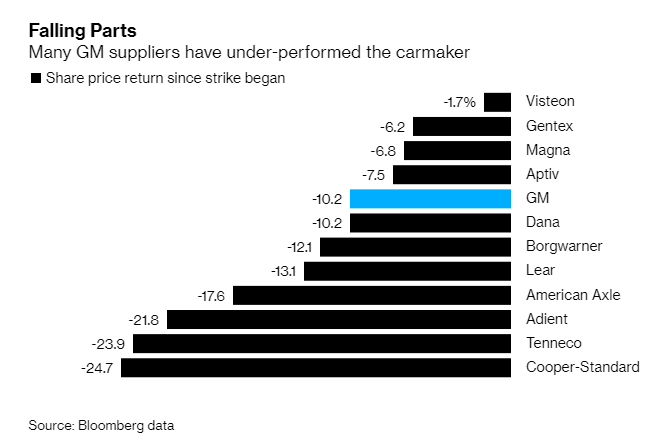

In Southeast Michigan, the layoffs have shaved off 1.8% of earned income and could be a cause for Southeast Michigan eventually going into recession. Component makers in Canada like Linamar which makes metal parts for drivetrains like camshafts and transmission cases, could be losing $750,000 a day due to the strike. Linamar’s stock slumped 13.8% last Thursday as a result.

Elsewhere, American Axle has had to lay off workers at its largest driveline plant in the US. The company, which was spun off from GM in 1994, still relies on the automaker for 39% of its revenue. Company CEO David Dauch said that it may have to adjust its full year earnings outlook lower, should the strike continue.

Other suppliers are also paying the cost of the strike:

The strike is costing Axle and Lear Corp., another big supplier, $2 million a day each while the toll on parts-maker Tenneco Inc. is $1 million daily, said RBC Capital Markets analyst Joseph Spak.

GM and its suppliers can make up some production once the strike ends, but not all of it. So some profit will either be lost or shifted to next year.

Spak commented: “We are getting to the point where it will be difficult to recover the lost production this year. In some respects, that makes the remainder of 2019 somewhat of a throwaway for the group and could shift the focus to 2020.”

The UAW’s strike has caused 46,000 workers at 34 plants nationwide to step off the job so far. Recall, days ago we reported that the UAW was considering a symbolic vote of “no confidence” for GM CEO Mary Barra, perhaps to try and get a leg up on negotiations with the company.

However, no vote is imminent, and a no-confidence vote by the UAW wouldn’t carry any force with GM or its board. Instead, it was being considered as a way to posture and put pressure on Barra, who has made a name for herself as a tough negotiator during her time at the company.

Tyler Durden

Sun, 10/06/2019 – 15:46

via ZeroHedge News https://ift.tt/35ceWlu Tyler Durden