Morgan Stanley: Only 3 Things Matter For The Future Of The Stock Market

Authored by Andrew Sheets, chief cross-asset strategist at Morgan Stanley

Three to Watch

Trying to gauge the direction of financial markets, if you haven’t noticed, is hard. They have a long history of being anticipatory, of moving ahead of the underlying data for an economy or a company. If the thing you’re trying to forecast reacts before everything else, how do you find something that moves before it does?

For all the complex quantitative models our team runs, three of our most powerful indicators for future equity and credit returns are quite simple. One of them currently looks bad. One is worrying. And one still looks fine but bears watching.

The first variable is the US ISM Manufacturing Purchasing Managers Index, or PMI. Because the Institute for Supply Management has been running it since 1948, the PMI provides a uniquely consistent, long-term measure of US industrial health, and plenty of data to help to gauge forward-looking implications.

And at the moment, those implications are troubling. US Manufacturing PMI has fallen sharply this year, and this week’s reading missed expectations badly. Our work suggests that a six-month moving average of the PMI reduces noise and produces a more reliable signal. With these recent declines, the six-month moving average is below average and falling, a reading that’s historically meant a poor environment for equities and credit. Because we focus on this average, even a better-than-expected PMI reading next month may not change the signal.

The second indicator is the Conference Board’s US Consumer Confidence Index, which like ISM is unique as a consistent data series with a very long history (dating from 1967). It’s currently near its highest levels since 2000, which is often cited as a reason to be positive on the market; a sign of consumer strength.

But history tells a different story. Markets peak when optimism peaks, and market and consumer optimism can frequently peak together. US consumer confidence made major tops in 1988, 2000 and 2007, all periods that were followed by decidedly worse-than-average equity and credit market returns. Today, consumer confidence is high but has started to weaken, a worrying sign that another such peak may be forming.

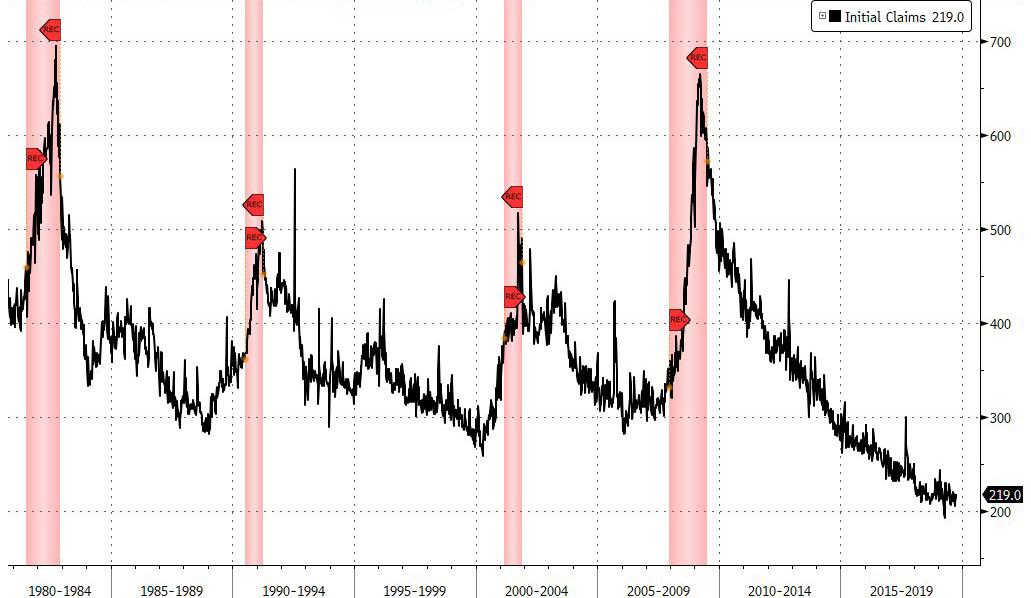

Our third variable is Initial Jobless Claims. This number reflects the health of the labour market, but importantly tends to move earlier than the official unemployment rate, making it a potentially more useful indicator for stock markets that are also trying to look ahead and anticipate. So far, new claims have remained low, a good sign, although one that we are monitoring given the signals from the other two indicators.

Economic data are important. But their usefulness can be limited because financial markets are anticipatory and often shift faster than the underlying data. We think ISM PMI, Consumer Confidence and Initial Jobless Claims are three exceptions to this rule, and over time have sent powerful forward-looking signals. All three are components of our US cycle indicator, and their readings are one of several reasons why we remain cautious on the market.

And I don’t think we’re alone. According to a not-very-funny joke about asset allocation, there aren’t many data series that over time have provided a strong signal about what to do in stock and bond markets, and even fewer that can do so over more than the last two or three economic cycles. ISM PMI, Consumer Confidence and Initial Jobless Claims are not some unique Morgan Stanley Research discovery. They are key barometers for many of our most sophisticated asset allocation clients.

This is important. Since downgrading global equities to underweight on July 7, we’re received the most disagreement from investors with shorter investment horizons, who frequently cite a lack of investor optimism and light positioning as a reason for markets to push higher. We’ve received the least disagreement from asset allocators and others tasked with steering portfolios over longer time periods. It could be because they are more focused on these very same signals.

Why does that matter? Short-term investors can help the market to rally over a given day or week. But the troubling signs from key long-cycle data, in our view, have made it harder for asset allocators to make a major positive shift in their exposure. This may be one reason why global equities are repeatedly failing to break out higher.

Tyler Durden

Sun, 10/06/2019 – 16:37

via ZeroHedge News https://ift.tt/2VjcdC9 Tyler Durden