$38 Billion In 3Y Treasuries Sell At Lowest Yield Since Nov 2016

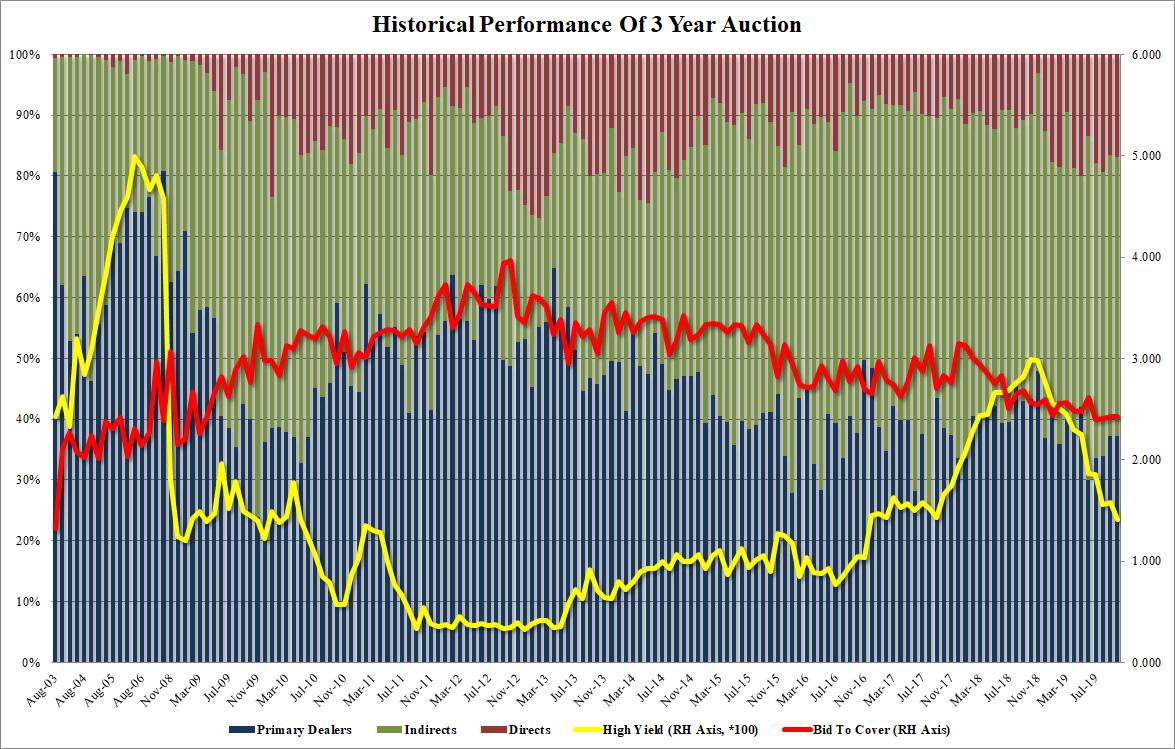

A new week of coupon auctions has started with the Treasury selling $38 billion in 3Y paper stopping out at a high yield of 1.4130%, which while tailing the When Issued 1.409% by 0.4bps, was the lowest 3Y yield since November 2016 and below last month’s 1.573% as short end yields have resumed collapsing amid a surge in rate cut expectations.

The Bid to Cover was virtually unchanged for 4 auctions in a row, rising tom 2.43 from 2.42 in September (and 2.39 and 2.41 in July and August respectively). The internals also showed virtually no change from last month, with Indirects taking down 45.8%, down from 46.2% last month, and just below the 46.4% six auction average, and with Directs also almost unchanged at 16.9% (up from 16.6%), it meant Dealers were left holding an almost identical amount to last month, at 37.3%.

Overall, a solid if not stellar auction, one which had no impact on the yield curve, with the 10Y last trading at 1.5374%, up modestly from session lows of 1.51%.

Tyler Durden

Tue, 10/08/2019 – 13:12

via ZeroHedge News https://ift.tt/2AVWOOV Tyler Durden