China Services PMI Tumbles To 7-Month Lows

With China coming back from Golden Week celebrations, all eyes are on PMI data (expected to be flat from August) as a sign that things are not getting any worse ahead of this week’s trade negotiations in Washington.

This is the last PMI print for September (after a mixed bag from official data across services and manufacturing):

-

China Official Manufacturing PMI small rise to 49.8

-

China Official Non-Manufacturing small drop to 53.7 (lowest since Nov 2018)

-

China Caixin Manufacturing notable rebound to 51.4 (highest since Feb 2018)

-

China Caixin Non-Manufacturing dropped to 51.3 (lowest since Feb 2019)

The weakness is somewhat surprising given the position China might want to portray during this week’s negotiations.

Source: Bloomberg

For the first time since Sept 2017, Services PMI is weaker than Manufacturing.

The level of positive sentiment in the manufacturing sector was little-changed from August, while optimism in the service sector slipped to its lowest since May. In both cases, expectations were among the lowest seen in the series history.

Commenting on the China General Services PMI data, Dr. Zhengsheng Zhong, Director of Macroeconomic Analysis at CEBM Group said:

“The Caixin China General Services Business Activity Index dipped to 51.3 in September from 52.1 in the previous month, the lowest reading in seven months.

1) Among the gauges included in the survey, the one for new business rose further, hitting the highest point since January 2018 and reflecting stable demand in the services sector. The increase was partly driven by new product launches. The gauge for new export business continued to drop, reflecting that growth in new business was mainly driven by domestic demand.

2) The employment measure increased significantly, reaching a level unseen since January 2017. The increase in employment was linked to growth in new orders.

3) The measure for input prices increased to the highest in a year, mainly driven by rising costs for labor, fuel and raw materials. However, the gauge for prices charged by service providers dipped marginally, indicating fierce competition. The gauge for business expectations dropped as rising costs restrained company confidence. “

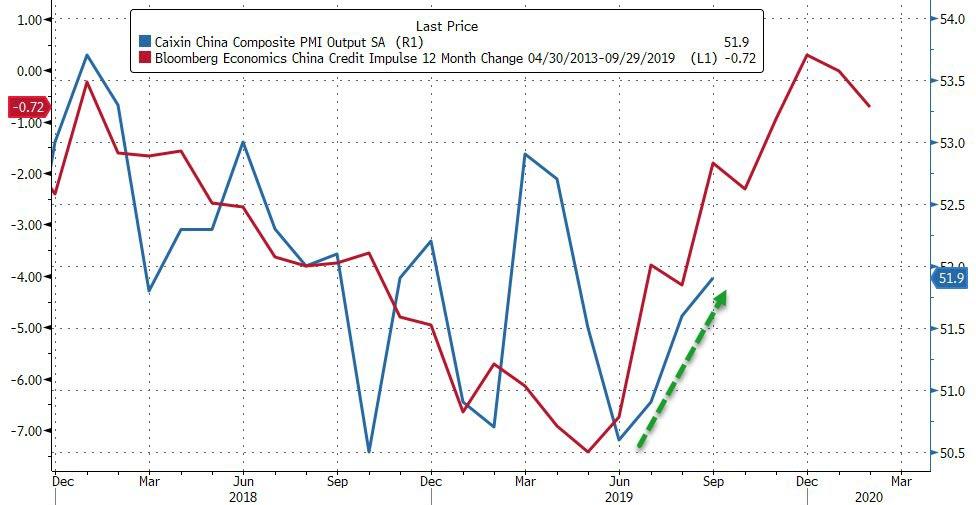

China’s notable credit impulse recovery is perhaps helping overall as China’s Composite PMI rises for the third month in a row…

Source: Bloomberg

“The Caixin China Composite Output Index increased to 51.9 in September from 51.6 in August, mainly driven by strengthened growth in the manufacturing sector. The gauge for new orders increased, hitting the highest level since February 2018. Employment increased at the fastest pace since January 2013, driven by the service sector. Backlogs of work had not expanded this quickly since April 2018. The pressure on companies from rising costs was great and business confidence dipped further.

“China’s economy showed signs of marginal recovery in September, as the labor market improved and domestic demand increased at a faster pace. However, fluctuations in exchange rates, and rising costs of labor and raw materials increased pressure on companies, which restrained business confidence. Due to previous destocking and capacity-reduction activities, constraints on companies’ production capacity became more severe and backlogs of work increased noticeably, which will help companies restore their investment. After a fast slowdown in previous quarters, China’s economic growth began to show signs of stability.”

Since China has been closed, US equities have dumped and pumped back to almost unchanged but the Trump administration placed eight Chinese tech companies on a blacklist after the US close today.

Source: Bloomberg

Chinese officials have confirmed that Vice Premier Liu He has departed China for his visit to Washington later in the week (so at least that’s a positive).

Finally, we note that gold has bounced modestly as the Chinese return from celebrations, fitting with the historical pattern of weakness into and through Golden Week, and strength after.

Tyler Durden

Mon, 10/07/2019 – 21:54

via ZeroHedge News https://ift.tt/35cvV7c Tyler Durden