Crisis In The Skies: 2019 Airline Bankruptcies On Pace For “Fastest Growth” In History

As macroeconomic headwinds develop in the global economy, something odd, but not really surprising, is occurring: the bankruptcy rate for airliners across the world is exploding, at a pace never seen before, reported Reuters, citing a new report from the International Bureau of Aviation (IBA).

Airline bankruptcies generally start to gain pace right before an economic downturn, and during a recession, which means the latest surge in bankruptcies, from companies like India’s Jet Airways, British travel group Thomas Cook and Avianca of Brazil, suggests 2020 could be a disastrous year for the global economy.

IBA states, “2019 has seen the fastest growth in airline failure in history,” with about 17 carriers filing for bankruptcy protection as of Sept.

With peak summer travel season winding down, many airliners are dealing with high debt loads, earnings deterioration, dwindling cash, higher fuel costs, a stronger dollar, and global economic turmoil that is squeezing the most vulnerable carriers.

“The last quarter of the year tends to see more failures during the northern hemisphere winter,” Phil Seymour, IBA’s chief executive, told Reuters.

Seymour said the strong dollar had severely damaged emerging market carriers.

Reuters notes that the series of bankruptcies has helped cash-strapped carriers acquire planes and airport slots at heavily discounted prices.

France’s Aigle Azur and XL Airways, Germania, Flybmi, and Adria of Slovenia, are some of the carriers that filed for bankruptcy this week.

With the Boeing 737 MAX fleet grounded, cash-strapped carriers have been exploring substitutes, and it’s the bankrupted carriers’ fleets that those companies are seeking to acquire.

Irish low-cost carrier Ryanair has been dealing with financial distress tied to the grounding of the MAX. The carrier decided to acquire Airbus A-320s that were previously leased by bankrupted Thomas Cook, as a substitute for the MAX.

“Opportunities crop up out of things like the failure of Thomas Cook,” Ryanair group CEO Michael O’Leary told Reuters.

“We’re talking to a number of the leasing companies about taking some of those Airbus aircraft and putting them into Lauda next summer,” he said.

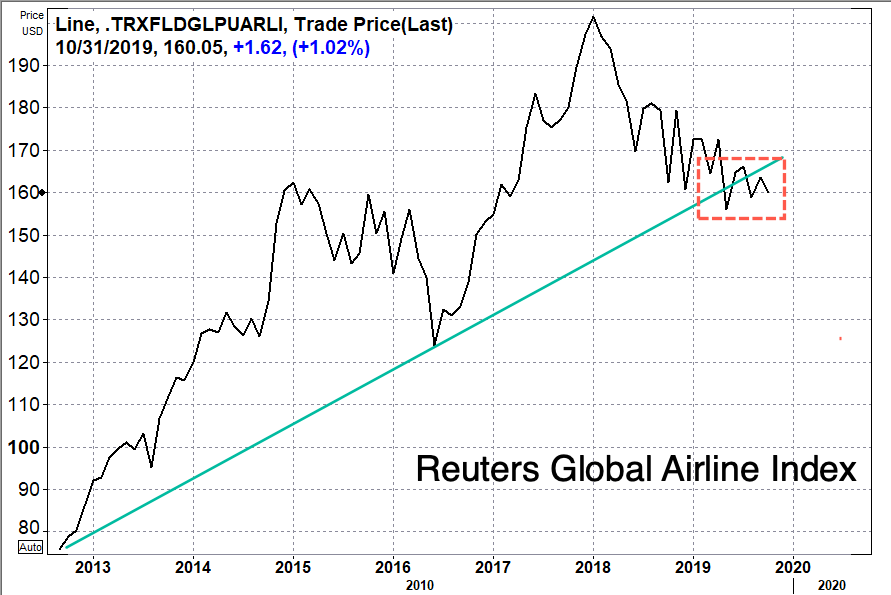

And judging by the Reuters Global Airline Index, the industry has been in a downturn since the start of 2018.

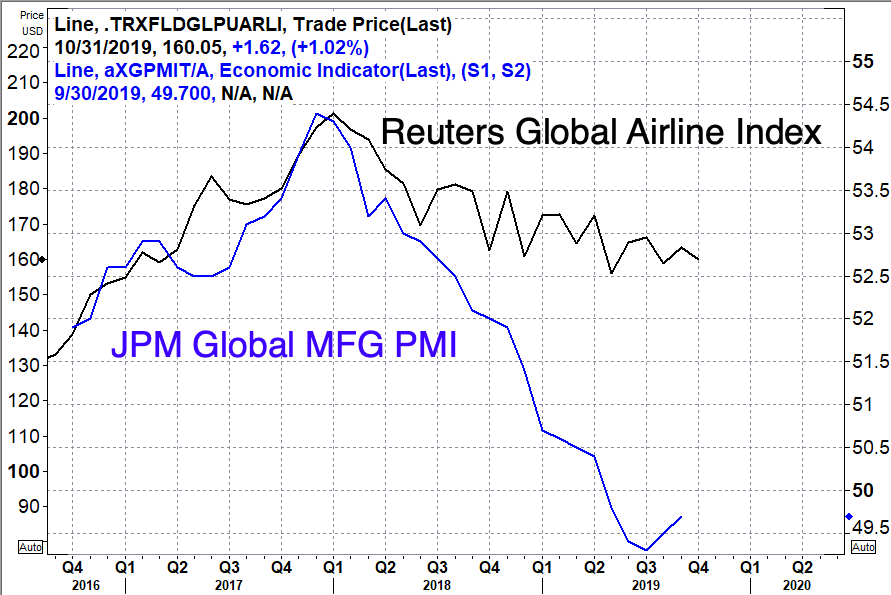

The Reuters Global Airline Index topped out in late 4Q17, several months before JPMorgan Global Manufacturing PMI peaked at the beginning of 1Q18.

With a global economy expected to weaken through year-end, more airline carriers will likely file for bankruptcy protection. Just imagine what will happen to the industry if a worldwide trade recession starts next year.

Tyler Durden

Mon, 10/07/2019 – 23:25

via ZeroHedge News https://ift.tt/2AV9LZ2 Tyler Durden