Fed Accepts $38BN In Both Overnight And Term Repo Securities As Liquidity Stabilizes

Today’s overnight/term repo announcement by the Fed was “not great, not terrible.”

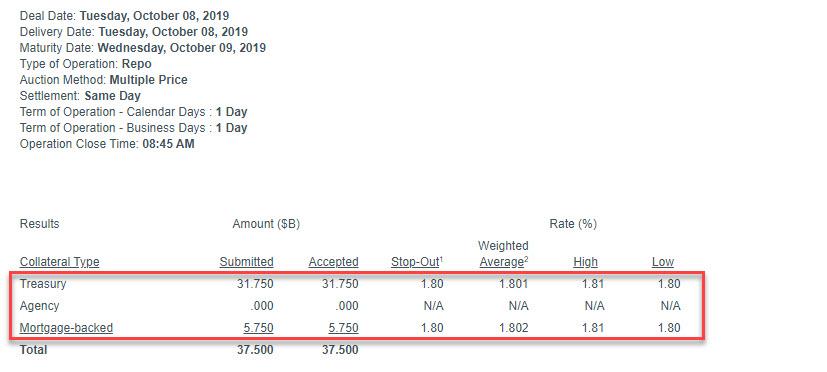

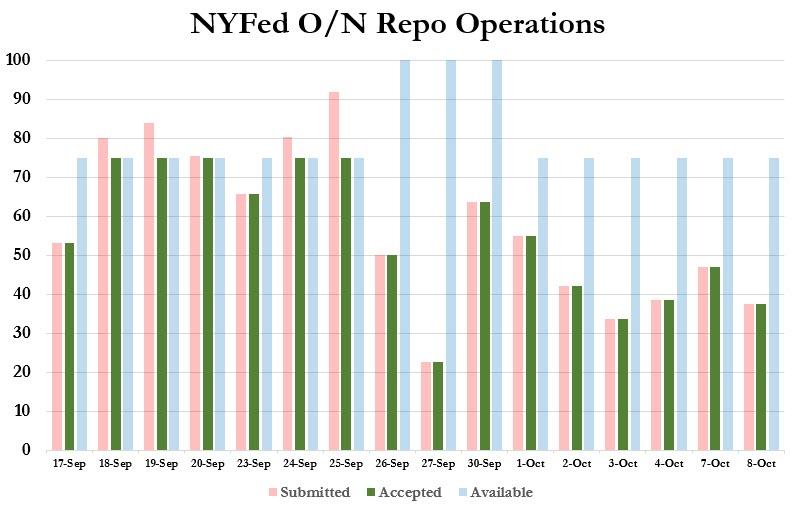

One day after the NY Fed accepted $47.05BN in securities for its latest overnight repo, demand for liquidity eased slightly, with the latest $75BN O/N repo operation seeing demand for exactly half of the maximum allotment, or $37.5BN, mostly in the form of TSYs, at $31.75BN.

It now appears that overnight repo usage has stabilized in the $30-$45BN range, with post-quarter end operations averaging around $40BN.

Separately, the Fed also announced the result of its first post-quarter end 14-day term repo operation which similar to the O/N repo, saw $38.85BN in submissions ($29.3BN in TSYs, $9.55BN in MBS), which while closer to the full allotment of $45BN still confirmed that there was some space for additional liquidity demand.

And with the repo market seemingly stabilizing, the question is what happens as we approach the coming year-end period when as we recall from last year, the demand for collateral exploded, and whether the Fed will be content to manage liquidity demands with repo or whether it will launch POMOs some time in November as most investment banks now believe.

Tyler Durden

Tue, 10/08/2019 – 09:01

via ZeroHedge News https://ift.tt/2oshJX0 Tyler Durden