Goldman Believes Johnson Can Still Pull Off Last-Minute Brexit Deal

Analysts at Goldman have been assiduously tracking ‘Brexit’ odds, and with the uproar over Prime Minister Boris Johnson’s alternative Brexit plan this week, the bank’s Brexit team has published a new note laying out the various alternatives for how the Brexit drama might play out over the coming weeks.

In terms of the final outcome, the bank’s odds haven’t changed much: Goldman’s team of analysts still believe that the most likely outcome (60%) is for the UK and EU to agree on a deal before Oct. 31. Next up? Another delay – the ‘no Brexit at all’ option – to which the analysts assigned odds of 25%.

The least likely outcome (15%), despite all of the handwringing and hysteria in Parliament, is a ‘no deal’ Brexit on Oct. 31, as most expect the Commons will find some way to force Johnson to comply with a law requiring him to request a delay if a Brexit deal isn’t reached by mid-October.

Their biggest cause for optimism is their belief that Johnson’s deal, contentious as it may be, will serve as the basis for a final deal with the EU27.

According to PM Johnson’s latest Brexit proposals, Northern Ireland (NI) and Great Britain (GB) would both leave the EU’s customs union, but NI would remain aligned with EU regulations on all goods and agri-foods. This plan would necessitate customs checks on North-South trade and regulatory checks on East-West trade, with the former taking place away from the frontier and the latter subject to re-approval by the Northern Ireland Assembly every four years. In most other respects, PM Johnson’s Brexit proposals resemble the Withdrawal Agreement negotiated between the UK and the EU under former Prime Minister Theresa May.

The customs checks proposed between Northern Ireland and Ireland are contentious because they repudiate the joint commitment made in December 2017 to avoid “a hard border, including any physical infrastructure or related checks and controls” on the island of Ireland.

The mechanism for approval by the NI Assembly is contentious because, at least on current proposals, the DUP would have an effective veto over Northern Ireland’s position in the EU’s single market. Any such veto would be unacceptable to Ireland, not least because it risks hardening the North-South regulatory border in the future.

Johnson’s plan, as the analysts observe, strikes a compromise between two proposals: “The Northern Ireland-Only Backstop” (which was rejected by the Commons) and the “Brady Amendment”, which was rejected by the EU27.

Because of this, they believe both sides have room for compromise.

We think there is political space for further compromise. PM Johnson was careful to present last week’s proposals as an opening offer rather than an ultimatum. First, the NI consent mechanism could be re-configured to remove any single party’s potential veto power. Second, the implementation period preceding any new customs arrangements could be extended, well beyond the end of 2020. Third, if a backstop were to be reinserted into current proposals, that backstop could be covered by a time limit together with the principle of consent, in order to allay concerns that NI might be permanently excluded from the customs territory inhabited by the rest of the UK.

In our view, a mutually acceptable compromise could include NI (not UK) membership of the “facilitated customs arrangement” proposed in the Political Declaration advocated by PM May, with the default position beneath Stormont’s consent mechanism implying ongoing NI membership of EU (not UK) regulatory rules. Taking a longer view, it is important to note that the current UK government seems intent on: (i) leaving the EU “whole and entire”, (ii) pursuing an independent trade policy, and (iii) respecting the peace process in Northern Ireland. These three objectives imply that – sooner or later – the UK and the EU must negotiate a practical solution to allow two customs territories to co-exist on the island of Ireland. That solution is likely to rely on the reconciliation of two different interpretations of the Good Friday Agreement.

And Johnson’s ability to shift the DUP’s position ever-so-slightly from opposing to accepting regulatory checks suggests that the PM would be able to sell a backstop-compromise deal to Parliament if it truly comes down to ‘this deal or no Brexit at all’.

PM Johnson has managed to shift the DUP from a position in which they oppose any checks of any kind between GB and NI, to a position in which they accept regulatory checks but oppose customs checks on East-West trade. If the DUP agree to the EU’s counter-offer, we think the majority of the Eurosceptics in the Conservative Party will follow suit. If the existing Political Declaration is also enhanced to include commitments to uphold workers’ rights and maintain existing environmental standards, we think a clutch of Labour MPs from “Leave” constituencies will also be incentivised to vote in favour of a Brexit deal.

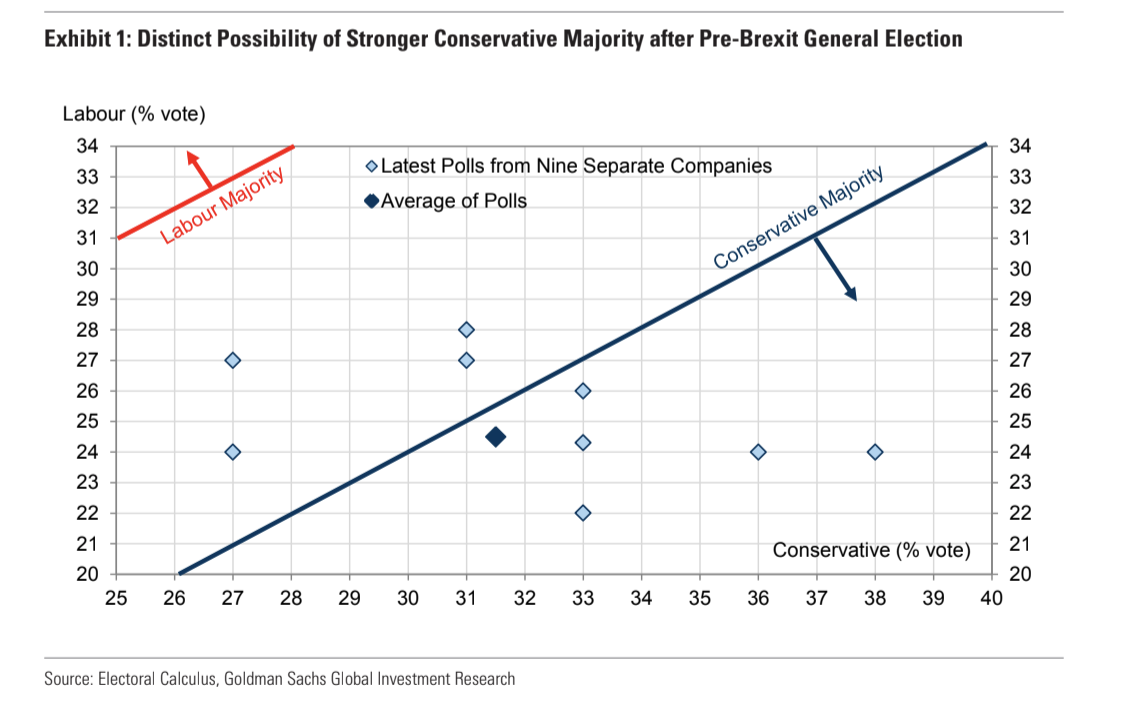

Of course, any keen observer of the Brexit process would have some thoughts on the possibility of a snap election. Goldman believes Parliament ultimately won’t brook the risk that an election returns a Johnson-led majority in favor of a no-deal exit. Polls suggest this is a real possibility (even if the perception from all of the media coverage might suggest that the conservatives would be in for a serious electoral beatdown).

For Johnson, the key to securing a deal, according to Goldman, is fanning the perception that no-deal is a real possibility. Thanks to the Benn Act (the law that was passed by last month by a ‘rebel alliance’ of MPs), Johnson will be legally compelled to request an extension if there’s no deal by Oct. 19. Goldman’s analysts are skeptical that Johnson will be able to find a legal loophole…but this must continue to seem like a real possibility for Europe.

But if Johnson has any trouble winning support for whatever compromise agreement is hammered out with the EU, a legal challenge to the Benn Act could help Johnson give Parliament the impression that its only choices are ‘Johnson’s deal’ or ‘no deal’. Which might be enough to convince any remaining Tory holdouts.

Tyler Durden

Tue, 10/08/2019 – 02:45

via ZeroHedge News https://ift.tt/2OAhsw9 Tyler Durden