Nomura Fears “Significant Downside Risk” From Here As Trade-Deal Odds Tumble

US equity markets are tumbling today following an avalanche of risk-negatives overnight:

1) Another seeming “reversal” of the prior White House denial of the “capital flows” report from last week (Navarro “fake news” comment last week R.I.P.), as a fresh Bloomberg story states that the Trump administration IS moving ahead with discussions around possible restrictions on capital flows into China, with particular focus on limiting investments in Chinese stocks made by US govt pension funds (despite the article noting that “It’s still unclear what legal authority the White House would rely on to force major indexes to drop certain Chinese companies,” as the Federal Retirement Thrift Investment Board is supposed to mirror the MSCI All Country World Index by mid-2020)

2) A SCMP article “source” story after hours US yday stating that the Chinese delegation has already planned to cut short its stay in DC by one night

3) And of course, the initial US / China trade negative impulse yday came via the tech co “black-list” announcement (with Chinese Foreign Ministry spokesman Geng Shuang telling reports overnight to “stay tuned” over potential retaliatory measures which importantly is an “escalation” from the US, because it’s the first time where “human rights” have been cited in a “new front” of the trade war (as opposed to “national security” as the basis with Huawei)

4) “Hard Brexit” odds again increase after negotiator talks with the EU head south (supposedly Johnson told Merkel “that a deal is essentially impossible”)

5) More “slowing global growth” confirmation, with Chinese Caixin PMI Services coming-in “light” (51.3 vs 52)

6) And just a bit ago, US Core PPI falls by the most in more than four years, while the NFIB Small Business Optimism Index declines for the second month in a row and back near the Trump Presidency “lows”

And Nomura’s Cross-Asset Strategy MD Charlie McElligott warns there could be more to come as markets appear overly complacent at some/any resolution in the US-China negotiations.

However, the market-implied odds of a China trade deal are plunging…

Source: Bloomberg

But, as McElligott notes, there remains a view with many investors that, due to President Trump’s domestic “impeachment” issue dominating the 24 hr news cycle, he would feel increased pressure to get a deal done, satiate his increasingly restless US farmers, and claim a much-needed “win” via bolstering the US stock market.

However, the Nomura quant suggests that, into next year’s election, Trump too needs to keep the pressure on the Fed with regards to cutting rates as well as potential balance sheet expansion, and thus, I do not expect him to give away this “free option” quite so early (instead, thinking 1Q19 where the pressure dials-up), which means he will likely keep the rhetoric and actions towards China negative / heavy-handed in the near-term.

The “partial” trade deal story was floated into the ether last week, and only generated a “meh” market response – because most realize that there is no substance if a deal doesn’t address “the seven deadly sins” of:

-

IP,

-

forced tech transfer,

-

hacking,

-

dumping,

-

subsidies for SOEs,

-

fentanyl and

-

currency manipulation.

Nonetheless, McElligott warns, “DANGEROUSLY,” I would say that investor expectations CONTINUE to expect a DELAY to the new tranche of US tariffs in order to keep discussions at least partially “thawed,” which means that there remains significant downside risk still from here if we do NOT see the expected delay come to pass.

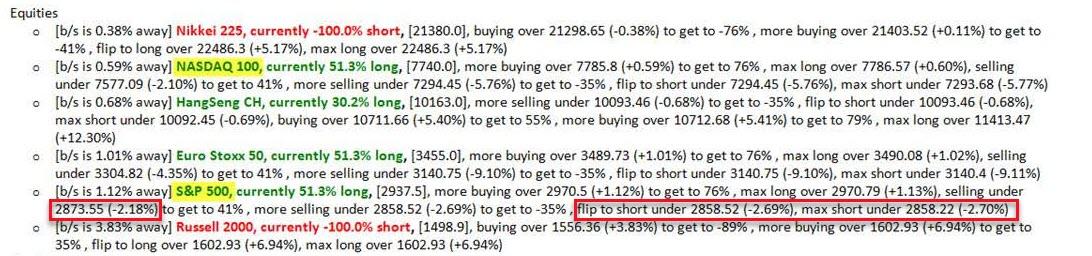

The S&P 500 levels to watch are 2873.55 (to see selling) and 2858.52 to see CTAs flip outright short…

Source: Nomura

Tyler Durden

Tue, 10/08/2019 – 10:59

via ZeroHedge News https://ift.tt/2VudW7N Tyler Durden