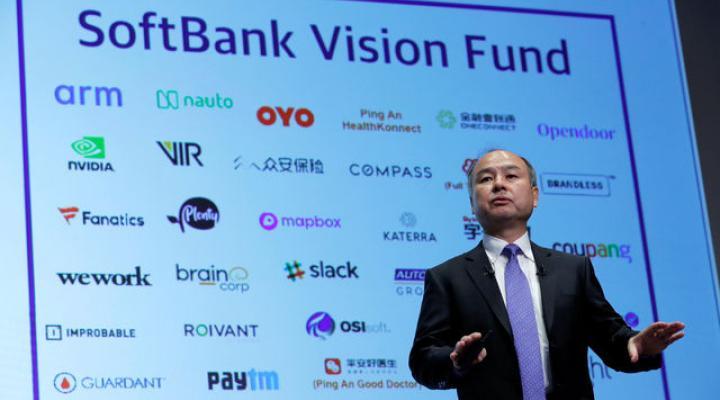

SoftBank Damaged After WeWork Implosion, Losses Could Exceed $5 Billion

SoftBank Group CEO Masayoshi Son has ruined his name in the investment community. His botched investments in WeWork, Uber, and Slack, just to name a few, could result in billions of dollars in losses for SoftBank Group Corp., according to Bloomberg, who compiled several notes from Wall Street analysts detailing the turmoil.

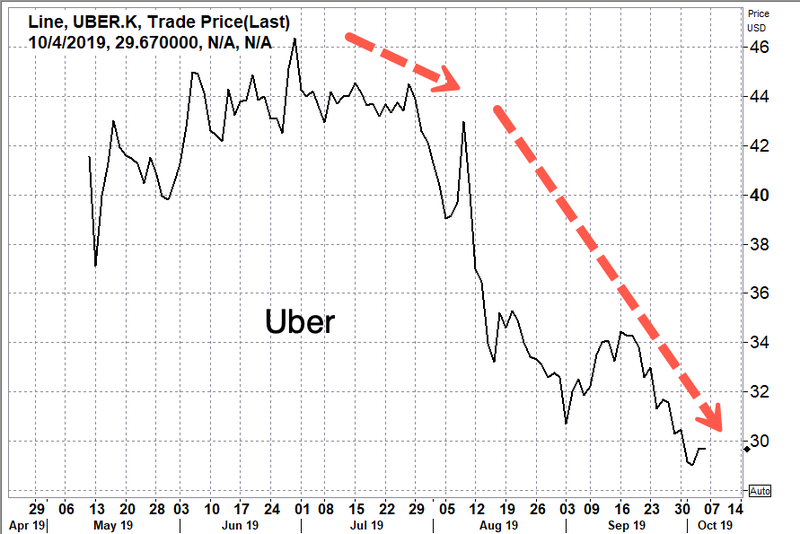

Profit estimates for SoftBank’s Vision Fund were slashed by $5.4 billion to an operating loss of $3.5 billion for 3Q19, wrote Mitsubishi UFJ Morgan Stanley Securities Co, in a recent note. Most of the losses were due to drastic valuation declines of Uber and Slack, and a massive writedown of WeWork after the shelved IPO collapsed valuations last month.

Sanford C. Bernstein & Co. believes SoftBank’s Vision Fund could writedown as much as $5.93 billion of WeWork, and SoftBank Group could writedown another $1.24 billion.

Mitsubishi UFJ analyst Hideaki Tanaka said, “Profits in the [SoftBank Vision Fund] segment may still see considerable volatility ahead.”

Tanaka said Uber’s 35% drop in 15 weeks was a massive reason for Vision Fund’s awful 2Q19 performance. He also reduced SoftBank Group’s fiscal year operating profit to $9.446 billion, from $14.861 billion.

Chris Lane, an analyst at Sanford C. Bernstein, said SoftBank might record a $3.54 billion drop in the value of its Uber stake and $350 loss in Slack. Lane believes the combined writedown for WeWork could be $2.82 billion, but that is based on WeWork’s valuation sliding to $15 billion from $24 billion. And as we’ve reported, WeWork could be worth $10 billion to $12 billion, a dramatic discount from the $47 billion valuation seen earlier this year.

It was only yesterday when Son spoke with Nikkei Business magazine, and said he is “embarrassed and flustered” by his recent track record.

“The results still have a long way to go and that makes me embarrassed and impatient,” said Son. “I used to envy the scale of the markets in the U.S. and China, but now you see red-hot growth companies coming out of small markets like in Southeast Asia. There is just no excuse for entrepreneurs in Japan, myself included.”

It’s apparent that Son’s aggressive risk-taking in technology companies left him overlooking valuation metrics in the last several years.

If macroeconomic headwinds continue to mount in the global economy, technology unicorn valuations will reset further, meaning that SoftBank’s Vision Fund will continue to incur steep losses and massive writedowns through 2020.

As we’ve highlighted in the last several weeks, the global IPO and M&A markets are starting to falter — this will further stress Vision Fund as their ability to cash out of technology unicorns are coming to an end for the year.

We even reported last week that veteran venture capitalists called an emergency meeting of the technology unicorns in Silicon Valley to advise them on the turbulent times ahead.

And of course, Son is “embarrassed,” who wouldn’t be, when you’re caught swimming naked as the proverbial tide goes out.

Tyler Durden

Tue, 10/08/2019 – 17:05

via ZeroHedge News https://ift.tt/2pV1LoN Tyler Durden