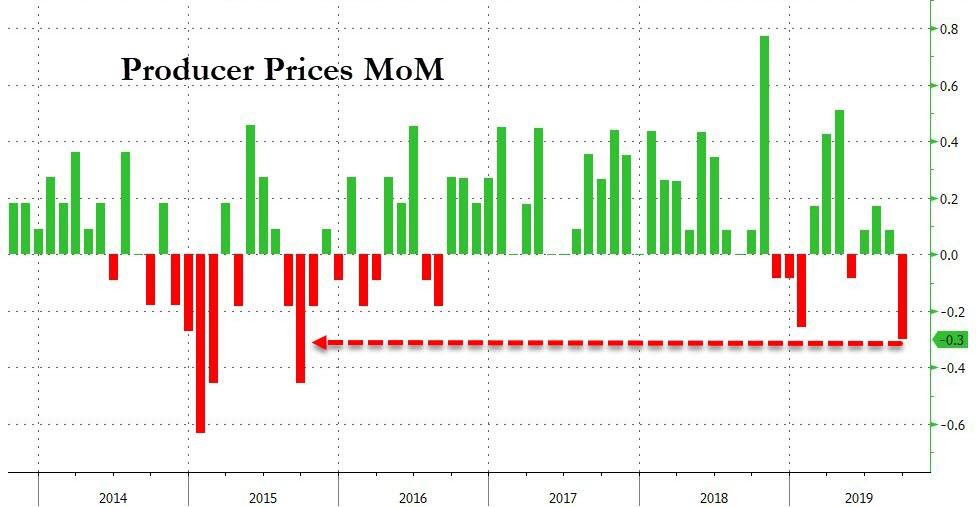

US Producer Prices Unexpectedly Plunge In September – Biggest Drop Since 2015

After falling (MoM) in July, US producer prices rebounded in August offering some hope, but September has now massively disappointed with a headline tumble of 0.3% MoM (+0.1% exp).

This is the biggest headline drop MoM since Sept 2015.

Source: Bloomberg

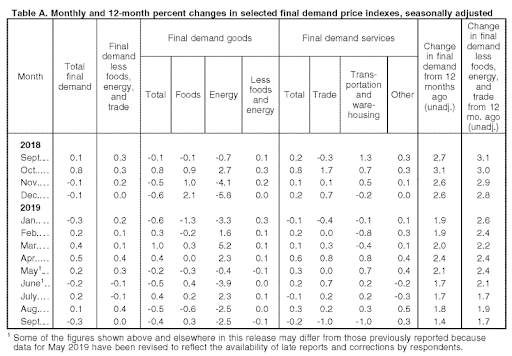

Excluding food and energy, producer prices decreased 0.3% in September from the prior month, compared with forecasts for a 0.2% increase.

Both headline and core PPI saw notable YoY slowdowns (although core PPI is at 2.0% or above for the 27th month in a row)…

Source: Bloomberg

Under the hood is a sea of deflation…

The cost of goods fell 0.4% after dropping 0.5% the previous month.

Nearly half of the September decline in prices for final demand services can be traced to the index for machinery and vehicle wholesaling, which fell 2.7 percent. The indexes for automotive fuels and lubricants retailing; apparel, jewelry, footwear, and accessories retailing; airline passenger services; gaming receipts (partial); and professional and commercial equipment wholesaling also moved lower. Conversely, prices for hospital outpatient care rose 1.1 percent.

Three-fourths of the September decrease in the index for final demand goods can be traced to prices for gasoline, which fell 7.2 percent. The indexes for electric power, iron and steel scrap, basic organic chemicals, fresh and dry vegetables, and light motor trucks also moved lower. Conversely, prices for meats rose 1.9 percent.

Theoretically, this provides Powell with some more ammo for cutting rates BUT we note that despite all the mainstream media screaming over tariff-driven price surges crushing the consumer – there is no evidence of it at all.

Tyler Durden

Tue, 10/08/2019 – 08:38

via ZeroHedge News https://ift.tt/2Vy40ud Tyler Durden