Cohen, Griffin, Balyasny All Hammered By Quant Quake: Here Are The Best And Worst Performering Hedge Funds Of 2019

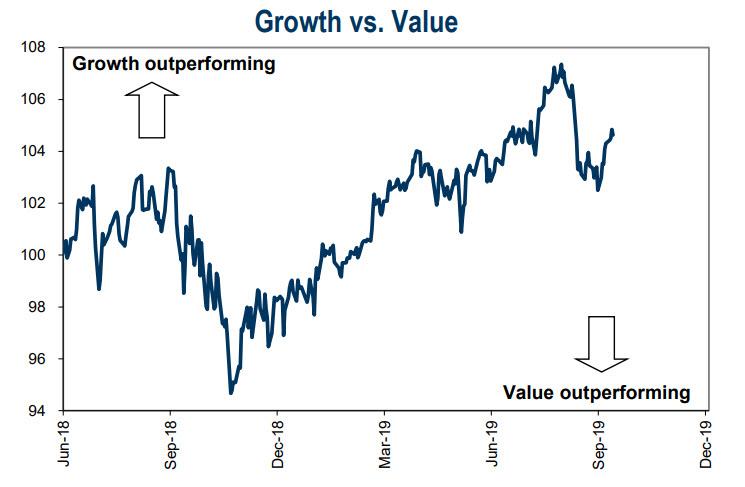

A little over a month ago, the best and worst performing factors of 2019, growth and value, respectively, were hit by a historic “quant quake” – one that surpassed even August 2007 in severity – and which sent value stocks soaring as perennial darlings, momentum and growth, tumbled on signals that a U.S. recession wasn’t imminent, which in turn sent 10-year yields sharply higher. The quake sent shockwaves across all asset classes, including commodities and currencies, where investors had positioned themselves for a further downturn in the US economy.

And while the relationship quickly re-established itself, as growth is one again outperforming value…

… the sharp unwind in these most loved and hated positions only made a bad year for hedge funds worse. After all, heading into September, Goldman’s famous Hedge Fund VIP basket of stocks that are most popular among the hedge fund community were sliding to YTD lows, a slump which only accelerated since.

As a result, not only were market-neutral quants – those at the center of the September factor storm – hit hard, so were some of the biggest marquee names in the industry, including SAC‘s, pardon, Point72’s Steve Cohen, who according to Bloomberg led losses among his biggest multistrategy hedge fund peers.

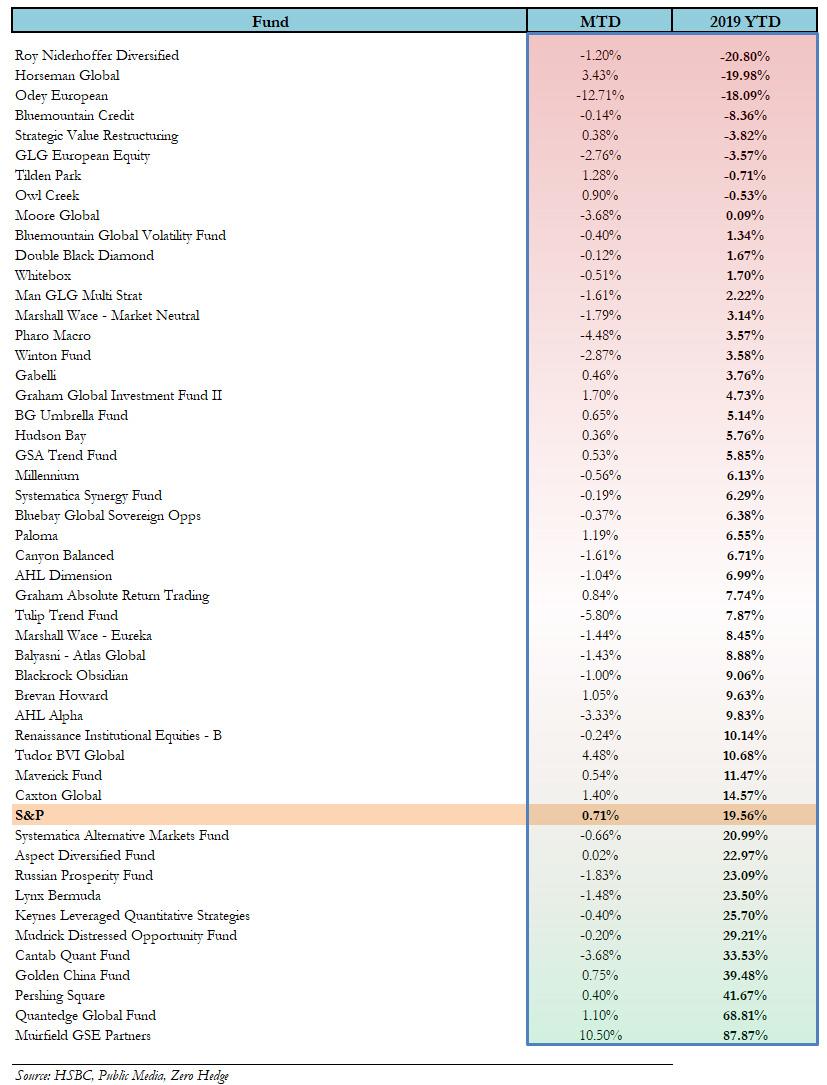

Cohen’s $15 billion Point72 fell 2% in September, trimming YTD gains through September to more than 10%. One of his closest multi-strat, silo-based peers, Balyasny Asset Management, also lost 1.4% in the month, similarly paring his 2019 return to 9%, while Izzy Englander’s Millennium fell 0.5%, bringing the YTD return to just over 6%, while “billionaire on a real-estate spending spree” Ken Griffin’s $32 billion Citadel lost 0.2% in its flagship fund, trimming its YTD returns to 14%.

Other multi-strats were also hurt: the recently renamed Sculptor, f/k/a Och-Ziff, dropped 1% in its main hedge fund, bringing its YTD return to 8.7%, while Carlson Capital’s Double Black Diamond fund lost about 0.12%, paring gains for this year to 1.6%, according to HSBC.

“The rotation drew blood early in September, with a P&L scar that remains today given the rotation has stalled, but not yet reversed in full,” Mark Connors, global head of risk advisory at Credit Suisse, wrote last month.

Looking at the big picture, however, there haven’t been major changes among the Top and Bottom 20, which are shown in the table below courtesy of HSBC’s Weekly Hedge Fund tracker.

Overall, despite a historic quant quake, the September pain was muted as long-term trends re-established themselves by the end of the month, and the hedge funds universe lost only 0.2% last month according to Bloomberg Hedge Fund indexes, paring gains for this year to about 6%, massively underperforming the S&P for the 10th consecutive year, which is up almost 20% YTD.

Finally, here is a full breakdown of MTD and YTD performance for some of the most notable hedge funds, or rather those which still report their performance to HSBC.

Tyler Durden

Thu, 10/17/2019 – 12:27

via ZeroHedge News https://ift.tt/2pq2cYb Tyler Durden