Fed’s Second “Not QE” T-Bill POMO Is 4.8 Oversubscribed

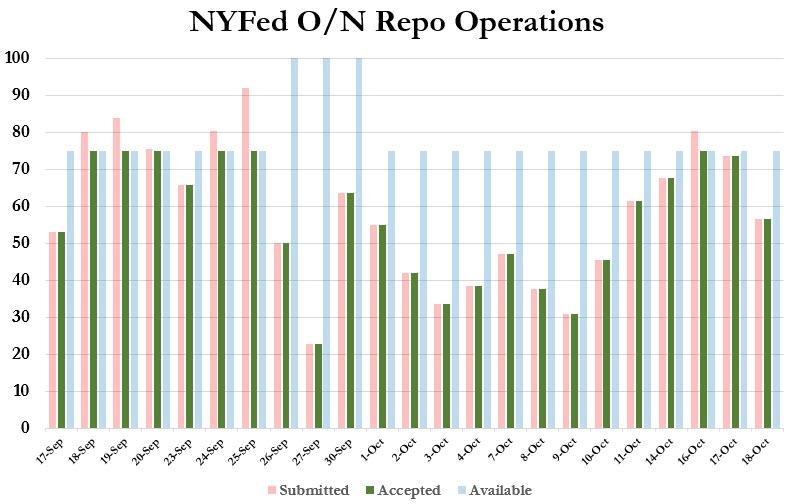

Just hours after the Fed announce that it accepted $56.65BN in collateral in its latest overnight repo operation ($47.95BN in TSYs, $8.2BN in MBS), which was a modest decline from Thursday’s operation, which as we noted at the time was on the verge of being oversubscribed…

… the Fed announced the results of its second “NOT A QE” Treasury-Bill POMO, which showed that Dealers submitted $36BN in bids for the maximum $7.5BN in purchases.

As such, the operation was 4.8x oversubscribed, a notable increase from the first POMO conducted on Wednesday when Dealers indicated they wanted to purchase $32.6BN in Treasuries, or “only” 4.3x oversubscribed.

And while the Fed kept all Bills that mature in less than a month on the exclusions list as expected, it is perhaps notable that unlike the Wednesday POMO, the number of CUSIPs that were purchased in today’s operation was decided greater than the first POMO, with CUSIP TR0 the most active, with $2.04BN of this Bill tendered back to the Fed, while TB5 was the second most active, at $1.035BN.

Composition of today’s purchases aside – and expect these to vary substantially as the Fed’s POMO lasts well into 2020 – what was most notable is that demand for the Fed’s permanent liquidity injection increased notably in its second operation, and that even though the overnight repo saw a modest dip in dealer interest, this was made up by the $3.5BN increase in POMO demand as demand for $28.5 billion in liquidity remained unmet.

As such the question we have been asking for the past month remains: why are banks still so desperate for liquidity even though the Fed has now made clear the Fed’s balance sheet will expand to accommodate all reserve needs, and why do they so stubbornly refuse to approach the interbank market for their funding needs? In short, what do they know about the banking system that we don’t?

Tyler Durden

Fri, 10/18/2019 – 11:27

via ZeroHedge News https://ift.tt/35Mb8aP Tyler Durden