Google Drops After Earnings, Paid Clicks Miss

After surging all day and hitting a new all time high of $1,299.24, moments ago Google parent Alphabet reported earnings which beat on the top line but missed on EPS, sending the stock lower, erasing almost all of its gains.

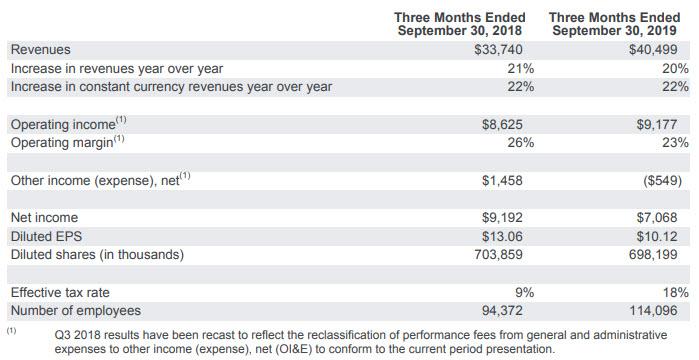

Here are the Q3 highlights reported by the search giant:

- Revenue Ex-TAC $33.01B, +21% Y/Y, and beating estimates of $32.72B

- Google properties revenues $28.65 billion, +19% y/y, estimate $28.41 billion

- Other revenue $6.43 billion, +39% y/y, estimate $6.30 billion

- Operating Income of $9.18BN, +10% y/y, but missing estimates of $9.45BN

- Operating margin 23%, down from 26% a year ago

- Net income was $7.068BN, down from $9.192BN a year ago

- EPS of $10.12, missing estimates of $12.35 and down sharply from $13.06 a year ago

In an interview with Bloomberg, CFO Ruth Porat attributed two main negative impacts on results: its legal settlement with France for a $1 billion related to taxes and unspecified losses from venture investments.

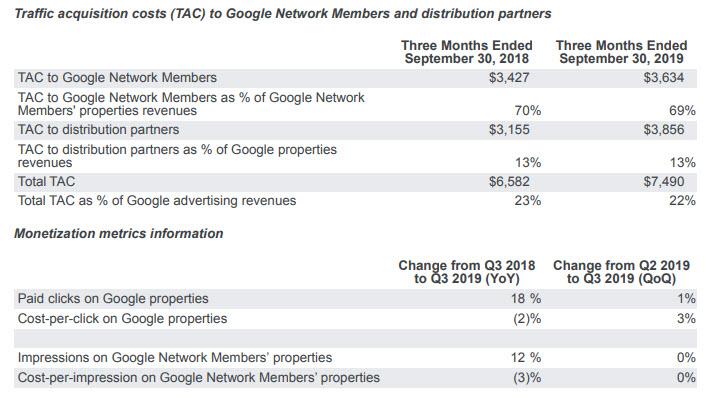

The key operating metrics were also mixed:

- Operating Margin of 23% missed estimates of 23.8%

- Cost-Per-Click on Google Properties was -2%, less than the -12.3% estimate

- Paid Clicks on Google Properties rose only +18%, far below the consensus estimate of +32%

Some other details:

- CapEx rose 26%, to $6.73 billion, but that was not enough to meet lofty expectations of $7.03 billion

- “Other Bets” revenue $155 million, +6.2% y/y, missing the est. $170.3 million

- “Other Bets” operating loss $941 million, +29% y/y, beating the est. loss $868.7 million

As Bloomberg points out, other Revenues rose from $4.6 billion to $6.4 billion year over year, “suggesting some of its hardware, like the cheaper Pixels, is having a positive impact. We likely won’t know how the Pixel 4 line is doing for several months, but the hardware upgrades likely aren’t big enough to be a notable positive to Google’s bottom line.”

Also notable is that while nowhere near Amazon’s relentless increase in headcount, Alphabet reported that its employee headcount also increased from about 94K to 114K in the last 12 months.

Commenting on the result, CEO Sundar Pichai said that “I am extremely pleased with the progress we made across the board in the third quarter, from our recent advancements in search and quantum computing to our strong revenue growth driven by mobile search, YouTube and Cloud. We’re focused on providing the most helpful services to our users and partners, and we see many opportunities ahead.”

After tumbling as low as $1,225 after hours, the stocks has stabilized around $1,265, roughly where it started the day.

Tyler Durden

Mon, 10/28/2019 – 16:23

via ZeroHedge News https://ift.tt/2Wi6zkm Tyler Durden