Halt All New Home Construction In Dubai Or Face Economic Disaster, Top Builder Warns

Damac Properties, one of the largest property developers in Dubai, warned over the weekend about an imminent economic crisis, festering in Dubai’s real estate market.

Damac Chairman Hussain Sajwani told Bloomberg that a collapse in the housing market is nearing unless new home construction is halted for several years. “Either we fix this problem, and we can grow from here, or we are going to see a disaster,” Sajwani said.

Sajwani is the latest real estate executive to voice his concern that Dubai’s housing market is on the brink of disaster.

The slump in the city’s housing market has been underway for the last five years. Prices have tumbled by more than 30% in the same timeframe.

Property broker JLL estimates 30,000 new homes will be constructed this year, which is more than twice the demand.

Despite the requests to halt all new home sales, Sajwani said Damac would complete 4,000 homes in 2019 and another 6,000 in 2020. The developer is expected to reduce new builds and concentrate on selling inventory next year.

“All we need is just to freeze the supply,” Sajwani said. “Reduce it for a year, maybe 18 months, maybe two years,” he said.

Sajwani predicted oversupplied markets would crash home prices.

He said if prices drop further, then it would trigger a tsunami in non-performing loans that would cause contagion in the banking industry.

“The domino effect is ridiculous because Dubai’s economy relies on property heavily,” he said.

Standard and Poor’s warned last month that economic growth in Dubai will trend lower through 2022 due to depressed oil prices, a global synchronized slowdown, turmoil from the US and China trade war, and geopolitical uncertainties in the Middle East.

The international rating agency said deterioration in real estate and tourism sectors had weighed heavily on the domestic economy.

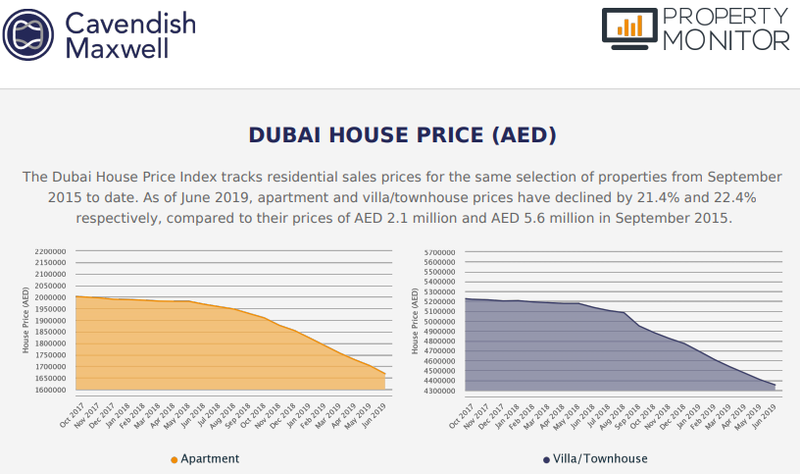

Housing data from Cavendish Maxwell’s Dubai House Price Index via Property Monitor showed home prices plunged to their lowest levels in June, not seen since the 2008 financial meltdown.

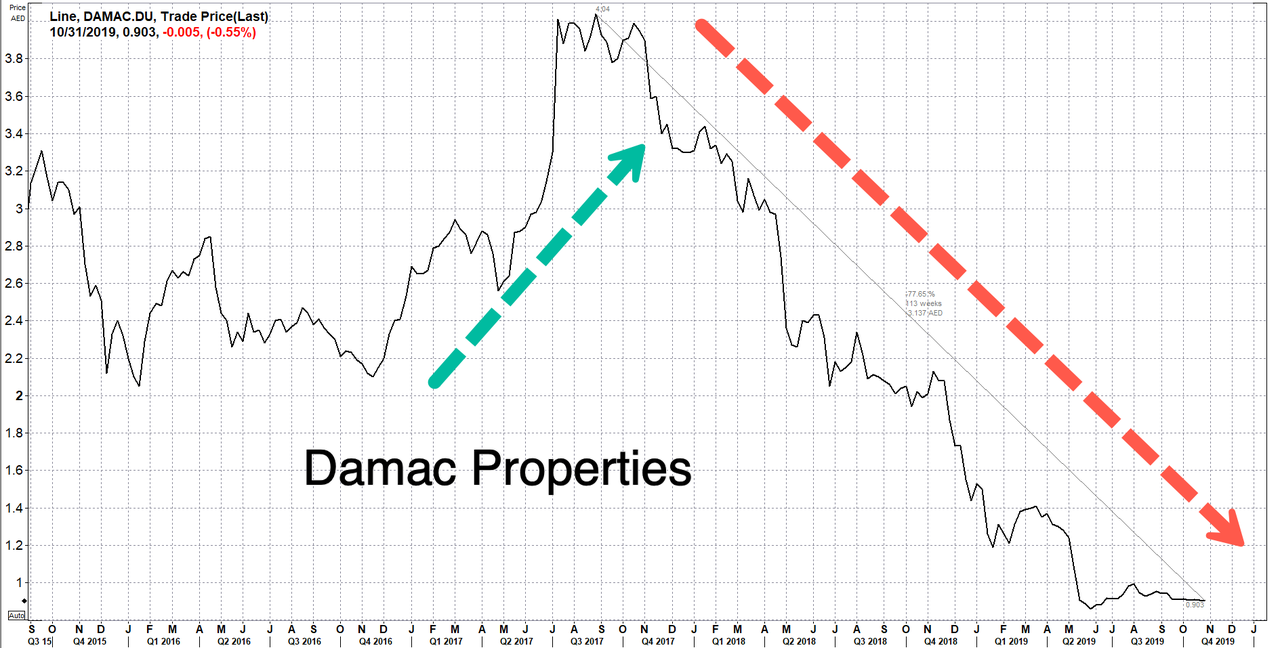

Damac’s shares have crashed more than 77% in the last 26 months, mirroring the downturn in the overall housing market.

If oversupplied conditions aren’t corrected in the coming quarters, Sajwani’s prediction of a market crash could unfold in Dubai in 2H20.

Tyler Durden

Tue, 10/29/2019 – 04:15

via ZeroHedge News https://ift.tt/32W6CVs Tyler Durden