Platts: 7 Commodity Charts To Watch This Week

Via S&P Global Platts Insight blog,

LNG breaks new records either side of the Atlantic in this week’s pick of energy and commodities trends from S&P Global Platts editors. Plus: US crude imports and refining, German power price dynamics and more.

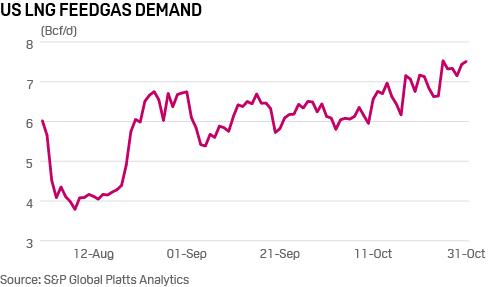

1. US LNG feedgas demand hits new single-day high…

What’s happening? US LNG feedgas demand is trending near record-high levels again this month as production at both Freeport LNG and Elba Island continue to ramp up. In October, demand from the six US LNG export facilities currently in operation has averaged over 6.6 Bcf/d. On October 26, demand reached a single-day record high at over 7.5 Bcf/d, data from S&P Global Platts Analytics shows.

What’s next? Growing export supply from the US and other emerging producers like Australia has put global gas prices under pressure this year. Over the past six months, delivered cargo prices for Northeast Asia’s benchmark JKM have averaged just $4.98/MMBtu, according to S&P Global Platts data. While swaps markets are pricing the JKM in the low $6s/MMBtu for this winter, new supply from the US and other producers is likely to keep the benchmark price well below last winter’s levels around $10/MMBtu.

2. … while UK leads Europe in LNG imports, pressuring prices

What’s happening? The UK was Europe’s leading importer of LNG in October, with supply mainly coming from Qatar. On October 30 the send-out rate rose to 105 million cu m/d, the highest seen in over eight years. This saw the British NBP market switch to a discount to the benchmark Dutch TTF gas market as NBP prices for front-month November tanked.

What’s next? November is forecast to start with slightly warmer temperatures across NW Europe and strong winds in the UK, suggesting the NBP will maintain its current discount to the Continent. Numerous floating LNG cargoes are set to keep the market well supplied in the next weeks, despite recent turndown in Qatari liquefaction.

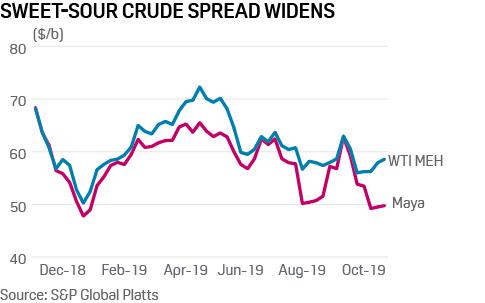

3. Sweet WTI builds premium over sour Maya ahead of IMO 2020…

What’s happening? The price spread between light, sweet US WTI crude and Mexico’s heavy sour Maya blend has risen sharply in October as US refiners start to avoid sour crudes ahead of the IMO’s low-sulfur marine specs in 2020. This switch from 3.5% sulfur to 0.5% sulfur in bunker fuel at the start of the new year has created consternation for some refiners and opportunities for others, particularly those with high-complexity coking plants along the US Gulf Coast.

What’s next? As US refiners look to blend and brand their own marine fuel for shippers ahead of IMO 2020, they are looking to all parts of the barrel, including blendstocks and feedstocks, giving refiners with cokers yet another advantage over less-sophisticated plants. One fuel they are looking at is HSFO, today’s bunker fuel, which these plants can convert and market as low-sulfur marine fuel before the IMO specs come into force. HSFO, or residual fuel, production has been declining in the US, but it remains a byproduct of less-sophisticated refineries.

4. …and Canada oil exports by rail could rise despite recent low arb

What’s happening? Western Canadian oil sands producers Suncor, MEG Energy and Cenovus said on October 31 they plan to ship more crude by rail as the Alberta government announced a deal to exempt those shipments from its production cap. Alberta set its output cap at 3.81 million b/d for December, but said producers will be able to apply to increase production if that crude is moved by rail. The arbitrage to move crude by rail tightened in October, on a narrower monthly average discount of Western Canadian Select at Hardisty to WCS at Nederland, Texas. However, the daily discount widened October 31 because the Keystone Pipeline was shut due to a leak.

What’s next? Other Canadian producers will likely take advantage of the Alberta rail exemption, so in the long term crude by rail is expected to increase in December, and through 2020. US Gulf Coast refiners are especially keen to rail in Canadian heavy crudes, as US sanctions have cut off the supply of Venezuelan heavies, while Mexican production is limited. The Keystone outage will widen the arbitrage, although it is hard to tell for how long, as Keystone operator TC Energy has not given a timeline on the return of the pipeline.

5. Shrinking German power Q1/Cal spread reflects changing power mix

What’s happening? The spread between Germany’s Q1 2020 and Calendar 2020 power contracts has narrowed in recent days following a decline in forward gas contracts. Denmark’s decision to grant a key permit to the Russia-Germany Nord Stream 2 gas pipeline has wiped premiums off 2020 gas contracts, negating the risk of disruption to Ukraine gas transits.

What’s next? As well as falling gas prices and reduced coal burn, a third factor is at play in the flattening of Germany’s forward curve: the structural shift to renewables. A growing surfeit of wind power can, on windy winter days, reverse the conventional seasonal logic. With coal/lignite generation being pushed off the system by cheap gas, the usual coal/carbon drivers on winter prices no longer apply to same extent. A windy winter will in turn push gas off the system, removing another chunk of fossil/CO2 costs.

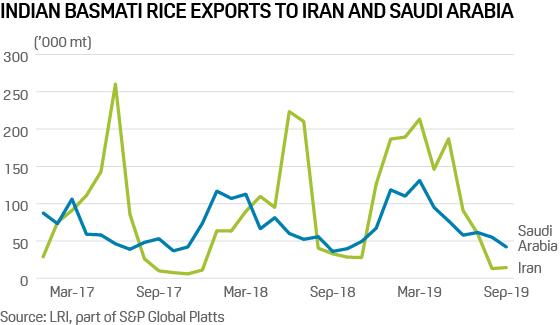

6. Iran sanctions cut off India’s biggest market for basmati rice

What’s happening? Harvesting of India’s annual Basmati rice crop is in full swing, although producers have seen sales to their largest market – Iran – fall to almost zero. Exports have dropped due to payment difficulties caused by the lifting of a US sanctions waiver on Iran-India oil imports in May – oil imports are crucial to providing sufficient currency liquidity for the bilateral rice trade to take place. Subsequently, producers are facing up to the prospect of harvesting a larger crop year on year but having to market it without access to their largest buyer.

What’s next? There are no signs that the payment difficulties will be resolved in the near future, while exports to India’s second largest market, Saudi Arabia, may also be complicated. The Saudi Food and Drug Authority plan to introduce more stringent quality checks regarding pesticides and authenticity effective January 2020. Instead, exporters will hope to re-capture market share in the EU, which has been lost to Pakistan, and to target new markets. The current outlook appears bearish for Basmati FOB export prices, and some varieties have already declined by around 15% in value since July.

7. Steel prices in US often hint at GDP strength, or weakness

What’s happening? US real gross domestic product increased at an annual rate of 1.9% in the third quarter of 2019, according to a recent advance estimate from the US Commerce Department’s Bureau of Economic Analysis. The rate was foreshadowed by declining Q3 steel prices, and reflected a continued slower rate of general economic growth in the US.

What’s next? Steel producers in the US tend to thrive, in terms of pricing, when US GDP growth is 3% or more. Not so in Q3 when the S&P Global Platts benchmark price of US-made steel hot-rolled coil averaged $568.54/st, down 7.7% from the Q2 average of $615.93/st, and down 18.2% from Q1’s average of $694.76/st. Correspondingly, US GDP growth in Q1 was 3.1%, but slipped to 2% in Q2 and further to Q3’s estimate of 1.9%. And if steel prices do portend US GDP rates of growth, Q4 is off to an even more sluggish start. The Platts benchmark averaged about $495/st in October.

Tyler Durden

Mon, 11/04/2019 – 11:25

via ZeroHedge News https://ift.tt/2NfRjla Tyler Durden