SaxoBank’s Mea Culpa: “The Risk Of A Melt Up In Equities Is Real”

Submitted by SaxoBank equity strategist, Peter Garnry

For more than a year we have been negative on equities relative to bonds as global leading indicators have continuously deteriorated. We have never pulled out the “all out” alarm but encouraged our clients to be defensive on equities gravitating towards high quality and minimum volatility stocks. To be fair our factor tilts have done well against the general equity market with minimum volatility stocks delivering the same return as MSCI World, but quality stocks have delivered 6.4% more in total return this year. In a longer horizon both minimum volatility and quality factors have done even much better. While we have got the equity factor tilts right, we have been totally wrong on our general allocation decision of underweight equities and overweight bonds. As a result, we are now officially positive on equities until the downward dynamics return.

Given the market reaction despite overwhelming data suggesting trouble ahead we now must contemplate a melt up scenario in US equities like the one in 1999-2000. In our equity presentation back in March we did in fact highlight the case for a melt up scenario as the similarities to the 1998 drawdown in equities followed by Greenspan’s panic resemble that of Powell’s panic early this year after the Q4 2018 meltdown. However, as the macro data and the US-China relationship continued to worsen we never materialized the melt up scenario as our base scenario. But for now, we must accept that central bank action pushing down interest rates again is driving strong substitution effects from bonds into equities and creates a strong there is no alternative (‘TINA’) effects offsetting any weakness in macro.

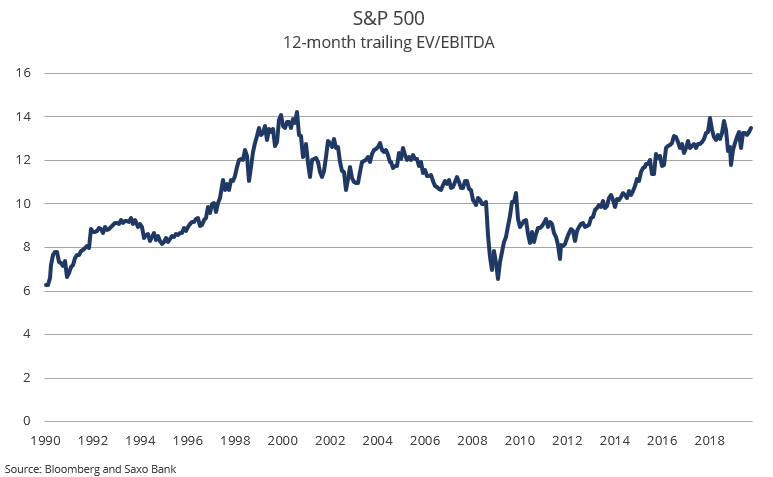

As we highlighted last week S&P 500 is becoming increasingly expensive in long historical context as valuation multiples have risen as technology companies with higher growth and higher return on capital have come to dominate the index.

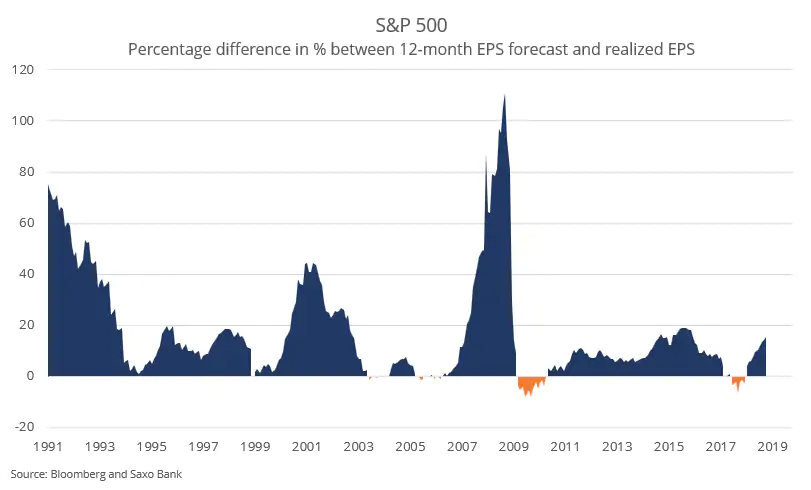

History shows that higher valuation comes with lower returns, so we are currently just borrowing returns from the future. In our monthly equity update published last Friday we are hypothesizing that that one of the key explanations for the disconnect between equities and macro is that equities are discounting a soft patch and a quick return to trend growth. This view is also reflected in current S&P 500 forward EPS estimates which are currently reflecting 14% growth over the next 12 month which in our view is an aggressive estimate for growth. It’s also important to note that S&P 500 estimates are generally too optimistic; the exact figures are 17% above realized earnings the following 12 months since 1991 and 7% in the period since the Great Financial Crisis.

In other words, the optimistic view currently baked into forward estimates will not hold pushing up valuation multiples even more over the coming period.

Tyler Durden

Mon, 11/04/2019 – 13:45

via ZeroHedge News https://ift.tt/2NELPzf Tyler Durden