Soaring Investor “Greed” Sends Dow To New Record High Despite Momo Massacre

Why are stocks soaring? Simple – it’s the fun-durr-mentals, stupid!

Source: Bloomberg

And everyone is chasing it now…

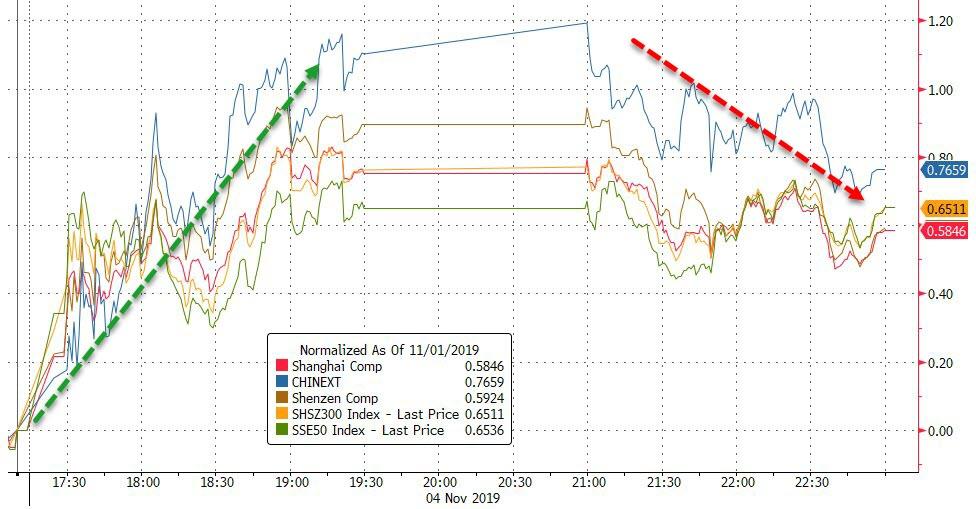

Chinese stocks all ended the day higher, but the afternoon session saw some giveback…

Source: Bloomberg

European stocks were all higher on the day, UK’s FTSE the laggard, Italy leader…

Source: Bloomberg

European equities surged to their highest level since August 2015 as miners to automakers advanced on optimism that U.S.-China trade talks are progressing.

Source: Bloomberg

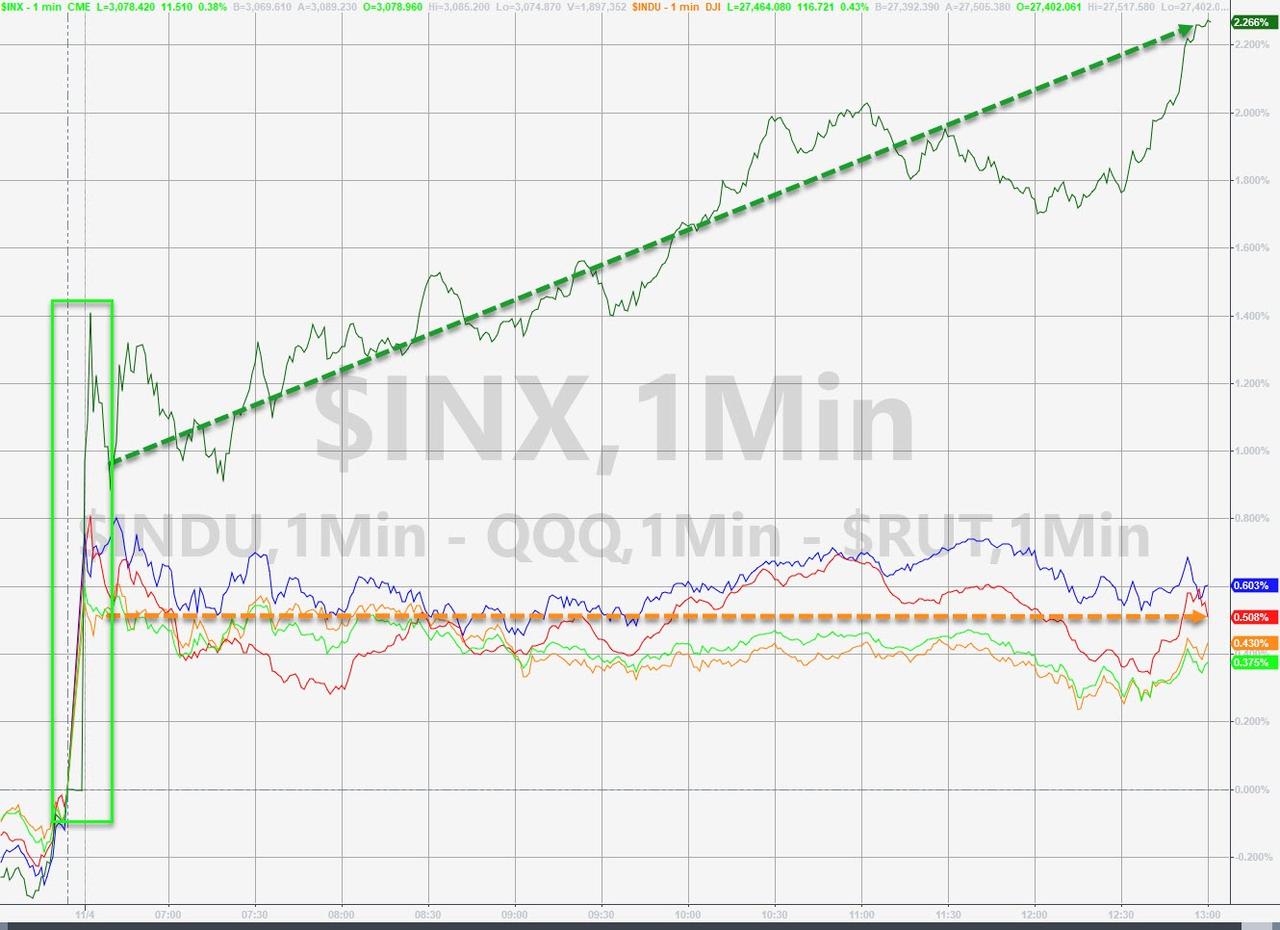

Major US equities indices were all higher (Dow joining the party at record highs) with Trannies outperforming (NOTE – the indices basically did nothing from the US cash open onwards – except Trannies)…

Futures show the action a little better with the US-China deal headlines sparking a pre-open ramp to record highs and then once Europe closed, stocks faded…

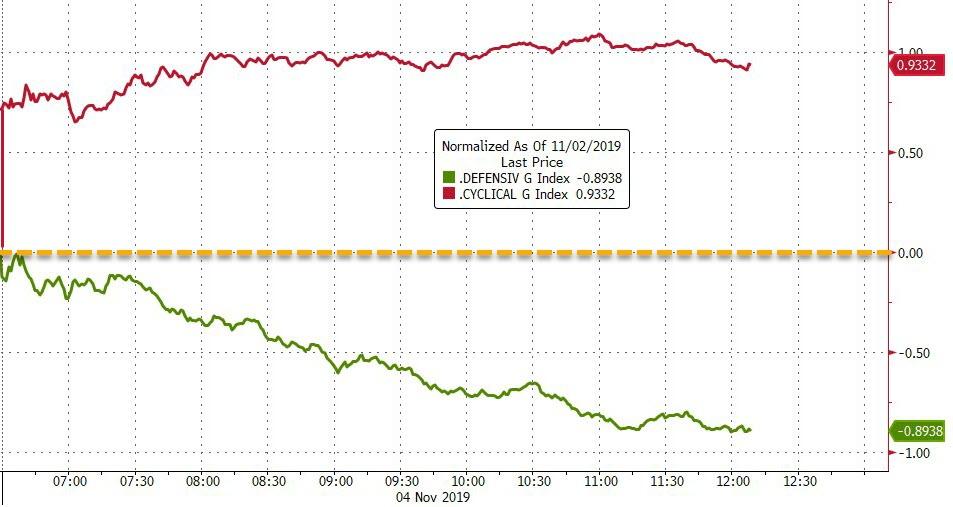

Defensives were straight down from the open as Cyclicals gapped open (short-squeeze – see below)

Source: Bloomberg

Momo stocks were massacred, extending Friday’s plunge… this is the biggest 2-day drop since the peak of the quant quake in September…

Source: Bloomberg

As Michael Krause (@michaelbkrause) noted so succinctly: “Junk stock short squeeze day. L/S momentum falling apart, value not picking up the slack, and most volatile stocks killing it… The pious quants with a long-term research-driven view are off-sides today.”

And sure enough, “most shorted” stocks ripped at the open, thanks to yet more trade deal rumors…

Source: Bloomberg

And as momo melts down, stocks soar to record highs but Bloomberg’s SMART money flow indicator signals the big boys are not playing along…

Source: Bloomberg

Treasury yields were all higher on the day with the long-end notably underperforming…

Source: Bloomberg

Which sent the yield curve notably steeper – erasing the post-Powell flattening…

Source: Bloomberg

30Y yields spiked 8bps today but if the quant quake is anything to go by, the yield should be soaring back near 3.00%…

Source: Bloomberg

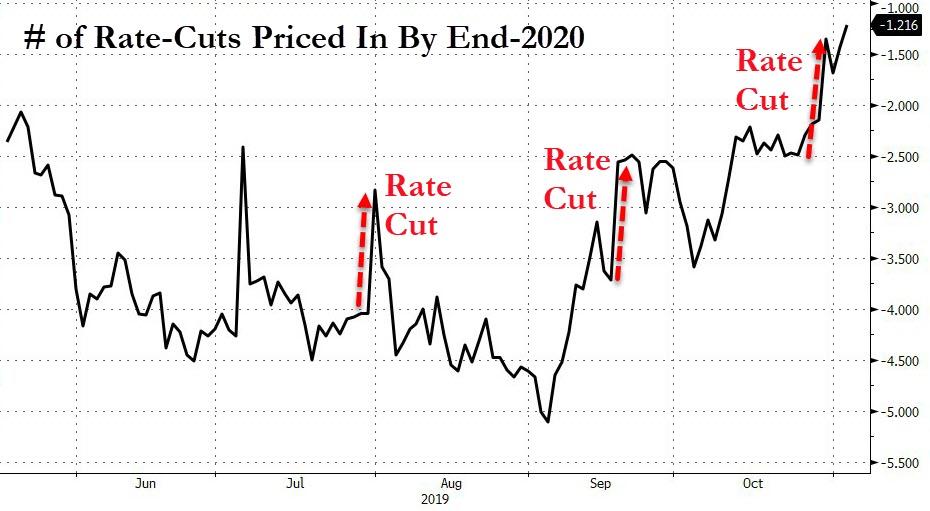

Notably, the market expects just 1.2 more rate-cuts by the end of 2020 – dramatically less dovish than the 5 cuts expected in early September (2 of which have been delivered)…

Source: Bloomberg

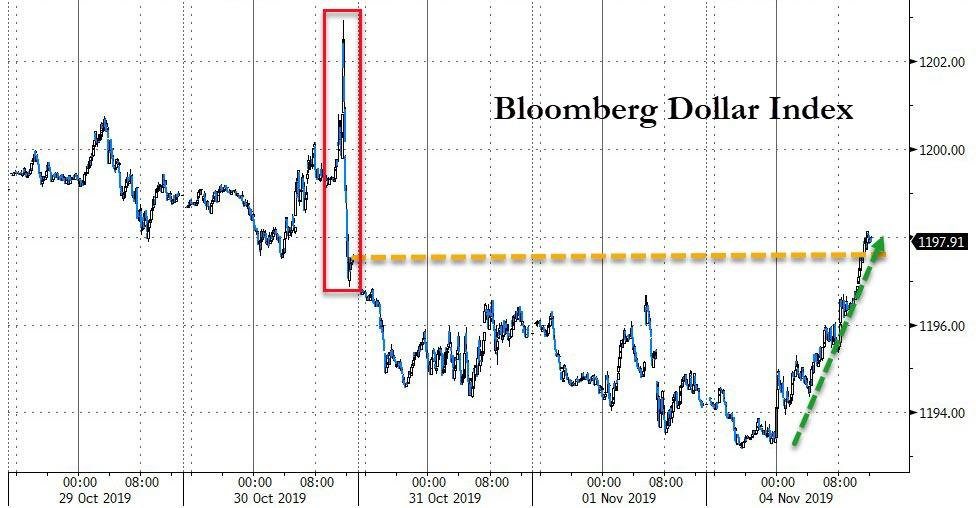

The dollar surged back to the lows of FOMC day…

Source: Bloomberg

Bitcoin and Ethereum trod water since Friday with Bitcoin Cash and Litecoin outperforming…

Source: Bloomberg

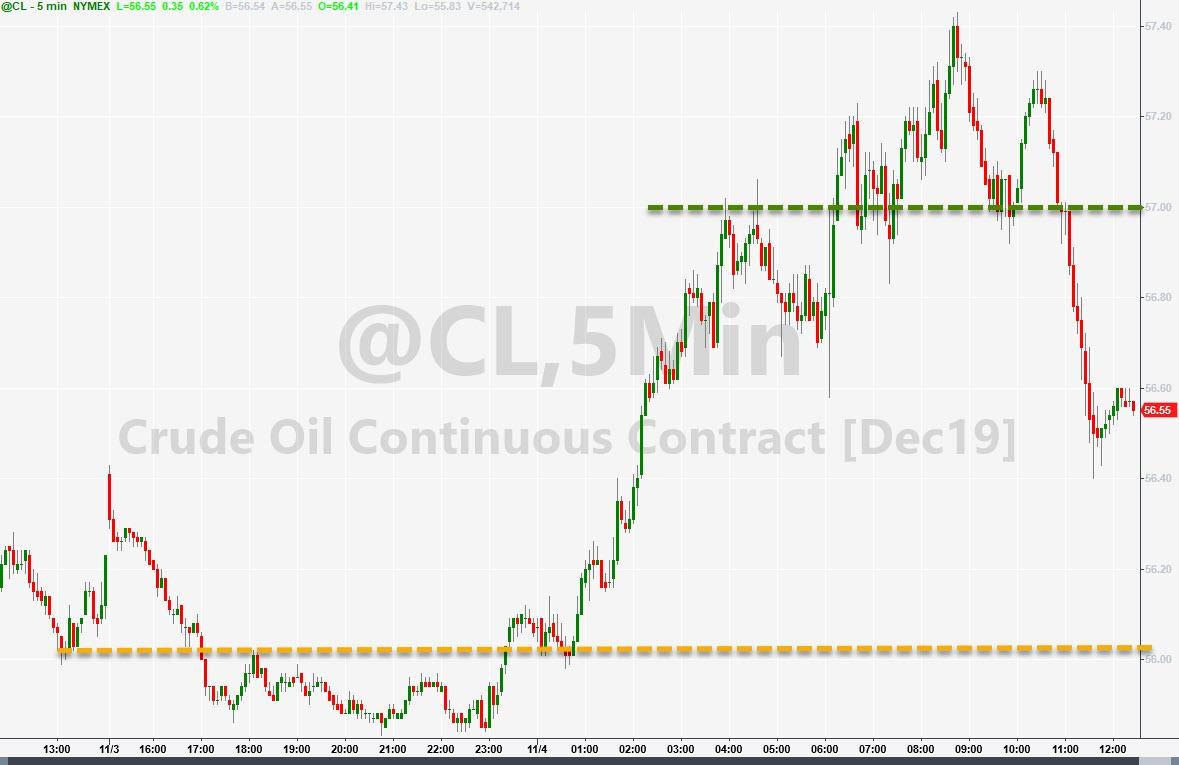

PMs were lower on the day, copper and crude gained but the latter gave plenty back after Europe closed…

Source: Bloomberg

WTI held on to its $56 handle but couldn’t hold the $57 intraday…

And while gold slipped, it remains above $1500…

Gold/Oil is back at the upper end of its long-term rang again…

Source: Bloomberg

Since Powell’s dovish inflation comments, gold remains the leader – despite stocks surge today…

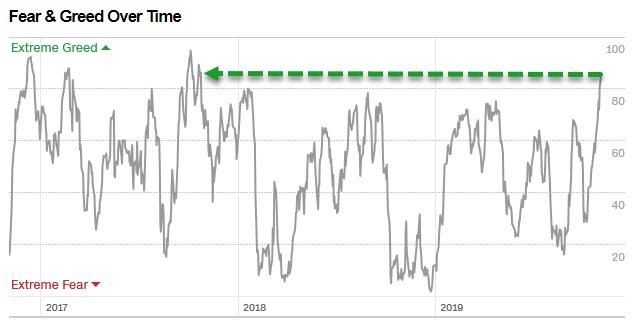

And finally, investors haven’t been this ‘Extremely Greedy’ since 2017…

Tyler Durden

Mon, 11/04/2019 – 16:00

via ZeroHedge News https://ift.tt/33gv9ET Tyler Durden