Uber Plunges After Another Huge Loss As Gross Booking Miss, $2.85BN EBITDA Burn Forecast

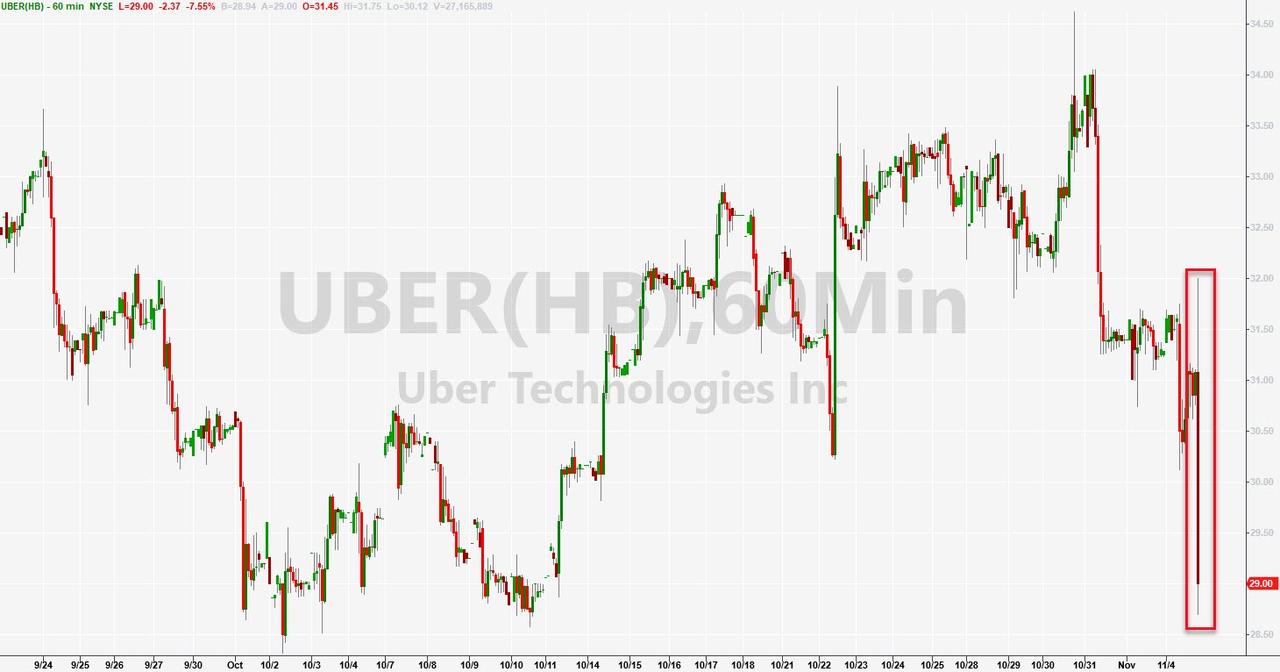

One quarter after Uber tumbled following its first report as a public company, Uber is plunging again, down 5%, after reporting a bigger than expected net loss.

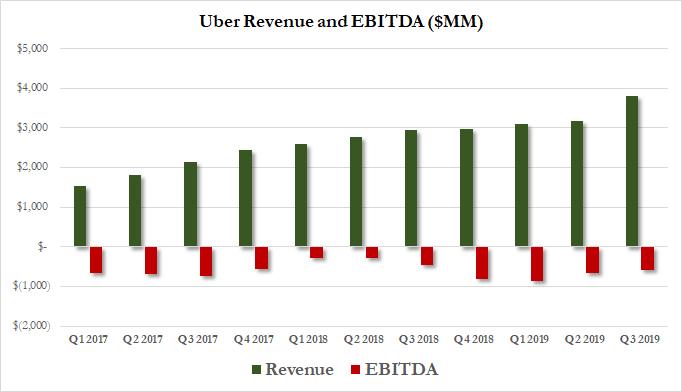

For the third quarter, despite net revenue rising 23% Q/Q to $3.53 billion, and better than the estimated $3.39 billion, Uber reported a 3Q loss per share of 68c, bigger than the estimated loss of 63c, translating to a net loss of $1.162BN, 18% worse than the $986MM a year ago, if modestly better than the $1.45 billion expected.

Looking at the breakdown of the topline, Uber reported the following Q3 numbers:

- Gross Bookings $16.47 billion, up 29% Y/Y, and missing estimates of $16.70 billion. This is said to be the main reason why the stock is hurting after hours.

- Uber Eats bookings $3.66 billion, +8% Q/Q, up 73% Y/Y, and also below the estimate of $3.89 billion; in the aftermath of the recent disastrous earnings from GrubHub, investors will be especially worried about this business line.

- Ridesharing bookings $12.55 billion, +3% Q/Q, up 20% Y/Y, and slightly above the estimate of $12.51 billion

Looking ahead, Uber provided a glimmer of hope that the cash burn may moderate and the company “improved” its full year Adjusted EBITDA guidance by $250 million to a loss of $2.8-2.9 billion, from $2.9-$3.0 billion previously.

However, the biggest concern is that despite the sizable improvement in revenue, the company’s adjusted Ebitda loss of $585 million was still staggering, and while it was a modest 11% improvement quarterly, and better than the estimated EBITDA loss of $805.1 million, it was still 28% greater compared to a year ago, as the business refuses to scale.

As Bloomberg summarizes, “Eats bookings, gross bookings and total active users were all below estimates” and while financial discipline is beginning to assert itself, “investors want those forward-looking estimates to keep going strong.” Alas, so far they are not. And as a result, the stock tumbled as much as 7.5% after hours before recovering some losses.

Which brings us to the right question as the stock tumbles just shy of its post-IPO low: when will the analysts covering the company shift from Buy to, well, reality.

Do any of them think it’s a sell now? pic.twitter.com/nztNWrkflZ

— Hipster (@Hipster_Trader) November 4, 2019

Tyler Durden

Mon, 11/04/2019 – 16:24

via ZeroHedge News https://ift.tt/2JQVGkp Tyler Durden