US Hotel Industry Contracts The Most Since The Financial Crisis

With virtually every other sector of the US economy slowing rapidly, or now outright contracting, we can now add the hotel industry – which in 2019 saw RevPAR decline for the first time since the crisis as the lower-tier class segments and markets outside the top 25 struggled – into the mix.

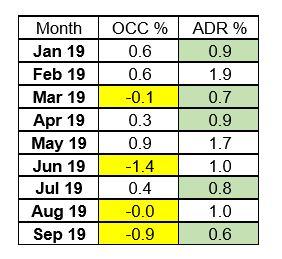

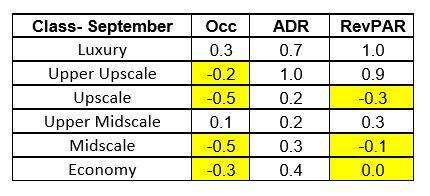

As HotelNewsNow reports, In September, US hotels recorded the second monthly revenue-per-available-room decline of 2019, declining by 0.3%, as average daily rates increased by 0.6%, but that was not enough to overcome the 0.9% occupancy decline.

Whether due to the impact of AirBnB, or some other reason, average hotel rates growth has now been below 1% for five of the nine months this year, while occupancy has now declined four of nine months.

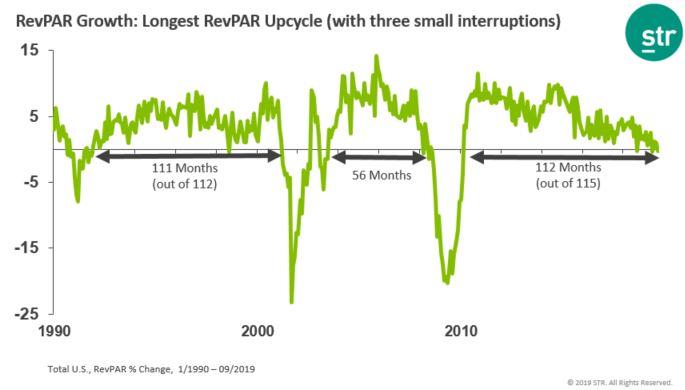

As HNN’s Jan Freitag writes, while the RevPAR cycle had enjoyed some 112 of the past 115th months – ever since the financial crisis – in positive territory, it may be time to retire the term “upcycle” if RevPAR is declining, as it did in September. The long-run monthly RevPAR growth chart now looks as if it is about to break with a period of record growth as its starts shrinking.

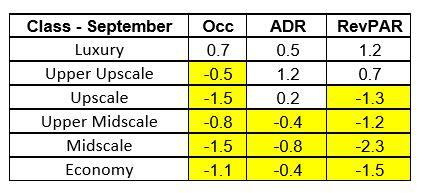

The slight RevPAR decline on the national level implies that there were likely some pockets of positive results, and indeed the upper end of the market did somewhat better than the remainder of the classes. This is the result of the group numbers coming in quite positive as discussed below.

As Freitag notes, a couple of data points stand out:

- Luxury hotels continue to do well, upper-upscale hotels continue to see some pricing power (when group demand is good).

- Upscale and upper-midscale hotels are seeing the impact of almost 4% supply increases in the occupancy results. It’s interesting then that the upscale ADR has not moved, although that could be seen as a positive outlier and not the norm going forward, as occupancy declines will be followed by ADR declines.

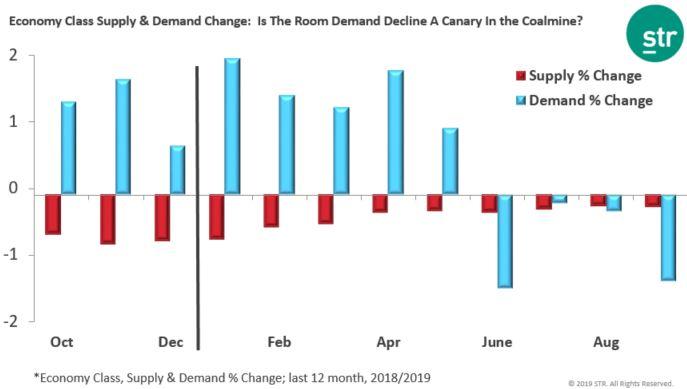

- Economy occupancy took a real hit, and that is noteworthy since supply for that class is still down 0.2%. Demand declined 1.3%, the steepest decline of all classes.

So when people look for canaries in the coalmine, is the ongoing deterioration of economy key performances indicators that sign? Is the leisure customer tightening the purse strings as the U.S. economy slows?

That, as the author notes, is the key space to watch.

* * *

Finally, some comments about the state of Q3, 2019: third-quarter U.S. RevPAR grew 0.7%, as occupancy declined 0.1% and ADR barely moved up 0.8%. Here a few things stood out: luxury continued to do better than average, pointing at continued healthy demand growth. Upper-upscale hotels had tiny bit of pricing power. Upper midscale hotels overcame supply increases of 3.6% to still report growth in occupancy. The most worrisome number, however, is “economy”, since the supply continues to decline (-0.2%), but in this quarter demand decreased (-0.5%) as well, the only class with Q3 demand decline.

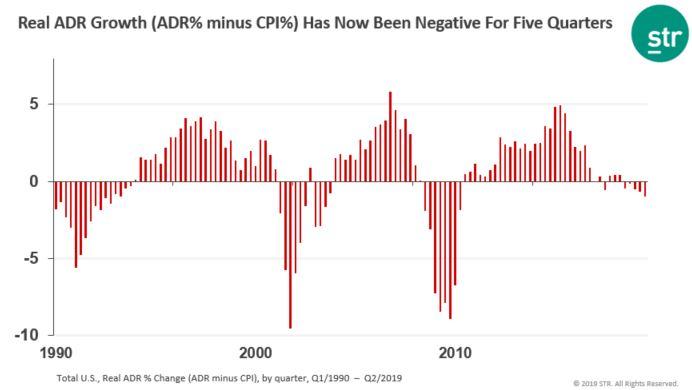

One last observation: real quarterly ADR, as in ADR less CPI, continued to paint a grim picture for profit growth. Real ADR in Q3 was down 1% – the biggest drop since the financial crisis.

Tyler Durden

Mon, 11/04/2019 – 18:30

via ZeroHedge News https://ift.tt/2PMHE73 Tyler Durden