We Have Melt-Up: Futures Jump To New All Time High On “Trade Optimism”

In retrospect, the Trump administration’s decision to announce a “phased” launch of the trade deal with China – which does not exist yet, and will likely never be completed – was the most insightful announcement because not only did it drive stocks sharply higher on the day “phase one” was unveiled, but it has been pushing stocks higher ever since.

And sure enough, Monday has been no different because after a weekend full of Trump and Ross soundbites that a deal appears imminent and Trump even offered up the US as a venue for the “phase one” signing, even though nothing has actually been agreed yet, S&P futures levitated higher all session alongside global stocks while bonds slipped and the dollar inched higher.

As we reported over the weekend, commerce secretary Wilbur Ross expressed optimism the U.S. would reach a “phase one” trade deal with China this month and said licenses would be coming “very shortly” for American companies to sell components to Huawei Technologies, while Trump told reporters a trade deal, if completed, will be signed somewhere in the U.S.

As a result, optimism ran rampant in Europe with the Stoxx 600 Index extending gains, in what was a sea of green amid the abovementioned trade deal optimism; the index advanced 0.8% with automakers leading gain among sectors, rising 3% while mining shares and banks follow, with sector indexes up 2.4% and 1.6%, respectively.

Risk assets favored optimistic comments on trade from U.S. officials over caution from China and soft manufacturing PMIs, with major European equities all gaining over 0.75%, Autos gain nearly 3% after Ross comments downplay expectations for U.S. tariffs on EU automakers, offsetting another contraction in Eurozone manufacturing PMI, with the final print coming in at 45.9, just above the 45.7 flash print.

Meanwhile, Dow futures were up triple digits even as MacDonald’s fell in pre-market trading after its CEO was fired for an inappropriate relationship with an employee. The Stoxx Europe 600 Index headed for a four-year high, led by miners and automakers, which jumped after the U.S. commerce secretary said tariffs on importing vehicles into the American market might be unnecessary. All major Asian markets advanced except Tokyo’s, which was shut. An index tracking emerging-market was set for its biggest gain in three weeks.

“Everyone is kind of upbeat around the prospect of at least a partial China-U.S. trade deal,” Peter Dragicevich, a strategist at Suncorp Corporate Services, told Bloomberg TV. “It’s going to keep equities pretty supported.”

After last week’s Q3 earnings reporting peak, investors are eager to push up stocks for a fifth successive week, adding to the 22% gain this year in the S&P500, even as long-time bulls such as Ed Yardeni are starting to get worried, noting that a “market melt-up” is becoming a real risk: speaking on CNBC, Yardeni said that “if the S&P 500 forward earnings multiple ticks to 19 or 20, it could spark a “nasty correction.”

“I just don’t want too much of a good thing here. I’d like this bull market to continue at a leisurely pace not in a melt-up fashion,” he told CNBC’s “Trading Nation” on Friday. “That’s actually the risk.”

For now, however, nobody cars, and earnings continue to roll in around the world, in what is set to be the 3rd consecutive quarter of declining S&P500 earnings. In China, trade data is coming at the end of this week and will give details for October against a backdrop of easing tensions on negotiations with U.S. counterparts.

In geopolitical news, the head of Iran’s Energy Authority says operation of 30 new centrifuges is underway, adding “We didn’t intend to take these steps, but Washington’s wrong policies pushed us to do so”, reported via Al Jazeera. Elsewhere, North Korea and US working level talks could be held in mid-November/December, Yonhap citing South Korea’s spy agency. Over in China, reports via China People’s Daily noted that government employees’ careers are at stake as it flagged intervention in senior appointments. Finally, Turkey was said to be evaluating a Russian offer for fighter jets and the second delivery of Russian S-400 missile system is planned for 2020 but could be delayed due to technology sharing and production talks according to the Head of Turkish Defense Industry Directorate.

In rates, Treasury yields jumped 4bps to 1.75% while the curve bear steepened, as long end Treasuries underperform having been closed during Asian hours.

In FX, most G-10 currencies weakened against the dollar, with the biggest losses seen in the haven Swiss franc, the pound and the Japanese yen. The New Zealand and Australian dollars rallied after U.S. Commerce Secretary Wilbur Ross said he was optimistic an initial trade deal would be signed with China this month, with the kiwi reaching its strongest level since mid-August against the greenback. The pound edged lower after polls over the weekend indicated the Conservative Party’s lead ahead of the December election may be narrowing; sterling dropped on Monday after last week’s 0.9% rally. In EMs, South Africa’s rand surged after the country clung on to its investment-grade credit rating. Treasuries fell along with most sovereign bonds in Europe. The dollar edged higher versus its biggest peers, reversing a five-session decline.

In commodities, crude-oil futures ticked higher. The IPO process for Saudi Aramco officially started on Sunday, with the stock likely to start trading in Riyadh next month. Valuations vary widely.

Expected data include durable-goods orders and factory orders. Ferrari, Sprint, Sysco, Uber, and Marriott are among companies reporting earnings

Market Snapshot

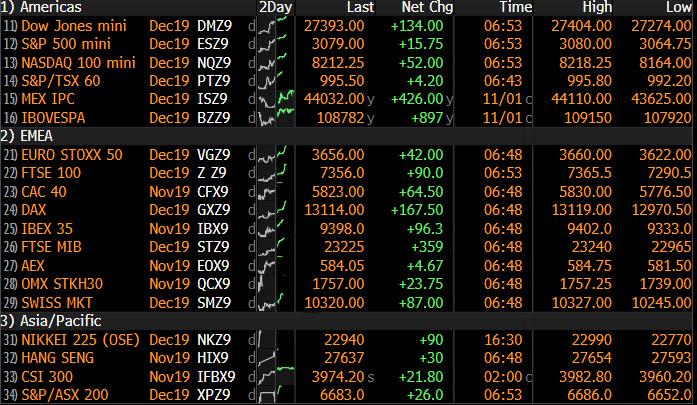

- S&P 500 futures up 0.4% to 3,075.75

- STOXX Europe 600 up 0.6% to 401.99

- MXAP up 0.7% to 164.73

- MXAPJ up 1.2% to 531.09

- Nikkei down 0.3% to 22,850.77

- Topix down 0.03% to 1,666.50

- Hang Seng Index up 1.7% to 27,547.30

- Shanghai Composite up 0.6% to 2,975.49

- Sensex up 0.4% to 40,336.29

- Australia S&P/ASX 200 up 0.3% to 6,686.87

- Kospi up 1.4% to 2,130.24

- German 10Y yield rose 1.8 bps to -0.364%

- Euro down 0.04% to $1.1162

- Italian 10Y yield rose 6.9 bps to 0.651%

- Spanish 10Y yield rose 2.0 bps to 0.294%

- Brent futures down 0.9% to $62.24/bbl

- Gold spot down 0.3% to $1,509.5

- U.S. Dollar Index little changed at 97.30

Top Overnight News from Bloomberg

- U.S.’s Ross met with Chinese Premier Li Keqiang at a regional summit in Bangkok, a person familiar with the discussion said. The meeting came hours after Ross told a morning business forum that the U.S. was “very far along” with “Phase One” of a trade deal with China

- Brexit Party leader Nigel Farage won’t stand as a candidate in the U.K. election, and will focus instead on campaigning across the country, as his party fields 600 candidates. His refusal to back British Prime Minister Boris Johnson has prompted criticism from other Brexit supporters, who say the strategy could split the anti-EU vote and help Labour leader Jeremy Corbyn win

- Eurozone October manufacturing PMI came in at 45.9 versus the flash reading of 45.7, while a similar reading for Germany was 42.1 against the flash reading of 41.9. Above the 50 mark indicates expansion, while below that level points to a contraction

- China’s private companies have been hit disproportionately hard as the economy slows, with their default rate doubling to 12% this year, compared with 1.5% for the overall domestic bond market, according to China International Capital Corp.

- Saudi Arabia is pulling out all the stops to ensure the success of Aramco’s initial public offering after Crown Prince Mohammed bin Salman finally decided to offer shares in the world’s largest oil producer

- McDonald’s Corp. fired Chief Executive Officer Steve Easterbrook because he had a consensual relationship with an employee, losing the strategist who revived sales with all-day breakfast and led the company’s charge into delivery and online ordering

Asian equity markets kick-started the week on the front-foot as the region took impetus from the record highs on Wall St. last Friday following a better than expected Non-Farm Payrolls report and constructive call between top US-China trade negotiators in which progress was said to be made in a variety of areas. ASX 200 (+0.3%) was lifted by outperformance in the mining related stocks due to the trade optimism and after the recent rally in oil prices, but with gains in the index limited by weakness in the largest weighted financials sector after Big 4 bank Westpac reported a decline in its FY profit. Hang Seng (+1.7%) and Shanghai Comp. (+0.6%) were also positive with the trade optimism turned up a notch after the recent top-level call, with even White House Trade Adviser and China-hawk Navarro noting the sides had good discussions and US President Trump also floated Iowa as a location for the signing of a phase 1 deal. Furthermore, strength in oil names contributed to the outperformance in Hong Kong, and Japanese markets remained closed today for Culture Day.

Top Asian News

- Philippine Central Bank Chief Says 2019 Policy Easing Over

Following on from Friday’s post NFP/encouraging trade rhetoric rally, major European bourses (Euro Stoxx 50 +0.9%) are again on the front foot, with further trade optimism the major tailwind. US Commerce Secretary Ross, over the weekend signalled optimistic China developments whilst noting that US may not need to impose auto tariffs later this month on the EU, Japan and South Korea, following positive conversations with these countries. DAX and Euro Stoxx indices are at fresh YTD highs, with the latter at its highest levels since early 2018. As expected, European auto names, including Fiat Chrysler (+4.0%), Peugeot (+4.9%), Daimler (+2.2%) and Volkswagen (+2.5%) are driving gains amid Ross’ comments. More broadly, sector performance is reflective of the market’s risk-on sentiment; Materials (+1.6%), Consumer Discretionary (+1.2%), Tech (+1.1%), Energy (+1.7%) and Financials (+1.6%) are all on the performing well, with the latter two aided by higher yields and crude prices from Friday’s late-doors rally. Meanwhile, the more defensive Utilities (+0.1%), Consumer Staples (Unch.) and Health Care (+0.5%) sectors are laggards. In terms of specific movers; strong earnings from Ryanair (+6.6%), Siemens Healthineers (+7.0%) and Telefonica Deutschland (+1.6%) has seen their respective stock prices advance. Wirecard (+3.7%) trades higher with the prospect of EUR 200mln in additional share buybacks providing some reprieve from the recent FT-induced declines. Finally, UK gambling stocks fell sharply (William Hill -6.9%, GVC -10%) amid pre-market reports via The Guardian that UK MPs are demanding an overhaul of gambling laws which would see online casinos subject to the a maximum stakes limit similar to the GBP 2 imposed on fixed-odds betting terminals.

Top European News

- U.K. Construction Contracts for Sixth Month Amid Weak Demand

- Ryanair Says European Regulator Holding Up Return of Boeing Max

- European Autos Surge to Six-Month High on Trade Deal Optimism

- Takeaway.com Proposes Just Eat Merger Via Recommended Offer

In FX, the Kiwi is head and shoulders above its G10 counterparts in wake of news that NZ and China will enhance their FTA, with Nzd/Usd extending gains through 0.6450 at one stage even though the latest NZ Treasury report paints a rather bleak picture of the domestic economy as Q2 GDP was weaker than expected and business activity remained depressed during the 3 months to September. However, cross-currents also favoured the Kiwi as Aud/Nzd retreated through 1.0750 and the Aussie lost traction vs its US rival on the 0.6900 handle following disappointing retail sales data on the eve of the RBA’s policy meeting – full preview available via the Research Suite. Elsewhere, the Rand is breathing a big sigh of relief after Moody’s SA ratings review on Friday as the agency resisted any temptation to go beyond the widely anticipated outlook downgrade to negative. Usd/Zar has reversed further from recent highs in response and back below the psychological 15.0000 level to test bids/support at 14.7500.

- CHF/JPY – The safe-havens have receded in line with risk-on sentiment prompted by the hefty US payroll beats and rising global trade optimism amidst latest positive updates on US-China Phase 1 alongside talks between the US, EU, Japan and South Korea that could culminate in auto tariffs being rolled over or even removed altogether. The Franc is also digesting even more dovish remarks than normal from SNB chief Jordan and latest weekly Swiss sight deposits showing a hefty rise in domestic bank accounts, as Usd/Chf hovers above 0.9875 and Eur/Chf over 1.1025, while the Yen and crosses are also elevated, with Usd/Jpy eyeing 108.50.

- CAD/GBP/EUR – All softer vs the Greenback as the DXY holds above 97.000 and Friday’s 97.107 post-NFP low, as the Loonie continues to reflect on the BoC’s rather concerned outlook and pivots 1.3150, while Cable strives to keep its head above 1.2900 ahead of the UK election and the Pound lags against a relatively resilient Euro after some signs of stabilisation in the core and pan Eurozone manufacturing PMIs. Note also, Sentix sentiment improved substantially and Eur/Usd may be benefiting from expiry hedging given 1 bn running off between 1.1155-60.

- EM – Choppy trade in Usd/Try within 5.7075-6800 parameters after another slowdown in Turkish CPI and reports that the second batch of S-400 missiles from Russia may be delayed, with the Lira testing 200 DMA resistance, but not quite breaching the technical marker.

In commodities, crude markets are firmer on the first trading session of the week following overnight consolidation from Friday’s late-door gains, with impetus derived from the overall risk sentiment and in wake of of comments from the Iranian Oil Minister Zanganeh who expects further cuts to be agreed at the 5th/6th December OPEC meeting (in-fitting with some of the recent sources reports ahead of the meeting, although the magnitude of the touted cuts is unknown). WTI Dec’ 19 futures have moved above last Friday’s USD 56.43/bbl high, as has Brent Jan’ 20 futures, which also eclipsed the USD 62.00/bbl level. Elsewhere, COT data released last Friday showed that speculators increased their net long in ICE Brent by 45.6k lots over the last reporting week, leaving them with a net long of 253,999 lots as of last Tuesday. “This is the largest weekly increase since early September, and also takes the net spec position back to levels seen in September” notes ING, who point out that “the increase was predominantly driven by fresh longs, rather than shorts coming in to cover.” Turning to metals; gold prices are subdued, despite the risk on moves being seen across equities and bonds. Copper meanwhile is similarly uneventful – CFTC data from last Friday revealed that speculators have increased gross longs by 11,514 lots over the week, and covered 11,949 shorts, amid recent gains in the markets risk tone.

Saudi Arabia have confirmed that Saudi Aramco is to be publicly floated, currently no indication on the timing, price or magnitude of the IPO. Reports note scepticism that Aramco will achieve its USD 2trl valuation, likely to be closer to USD 1.5trl. Stake offered could be between 1-3% valued at USD 15-60bln.

US Event Calendar

- 10am: Durable Goods Orders, est. -1.1%, prior -1.1%

- 10am: Durables Ex Transportation, est. -0.3%, prior -0.3%

- 10am: Factory Orders, est. -0.4%, prior -0.1%

- 10am: Cap Goods Orders Nondef Ex Air, prior -0.5%

- 10am: Factory Orders Ex Trans, prior 0.0%

- 10am: Cap Goods Ship Nondef Ex Air, prior -0.7%

DB’s Jim Reid concludes the overnight wrap

Happy Monday to you all. In all the time I’ve been writing the EMR, the story I get asked about the most is the time I discussed how I had a whole bank of freshly planted trees stolen from outside my old house. This was around 7 years ago. I even replanted some, got stakes inserted through the roots to secure them deep into the ground and they attempted to steal those too. I was incandescent with rage. Well this weekend we’ve tempted fate and planted new ones at the boundary of our new house. So, if anyone reading this from anywhere around the world suddenly gets offered some cheap trees please don’t be tempted as they’re probably using my garden as their tree nursery.

Talking of trees, some green shoots of data recovery were seen towards the end of last week in the US.Indeed our economists have changed their US rate call this weekend for the second time since Wednesday’s Fed meeting. After the FOMC they marginally decided to keep a December cut in their forecasts but Friday’s impressive jobs report (more below) means that the Fed are unlikely to receive enough information prior to the December FOMC that leads to a “material reassessment” in the outlook that they have noted is needed to cut rates again. Therefore, unless they see negative surprises in key events – most notably auto tariffs and China negotiations they now see the Fed remaining on hold for the foreseeable future. They still see the risks to the downside, and the Fed having to cut again, but being on hold is now their central scenario. Interestingly on auto tariffs, US Commerce Secretary Wilbur Ross said yesterday on Bloomberg TV that the US has been having “good conversations” with automakers from the EU, Japan and Korea. He went onto say that he hoped the negotiations had so far will bear enough fruit that the 232 may not need to be put into full or even part effect. This will be seen as good news as the end of the 6-month delay on making a decision on EU auto tariffs ends this month. He also sounded optimistic on the “phase one” trade deal being signed this month and said licences for US companies to sell to Huawei will be coming “very shortly”.

The strong close on Wall Street on Friday and those comments from Ross seem to have helped Asian markets kick start the week on the front foot with the Hang Seng (+1.30%), Shanghai Comp (+0.76%) and Kospi (+1.30%) all up with markets in Japan closed for a holiday. Meanwhile, futures on the S&P 500 are up +0.23%. In FX the big mover is the South African rand (+1.28%) after Moody’s announced on Friday that it had decided not to downgrade the country’s credit score to junk, although it did reduce the outlook to negative.

Back to Friday’s data, the US economy added 128,000 jobs in October, plus another 95,000 of positive revisions to previous months. Consensus was at 85k. Given the GM strikes and revisions these were seen as healthy numbers. For many this meant the subsequent ISM was less of an issue. This proved to be the case but we should note that it came in slightly below expectations at 48.3 (48.9 expected – 47.8 last month) marking the third month below 50. The good news in the report was the surge in new export orders from a shockingly low 41.0 last month to a 4-month high of 50.4. All eyes on the services component tomorrow (53.4 expected from 52.6 last month).

The week post payroll is usually quiet for data. This week is slightly different as given payrolls was released on the 1st (Friday), and that Europe had a part holiday on the same day, we have the rare situation where European manufacturing PMIs (today) and European (Wednesday) /US non-manufacturing PMIs/ISM (Tuesday) are released after payrolls. There’s a raft of Fedspeak due this week and the first speech from new ECB President Lagarde (today). Expect the UK election campaign to gain momentum. The polls (YouGov, Opinium, Orb) over the weekend showed some interesting developments as 1) the Conservatives ranged from an 8-16pc lead, 2) both the Conservatives and Labour are gaining support since the election was announced and 3) Labour seem to be gaining a little more of it from a low base but the Lib Dems and the Brexit Party and getting squeezed. The early signs are that this could be more of the traditional two party race than many thought.

Today’s European manufacturing PMIs will be a big focus and expectations for the Eurozone, Germany and France numbers are for no change to the flash at 45.7, 41.9 and 50.5, respectively. Spain and Italy’s are expected to dip 0.2 and 0.1 points respectively from last month to 47.5 and 47.7 respectively. So with stabilisation expected, any move either way will get markets excited. For Wednesday’s European final services PMIs, the Eurozone and German number is also expected to be unchanged from the flash at 51.8 and 48.6 respectively with the other main countries expected within a few tenths of last month’s readings in the 51-53 range. The Eurozone composite is expected to edge up 0.1 points to 50.2

In terms of other US data we have the final September durable and capital goods orders revisions today, Q3 non-farm productivity and unit labour costs on Wednesday and the preliminary November University of Michigan consumer sentiment survey on Friday. In Europe we’ve also got the September industrial production prints in Germany on Thursday and France on Friday, while the European Commission will also publish its latest economic forecasts on Thursday. Finally in China we’ll get the services and composite Caixin PMIs for October on tomorrow (another important release for global markets) and the October trade data on Friday.

As for policy meetings this week, the BoE meet on Thursday. No policy changes are expected. Our economists expect the BoE to sound dovish, dropping its tightening bias and instead moving towards an easing policy stance. They note that, domestically data have deteriorated sufficiently to warrant more supportive monetary policy. Growth has slowed and is tracking below the Bank’s “speed limit” of 1.5% with uncertainty likely weighing further on the near-term growth outlook. Equally, the UK supply side story is also turning softer, with labour market indicators pointing to downside risks for both pay and jobs by Q4-2019 and inflation now expected to remain below target in 2020. The team see an increasing risk of a rate cut at the January Inflation Report – Governor Carney’s final MPC meeting.

Staying with central banks, as discussed earlier it’s another busy week for Fedspeak. Indeed today we’ll hear from Daly, Tuesday will see Barkin, Kaplan and Kashkari speak, Wednesday will see Evans, Williams and Harker speak, Thursday will see Kaplan speak and on Friday we’ll hear from Bostic and Daly.

Meanwhile, earnings season starts to slow down with just 66 S&P 500 companies reporting. The highlights include Sysco and Berkshire Hathaway on Monday, CVS on Wednesday, and Walt Disney and Cardinal Health on Thursday. Away from the US we’ll also get results from Telefonica, Softbank, BMW, Toyota, Siemens, Allianz and Honda.

Reviewing last week now and it was another positive week for equities with data on balance more positive, trade talks seemingly going in the right direction, a U.K. election finally called and a Fed rate cut. The S&P 500 advanced +1.5% (+0.97% Friday and a new record high) with semiconductors leading gains, up +2.5% on the week. The Nasdaq gained +1.7% (+1.13% Friday and also to a new record). In Europe, the Stoxx 600 gained +0.4% (+0.68% Friday) though banks underperformed, down -2.6% but up +0.99% Friday. Yields fell, with 10-year yields on treasuries and bunds down -8 and -2 basis points respectively but up 2bps and 2.5bps on Friday. Friday not only had positive data but markets liked the comments from the Chinese Ministry of Commerce that they had achieved a “consensus in principle” on trade. Phone talks on Friday were also seen as “constructive” from both sides.

Tyler Durden

Mon, 11/04/2019 – 07:39

via ZeroHedge News https://ift.tt/2JOjXHJ Tyler Durden