Bond Yields Tumble As Stocks Reach Longest (Best) Bull Market Ever

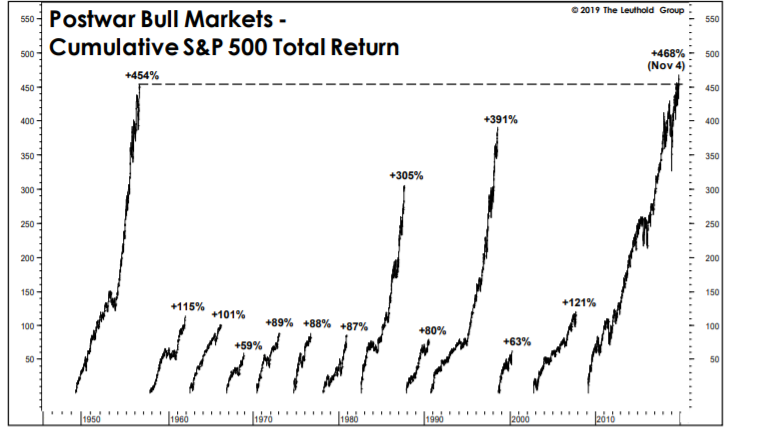

This is now the longest bull market in history… and the best ever…

“The other thing that’s helped the bull is how poorly the rest of the world’s done. It sort of kept everyone here. If they are going to buy anything at all, they’d buy U.S.” Jim Paulsen, chief investment strategist at The Leuthold Group, told CNBC.

So why is the American consumer losing faith?

Source: Bloomberg

FEDSPEAK-FEST today – all singing from same songsheet – “We’re on hold unless world collapses”…

0900ET Clarida NEUTRAL – US Economy “at or close to” Fed’s goals

0910ET Evans – Cryptocurrency could cause “the business models of commercial banks to come under significant pressure”

1000ET Powell NEUTRAL – US is “star economy”, repeats baseline economic outlook remains favorable, policy is appropriate

1145ET Daly NEUTRAL – Monetary policy in good place given healthy momentum in the economy and consumer spending

1200ET Williams NEUTRAL – US economy and policy in good place, backs keeping rates steady

1220ET Bullard DOVISH – Positive yield curve is bullish for 2020, economy still faces downside risk

1300ET Kaplan NEUTRAL – US consumer in good shape, labor market tight, policy appropriate

Additional market movers were

1100ET Pelosi – USMCA by year-end, sent CAD higher, USD lower

1400ET U.S., CHINA STRUGGLE TO CLOSE PHASE-1 DEAL, FT SAYS

1530ET USTR Sources confirm deputy-level trade talks

All of which left US stocks flat-ish on the day…

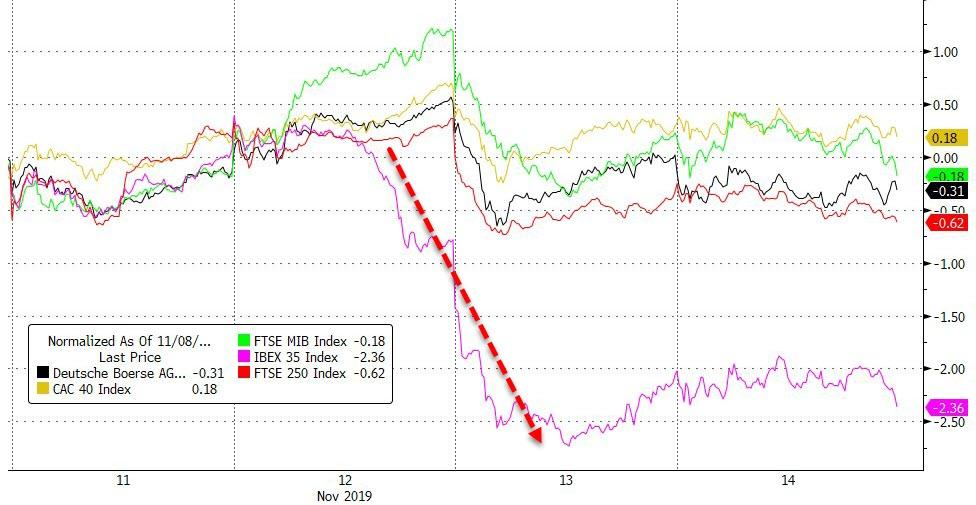

Europe was also flat-ish again today…

Source: Bloomberg

And China was flat-ish on the day (down on week) despite terrible macro data overnight…

Source: Bloomberg

US stocks mixed on the week with Dow leading and Trannies lagging (S&P and Nasdaq levitated green)…

Source: Bloomberg

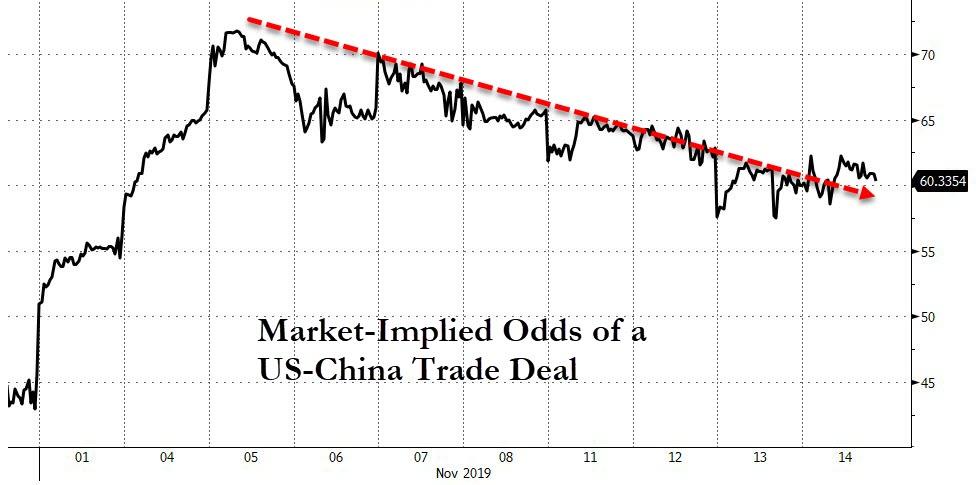

The market’s expectations for a trade deal are fading (albeit modestly)…

Source: Bloomberg

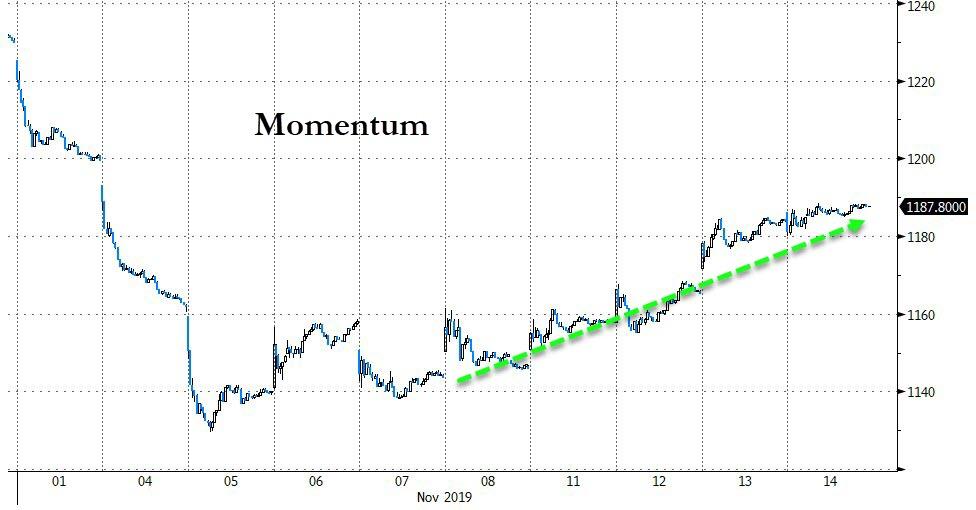

Momo is up 5 days in a row…

Source: Bloomberg

Treasury yields tumbled once again, completely decoupling from stocks…

Source: Bloomberg

Rates were lower by 5-7bps across the entire curve…

Source: Bloomberg

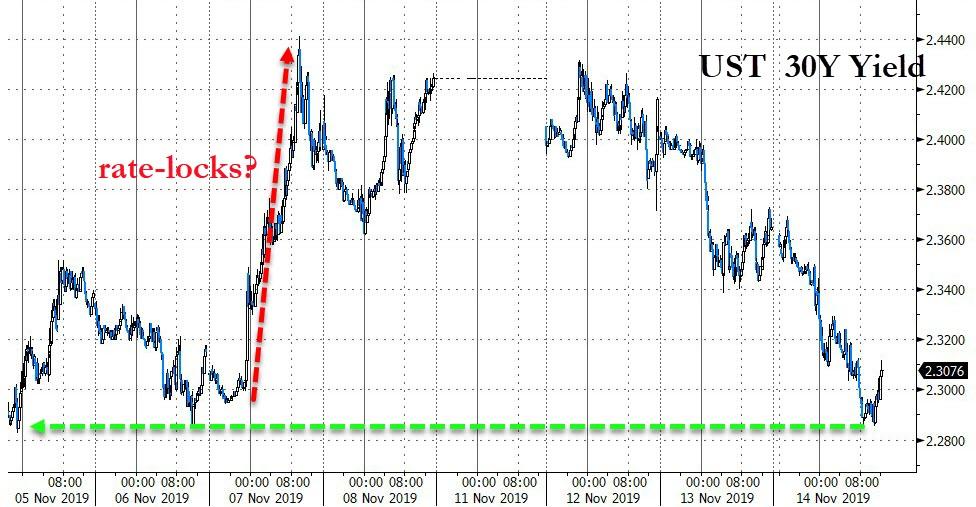

The plunge in 30Y yields erases all last week’s Abbvie-rate-lock-driven spike…

Source: Bloomberg

The Dollar dumped today

Source: Bloomberg

Cryptos all faded today, all in the red for the week…

Source: Bloomberg

Commodities continued to diverge with copper/crude fading (weak China data) and PMs bid (weak dollar)…

Source: Bloomberg

WTI once again reverted lower from the upper rail of its recent range…

Gold pushed back up to $1475, erasing the losses from the early part of the week…

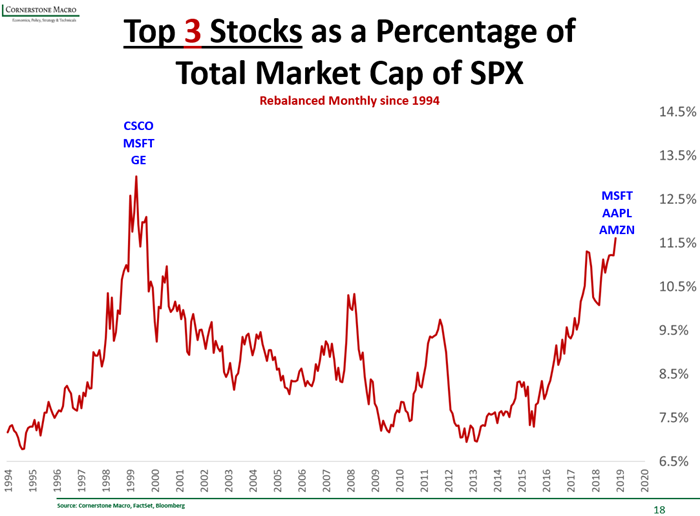

Finally, in case you wondered… it’s different this time.

h/t BMO Nesbitt Burns

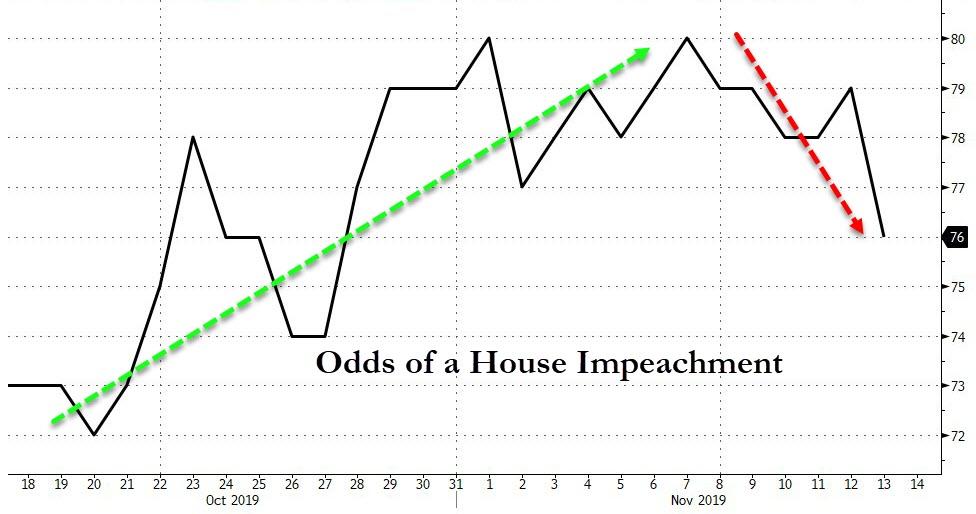

And then there’s this – impeachment odds fell after yesterday’s hearings…

Source: Bloomberg

And if you don’t think the market cares about Elizabeth Warren, think again…

Source: Bloomberg

Tyler Durden

Thu, 11/14/2019 – 16:00

via ZeroHedge News https://ift.tt/374YHHR Tyler Durden