Stay Strong, Go Long – Bulletproof Russia Becomes Contrarian Haven

Authored by Tom Luongo via Gold, Goats, ‘n Guns blog,

It’s a tough road being a contrarian on Russia. This is especially true today when the entirety of the U.S. and European political system is aligned to demonize Russia at nearly every level.

And the main reason for this is that Russia under President Vladimir Putin refuses to do the West’s bidding both at home and abroad. The central tenet of U.S. foreign policy is that U.S. concerns, no matter where they are, are supreme and everyone else’s are subordinate.

Russia under Putin doesn’t play that game. He hasn’t for nearly twenty years now. This is not to say, of course, that objectively speaking Putin is a good man or even a good leader. In studying Putin for the past seven years I’ve come to one inescapable conclusion.

He was exactly the leader Russia needed to dig the country out of the abyss it found itself in when he took over. He is exactly the kind of leader Russia needs to guide it through the next period of history.

So much analysis of Putin and Russia is so thoroughly ideologically tainted that, on that basis alone, it should be dismissed out of hand. And it has been successful enough that even the best analysts who are truly skeptical of the U.S. narrative still get some of the basics about Russia and Putin horribly wrong.

I’ve been recommending Russia as an investment to people since early 2015 and its state-owned gas giant Gazprom (NYSE:OGZPY) since mid-2014. I haven’t wavered in that recommendation, despite the ups and downs.

And the reason for this is simple. While markets do not trade on fundamentals every day, over the long run a market’s or stock’s fundamentals do eventually overcome sentiment and assert themselves on the price.

So, in 2014 when oil prices collapsed so did the price of Gazprom. The ruble went through a crisis intended to oust Putin from power in revenge for his thwarting the U.S. takeover of Crimea.

Putin’s deft handling of the ruble crisis and Russia’s impeccable national balance sheet allowed both to survive and begin digging the country out of the latest hole placed in front of it.

Since then the U.S. has piled on obstacle after obstacle in front of Russia in the global marketplace for capital. The Magnitsky Act has been used like a bludgeon to scare investors away from the land of the Evil Putin.

False flags and overt provocations to war in Syria, Ukraine and the U.K. have slowed the pace of investment in Russia’s capital markets. Gazprom for years languished both because of the political risks of U.S. pressure in Europe to stop first the South Stream and then the Nordstream 2 pipelines.

Frivolous lawsuits from Ukraine, the EU and the Baltics have dogged the company for years. The EU has changed its laws to retroactively try and gain a legal upper hand on Gazprom’s pricing of natural gas. But, ultimately, none of it has worked.

Slowly, but surely, Russia’s fundamentals and its stable and improving political situation are winning the hearts of investors looking for yield in a yield-free world.

An article in Forbes last week documented this shift in sentiment perfectly.

“They’ve made themselves bulletproof,” says James Barrineau, co-head of emerging-market debt for Schroders Investment in New York.

“They can pay off all their foreign debts with their central bank reserves. Plus, they’re cutting interest rates. The currency is very stable. And they have room on the fiscal side to spend on their economy.”

The first point is something I pointed out in 2015. The numbers were this good then. And yet, the ratings agencies, like dutiful quislings, cut Russia’s ratings to junk status.

And they did this against fundamentals like having enough money to pay off the entire country’s debt load, public and private, and at the time at 13.3% debt-to-GDP ratio. Today that ratio stands, after a currency crisis, at just 11.8%.

Someone remind me what the U.S.’s is?

As always, what the world responded to was the hardship of the U.S. all but kicking Russia out of the dollar-funding markets. The only step not taken against Russia was removing it from the SWIFT interbank messsaging system.

That wasn’t done for the same reasons that it wasn’t reinstated by Trump on Iran after he pulled out of the JCPOA. It doesn’t work. All it does is hasten the rate at which the country learns to work without U.S. dollars.

By 2019 Russia, China and Iran have alternatives to SWIFT to prosecute international trade outside of the U.S.’s purview. Once those transactions leave SWIFT the U.S. loses a very powerful monitoring tool.

And in surviving this full court press to destroy Russia financially and keep capital from fleeing there the U.S. has made it a stronger destination today than it would have ever been had it not gone this route.

Instead of isolating Russia financially and destroying the ruble, it actually made the dollar more suspect and raised the profile of the ruble across central Asia.

President Trump has weaponized the dollar to such an extent that he’s raised the costs of using it for countries that do significant business with Russia above that of the ruble.

And it starts with the political stability created by Putin and his deft diplomatic corps, led by Foreign Minister Sergei Lavrov. Putin has made it a point of always keeping his promises on the world stage, no matter how rocky the relationship.

Trump on the other hand has unilaterally bullied and sanctioned most of the world for not doing what he wants. Putin keeps making this point over and over again, Trump is destroying the long-term viability of the dollar. The key to that statement being ‘long-term.’

Because a country that acts honorably on the world stage, encourages trade over blackmail, honors its contracts even when the rules are arbitrarily changed against them and stands by its allies will generate the kind of good will that will increase the willingness of people locally to accept that country’s currency.

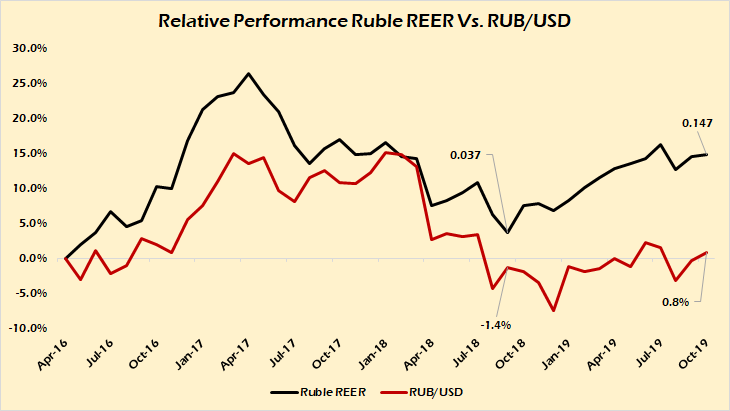

Since Trump went on his sanction the world policy, the ruble has been on a tear in international markets. While mildly strengthening versus the dollar (0.8%), the ruble has risen 11% versus the total basket of its trading partners (REER).

This is the clearest picture I can paint of the ruble decoupling from the U.S. dollar and it’s a trend worth watching into the future. Because as the dollar rises into the teeth of the brewing financial crisis (think European banking meltdown currently underway) the ruble will act as a port in the storm for those economies terminally short dollars.

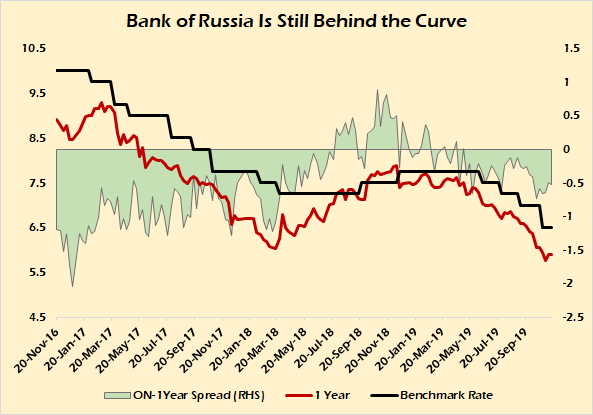

With the Bank of Russia finally letting its boot off the neck of the Russian economy by lowering interest rates aggressively over the past four months, the Ruble hasn’t degraded one bit.

If anything all this has done is strengthen demand for the ruble as pent-up demand in the form of huge domestic savings now can be deployed as new business loans and corporate bond issues at far better rates a few months ago.

That said the Bank of Russia is still behind the curve by looking at the spread between the Overnight lending rate (a proxy for the benchmark rate) and the yield on a 1 year government note.

All that’s happened since Elvira Nabullina began cutting rates is demand for Russian debt has skyrocketed as investors in the West search for safe returns and across Emerging Markets starved of dollars. And while the ruble is nowhere close to overthrowing the dollar on the global stage and likely never will, it only takes a small shift in demand to create outsized effects on markets as comparatively small as Russia’s.

The rate of de-dollarization of the Russia economy is not as fast as the headlines would have you believe, but it is happening. The ruble now accounts for more than 30% of Russian exports and 20% of its overall international trade.

The world is insanely short dollars at this point and will continue to be for the next decade. That much is certain. It will fuel a massive dollar rally ove the next few years.

But Russia isn’t alone in the woods anymore on this path. India, Turkey, China, Iran and others understand what that reliance on the dollar means during economic downturns. And they are working with Putin to lay the groundwork to keep their economies from collapsing as the dollars flow out.

This is why Putin and Xi have been adamant about building ways to bypass the dollar for local trade. It will allow the dollar short positions of local companies to fade just like did for Russian companies after the ruble crisis in 2015.

Now that we’re four years beyond the worst of that and the political reality surrounding Russia far better than it was then, its stock market is booming, demand for its debt is rising and contrarian investors are looking for the next generational play to park their cash despite the obstacles the U.S. places in front of them.

The key for this will be the EU, as Russia’s trade with the EU in euros is nearly as big as it is in dollars now. This is what will prompt the rescinding of sanctions against Russia this year.

When that happens you can expect a big pop in the Moscow Exchange.

* * *

Join My Patreon if you want the real story about what’s going on in Russia Install the Brave Browser if you want to bypass the roadblocks to letting you do so.

Tyler Durden

Tue, 11/26/2019 – 02:00

via ZeroHedge News https://ift.tt/2KTFwY4 Tyler Durden