Tesla’s Biggest Bear: US, China Auto Sales Are In Free-Fall; Musk Lied To Einhorn

Gordon Johnson has long been Tesla’s biggest sellside analyst bear, and with a price target of $44.52 (and a rating of Sell of course) we don’t see that changing any time soon. Now, in his latest research report published overnight and slamming the Cybertruck orders as periodically updated by Elon Musk, Johnson takes aim at Tesla’s China/US sales experience in October, which he calls a “Wile E. Coyote” moment.

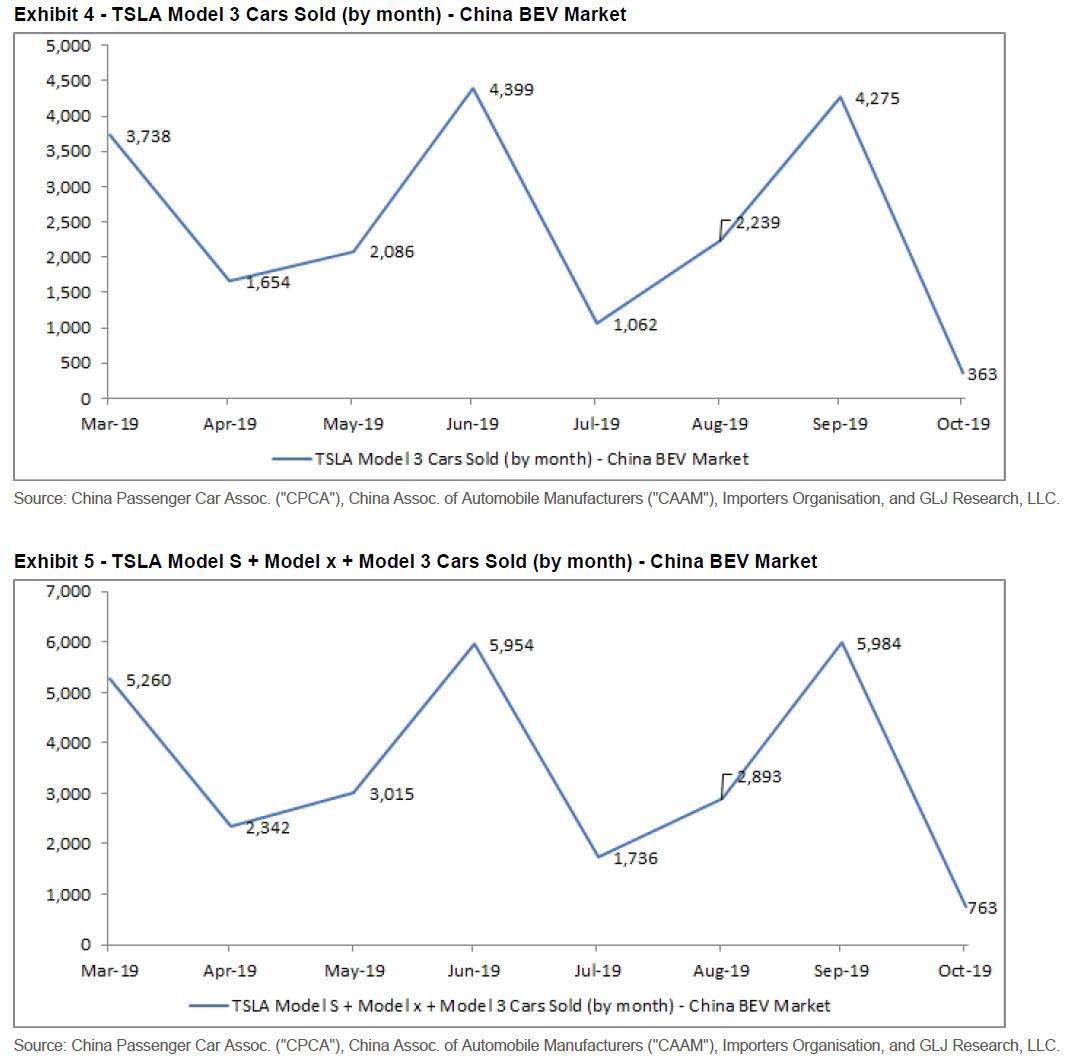

As shown in the two charts below, which are based on data from CPCA & CAAM released to Gordon Johnson’s GLJ Researchy, TSLA’s total car sales in China were down -87.2% m/m and -56.0% vs. the first month in 3Q19.

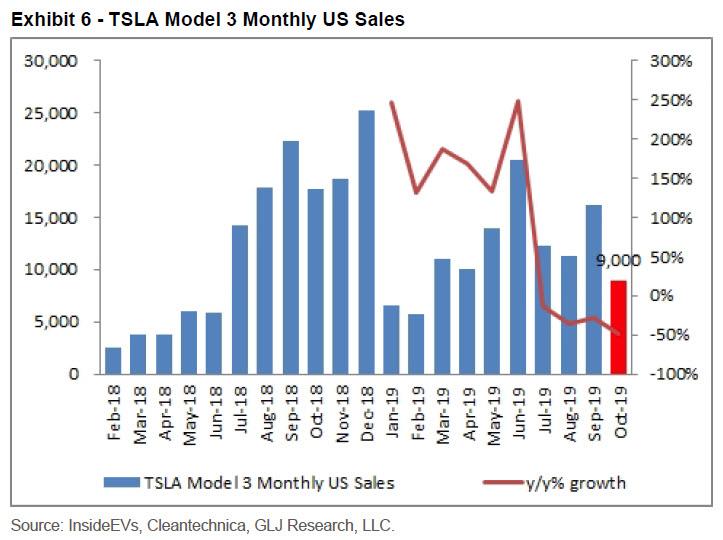

Then, moving to US car sales, Model 3 sales were down -49% y/y…

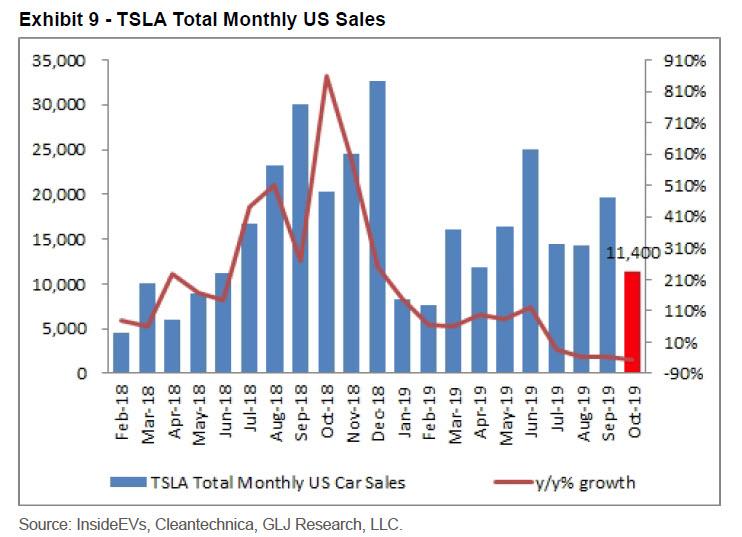

…. while total TSLA US cars sold in Oct. fell -44% y/y.

Stated differently, Johnson notes that “in the two markets that are supposed to drive growth for TSLA, the sales trend is one of free-fall.” And, while sales in the Netherlands are booming due to tax hikes set to take effect 1/1/20 (i.e., roughly a €7K diff. in a 5yr TCO), with Norway on par with 3Q19 thus far & Spain trending at a record low, as well as the fact that just 7 ships have arrived thus far in 4Q19 at EU ports (link), Johnson expects EU sales in 4Q19 to be on par with those

achieved in 3Q19 (& then collapse in 1Q20). As the bearish analyst sums it up, “it appears TSLA’s 4Q19 overall unit growth will be on par with 3Q19, & then plummet in 1Q20.”

If that wasn’t enough, the Tesla mega bear then takes on the recent feud between Musk and Einhorn (incidentally started by us), and – predictably – slams the Tesla CEO’s response to Greenlight Capital’s as “Mathematically Impossible“, to wit:

In response to David Einhorn’s question around why, with lower sales y/y in 3Q19, TSLA is still owed over $1bn by its customers via accounts receivables (link) – in his most recent twitter bout with E. Musk – our checks suggest TSLA’s IR told investors it sold $1bn in cars in the EU in the last two days of 3Q19, most of which were paid for by check (TSLA’s IR refuses to answer any questions posed by us by email, including questions around this topic). For this analysis, we will ignore, for a moment, our work that the lion’s share of Europeans do not pay for cars by check, as well as discussions with folks on the ground in Europe that suggest TSLA Europe does not accept checks; that is, we are assuming all of the cars TSLA claims were paid for using check were indeed paid for using a personal check. Yet, when taking sales of ~$45mn registered in the Netherlands, Spain, and Norway in the last two days of 3Q19, & also considering these countries accounted for 40% of EU TSLA registrations in 3Q19, the math shows just $115mn in EU sales in the last two days of 3Q19 (not the $1bn TSLA IR is allegedly claiming). In fact, the rest of Europe registered just ~$600mn worth of TSLA cars sold in all of Oct.

Thus, when looking at the numbers, in response to Einhorn, Johnson states that “TSLA’s claim that $1bn worth of cars were sold in the last two days of the quarter appears categorically false”, in other words Musk lied to the Greenlight Capital founder. And, as Einhorn noted in his letter, while TSLA’s claimed last year that its 3Q18 accounts receivable balance doubling q/q centered on the quarter ending on a Sunday (an explanation Einhorn saw as unsatisfying at the time), in 3Q19 the quarter ended on a weekday.

Why does any of this matter? Well, as Johnson explains, assuming TSLA’s auditor, PricewaterhouseCoopers (“PwC”), looks into this further & raises a red flag, “there could be yet another “ding” placed on E. Musk’s seemingly impenetrable cloak of armor, begging the question, is the “death by a thousand cuts” scenario apropos here.”

FInally, as examples of the “thousands cuts”, Johnson lists the SCTY acquisition, where the deposition answers by E. Musk we’ve read suggest a heavy amount of deception + funding secured at $420/shr in the summer of 2018 + the 1 million robotaxis by April 2020 claim, supporting a huge capital raise + the Model Y unveil + 3Q19 margins skyrocketing despite flat sales growth & unit growth + the cybertruck unveil…. and so much more.

Tyler Durden

Tue, 11/26/2019 – 11:15

via ZeroHedge News https://ift.tt/33lZfWD Tyler Durden