Climate Change Hits Property Prices

Authored by Bilal Hafeez via MacroHive,com,

One of the clearest effects of climate change is sea level rise (SLR). The scientific community expects a global average SLR of around 3-6 ft. over the next century. This could affect over 6 million American homes and put one trillion dollars of coastal US real estate at risk. A new paper, Disaster on the Horizon: The Price Effect of Sea Level Rise, by Asaf Bernstein, Matthew Gustafon, and Ryan Lewis finds that exposed properties are starting to sell at a discount.

The Data

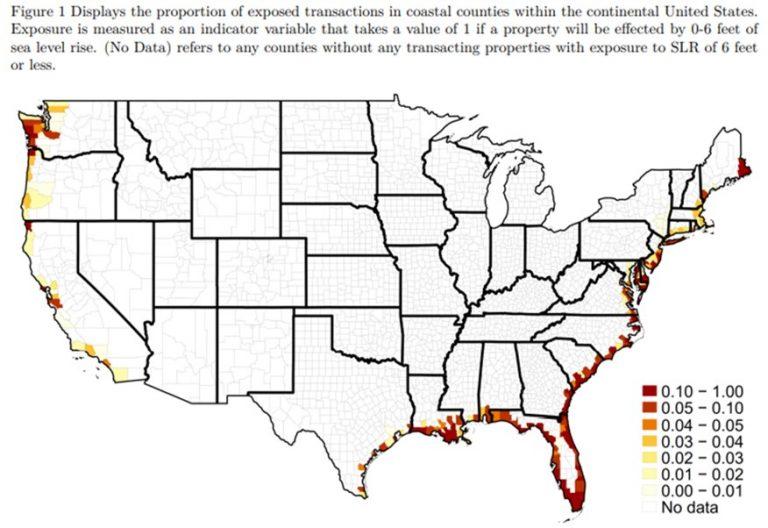

The academics combine Zillow US residential data with the National Oceanic and Atmospheric Administration’s (NOAA’s) SLR calculator to identify each property’s exposure to SLR. They have over 1.7 million homes in their sample exposed to SLR of between 0 and 6 feet. The most exposed counties are in the gulf region, Washington state, and along the eastern seaboard (Fig. 1, c.f. paper)

Figure 1: Sea Level Exposures by County

Source: Disaster on the Horizon: The Price Effect of Sea Level Rise

For the purpose of their analysis, they restrict their sample to the properties most at risk – those within 0.25 miles of the coast. This allows them to analyse 460,000 sales between 2007 and 2016.

How are Property Prices Affected?

Overall, the team find that coastal properties exposed to SLR sell at a discount of 7%. Breaking the properties down by risk (most risky are those that get inundated by a small rise in sea levels), they find the following:

-

1 ft. SLR = 15% discount

-

2-3 ft. SLR = 14% discount

-

4-5 ft. SLR = 8% discount

-

6 ft. SLR = 4% discount

Importantly, these properties are unlikely to be flooded for over half a century, which suggest property buyers are pricing long term risks. Supporting this view, they find that rental rates, which reflect the current state of the property, are unaffected by SLR exposure.

Does Type of Property Investor Matter?

Yes. The SLR exposure discount is greatest for markets with sophisticated buyers as proxied by non-owner-occupied properties. Exposed non-owner-occupied properties trade at a 10% discount, compared to unexposed properties. Meanwhile, exposed and unexposed owner-occupied properties trade at similar prices.

However, the team do find that climate beliefs significantly affect the SLR exposure discount in the owner-occupied segment of the market. For example, in areas with high levels of climate change worry, exposed owner-occupied properties sell at an 8.5% discount.

Is the Effect Changing Over Time?

Yes. The discount has increased significantly over time. In their sample, the discount to non-owner-occupied properties was significant from 2007-14, but saw a notable jump after 2014 from 9% to 15%. This was probably due to new data and projections on climate change emerging around that time. Despite this, they don’t find similar increases for owner-occupied properties.

Bottom Line

Sophisticated investors are already pricing in the climate change impact on coastal properties, but it appears that less sophisticated investors are not. This suggests that there is a potential wealth loss that has not fully been appreciated. Notably, if residents in coastal regions are expecting their properties to provide them a pension – they could be in for a surprise. Policymakers will then have to judge whether to “bail” them out.

Tyler Durden

Wed, 12/04/2019 – 12:24

via ZeroHedge News https://ift.tt/2LjFKrC Tyler Durden