ISM Services Disappoint As “Optimism Remains Historically Subdued”

Following the mixed picture from ‘soft’ surveys on the manufacturing side of the US economy (Markit PMI higher, ISM lower), and the extremely mixed picture from AsiaPac overnight, all eyes are on the Services data this morning to confirm/cherry-pick data that means the trough in growth is over.

-

Markit Manufacturing PMI rose to 52.6 (from 51.3)

-

ISM Manufacturing fell to 48.1 (from 48.3)

-

Markit Services PMI rose to 51.6 (from 50.6)

-

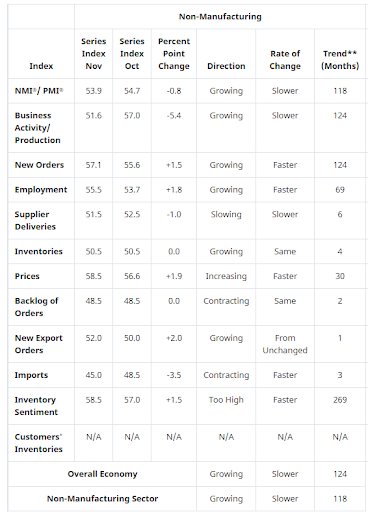

ISM Services fell to 53.9(from 54.7)

Source: Bloomberg

Under the hood, only 3 of the subindices are lower…

Source: Bloomberg

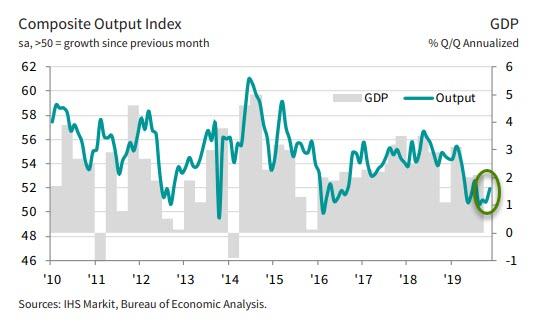

Aggregating the ISM Manufacturing and Services data provides a Composite picture (weighted by jobs and earnings) that shows the brief rebound fading…

Source: Bloomberg

But, as Chris Williamson, Chief Business Economist at IHS Markit, said:

“With both services and manufacturing reporting stronger rates of expansion, the November PMI surveys indicate the fastest pace of economic growth for four months. The improvement is coming from a low base, however, and even at these higher levels the survey is merely indicative of annualised GDP growth in the region of 1.5%.”

“Similarly, while reviving order book growth has encouraging more companies to take on extra staff after two months of net job losses being reported, the survey’s employment index continued to run at a level consistent with monthly jobs growth of only around 100,000.

“Weakened business activity and jobs growth compared to earlier in the year also led to widespread caution with respect to pushing up selling prices in the face of an uncertain outlook. Business expectations for the year ahead continue to run at one of the lowest levels recorded by the survey since 2012 with firms worried about trade wars, slowing economic growth at home and abroad, as well as the possibility of next year’s election cycle causing customers to postpone spending decisions.”

So take your pick of ‘soft’ surveys to support your panic-bid or scramble to sell.

Tyler Durden

Wed, 12/04/2019 – 10:04

via ZeroHedge News https://ift.tt/2Rq7z5D Tyler Durden