Trump’s Trade Talk Tanks Stocks… Until Unsourced Rumor Sparks Buying-Panic

Trump’s actual words on tape prompted a notable plunge in stocks yesterday and his thoghts were confirmed by Wilbur Ross and Larry Kudlow. However, in this new normal of muppetry, today saw an unsourced rumor from Bloomberg saying that a deal is close (yeah, seriously), spark a short-squeeze-ignited ramp to erase all those losses…

Source: Bloomberg

But we note that the market was unable to crack that pre-plunge level.

All of which reminds us of the golden rule (and no, it never gets old!!!)…

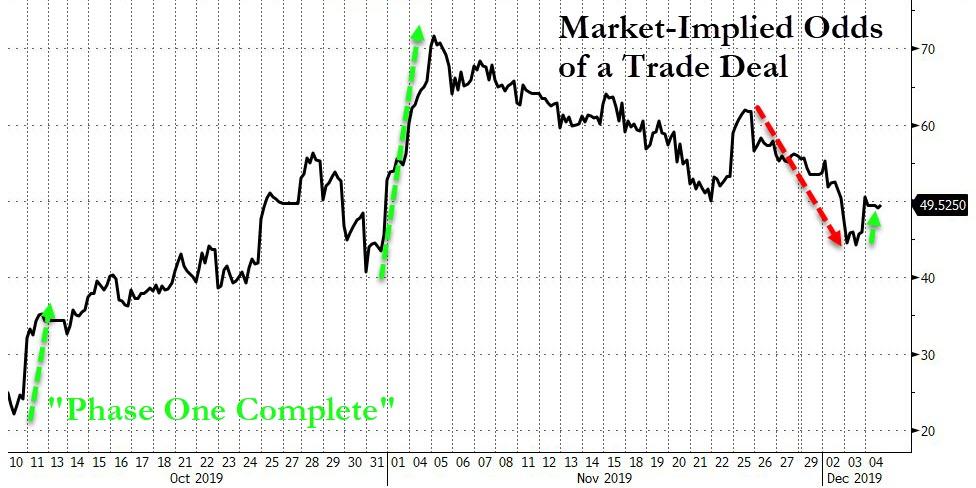

The odds of a trade-deal rebounded to a coin-flip today (still well off the 70-plus percent odds from early November). It’s now been 53 days since Trump announced that the phase one deal was “complete”…

Source: Bloomberg

S&P and Small Caps managed to erase all of yesterday’s losses but all US majors remain lower on the week…

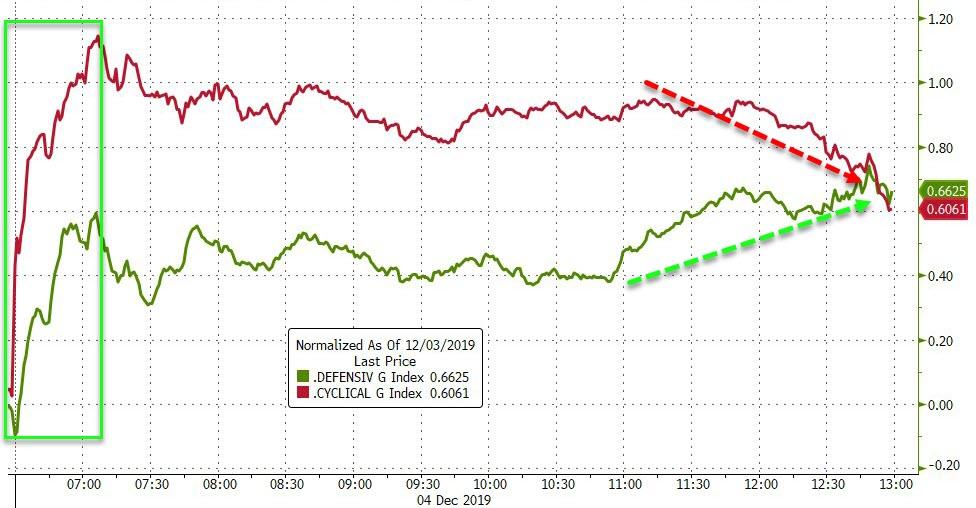

Notably the day saw defensives outperforming cyclicals by the close as the early exuberance in the latter faded…

Source: Bloomberg

Note that stocks really did nothing after the gap-up opening (and Trannies actually faded all day)

Today’s gains came thanks to a double-short-squeeze…

Source: Bloomberg

VIX dropped back below 15…

Stocks and bonds remain decoupled after almost catching down yesterday…

Source: Bloomberg

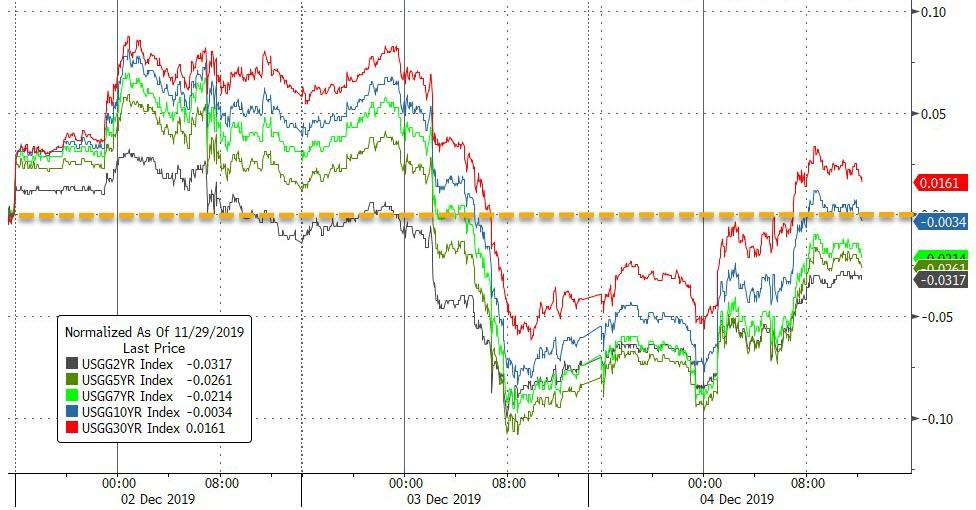

Treasury yields spiked today (long-end marginally underperforming – 30Y +6bps, 2Y +4bps) leaving the 30Y higher on the week…

Source: Bloomberg

30Y retraced about half its high to low drop yesterday…

Source: Bloomberg

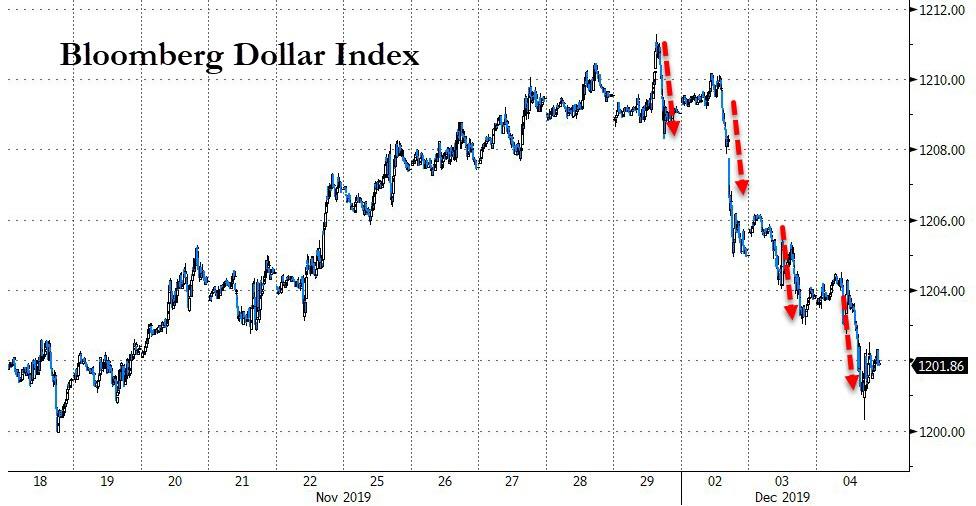

The Dollar fell for the 4th straight day…

Source: Bloomberg

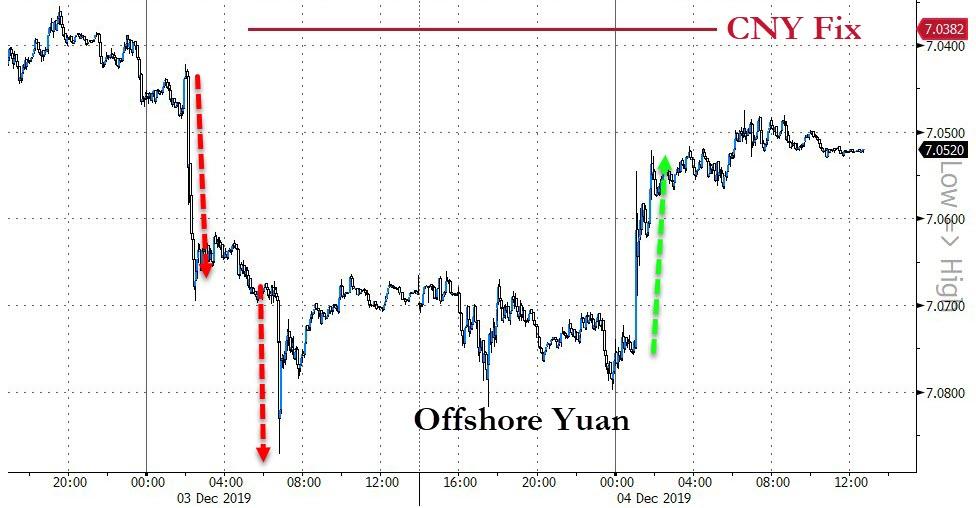

Yuan rallied today, lifted by the trade deal rumors…

Source: Bloomberg

Cryptos made solid gains today until the end of the day when they got dumped…

Source: Bloomberg

…but all remain down on the week…

Source: Bloomberg

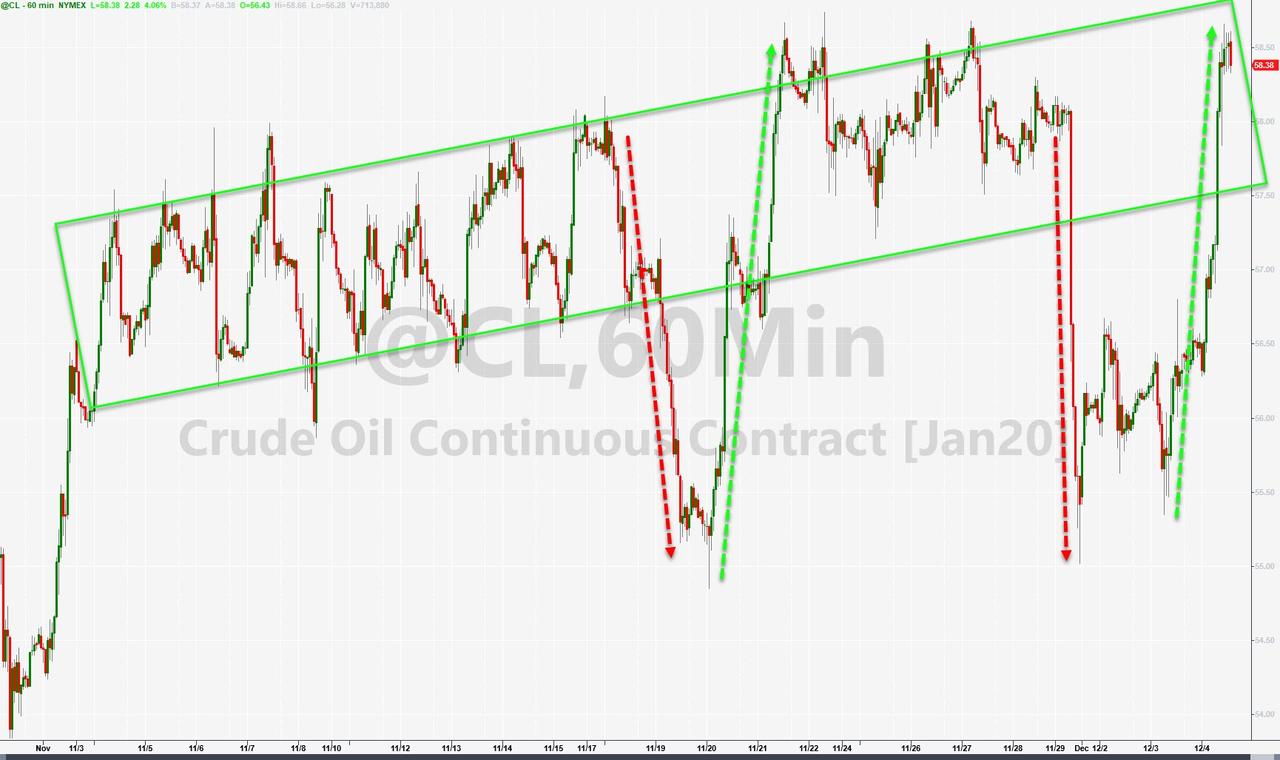

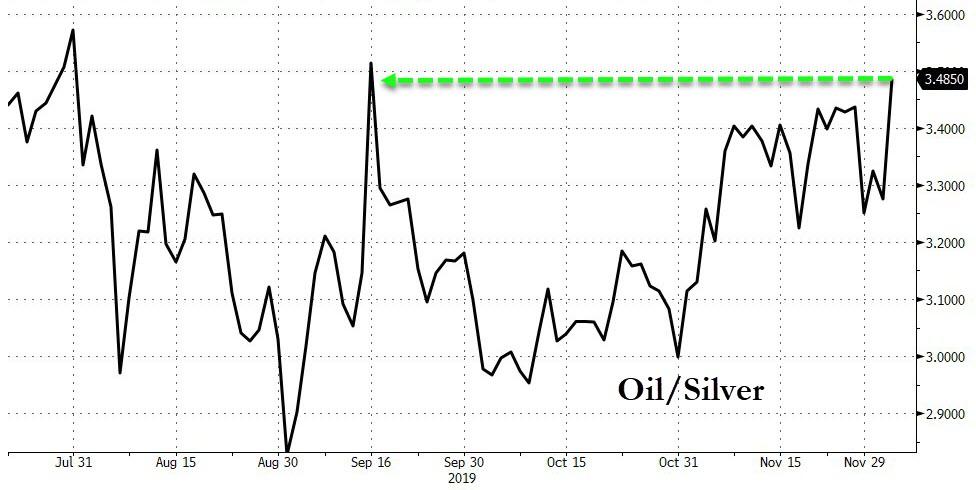

Oil prices shot higher on trade hope and inventory draws and as oil surged, silver was slammed…

Source: Bloomberg

Oil surged back to recent highs…

As Silver was monkeyhammered back below $17…

Today’s shifts sent the price of a barrel of crude in silver to its highest since mid-Sept…

Source: Bloomberg

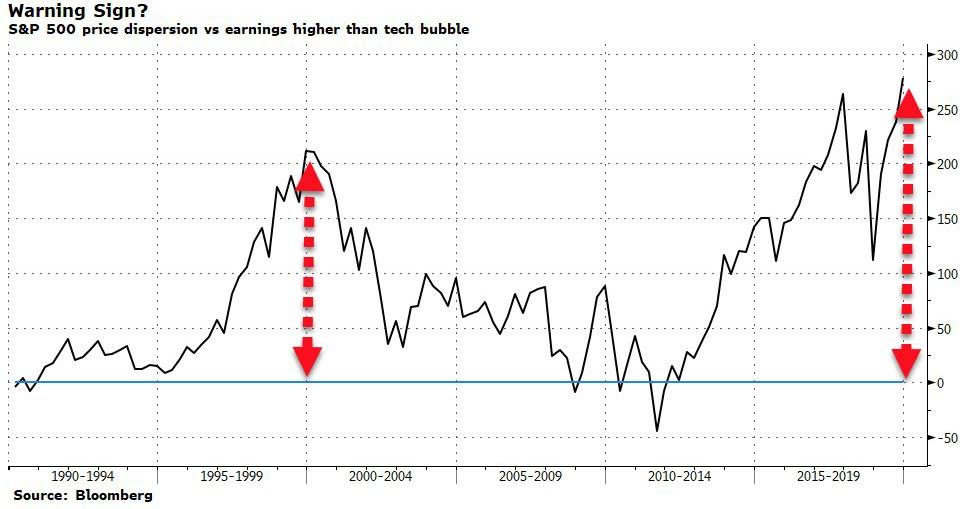

Finally, as Bloomberg reports, Charles Freeman, CEO of Adaptfirst Investments, flags a warning sign for the S&P 500. Normalizing the S&P 500 for earnings suggests the price dispersion is even bigger than during the tech bubble of the late 1990s.

Source: Bloomberg

His point is, if earnings start to crack in 2020, the fallout will be much worse than it was back then.

Tyler Durden

Wed, 12/04/2019 – 16:00

via ZeroHedge News https://ift.tt/2PcizR7 Tyler Durden