WTI Hovers Above $58 After Bigger-Than-Expected Crude Draw

Oil prices, led by hope-ridden trade-deal headlines and OPEC+ chatter, have soared back above $58, erasing Friday’s losses…

But, after API’s reporting a bigger than expected crude draw, all eyes are on the official government data this morning…

API

-

Crude -3.72mm (-1.5mm exp) – biggest draw since September

-

Cushing -251k

-

Gasoline +2.931mm

-

Distillates +794k

DOE

-

Crude -4.856mm (-1.5mm exp) – biggest draw since August

-

Cushing -302k

-

Gasoline +3.385mm

-

Distillates +3.063m – biggest build since July

DOE data shows an even bigger crude draw than API reported (and an even bigger build in gasoline stocks)…

Source: Bloomberg

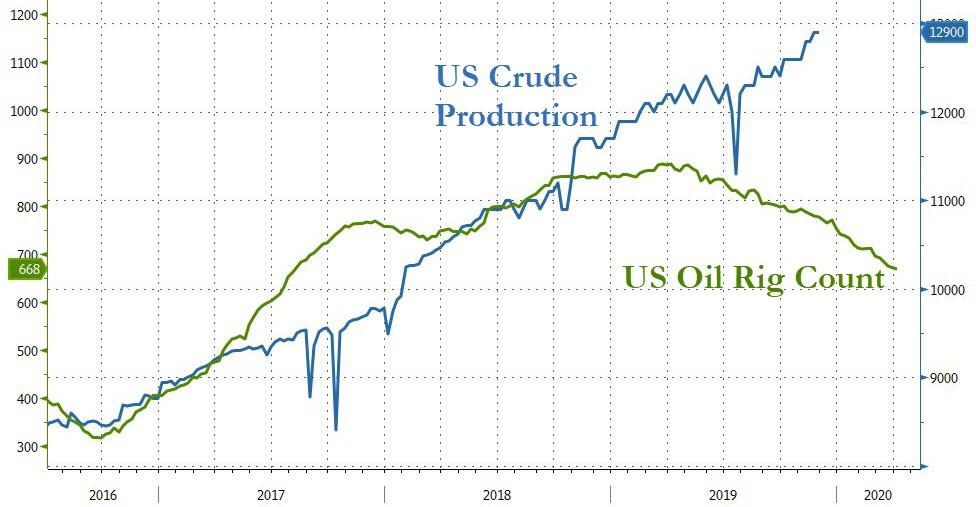

US crude production held at record highs…

Source: Bloomberg

And WTI was unsure where to go now that the algos ran the stops…

Bloomberg Intelligence Senior Energy Analyst Vince Piazza concludes: “Increasing demands among OPEC+ participants for deeper supply curbs confirm our concern about slowing demand. Additional cuts of 400,000 barrels a day would raise reductions to 1.6 million, while stronger compliance would further aid sentiment. Extending the deal for six months into 2H20 would provide the market with greater clarity.”

Tyler Durden

Wed, 12/04/2019 – 10:37

via ZeroHedge News https://ift.tt/2rToh2n Tyler Durden