For First Time Since 2012, A China IPO Flopped…

On Wednesday, a Chinese IPO closed below its listing price for the first time since 2012, signaling that the public’s former unquestionable love affair with risk and equities is fading as the economy continues to decelerate,.

- LUOYANG JALON MICRO-NANO NEW MATERIALS SAYS TRADING IN SHARES TO DEBUT ON DEC 4 IN SHANGHAI

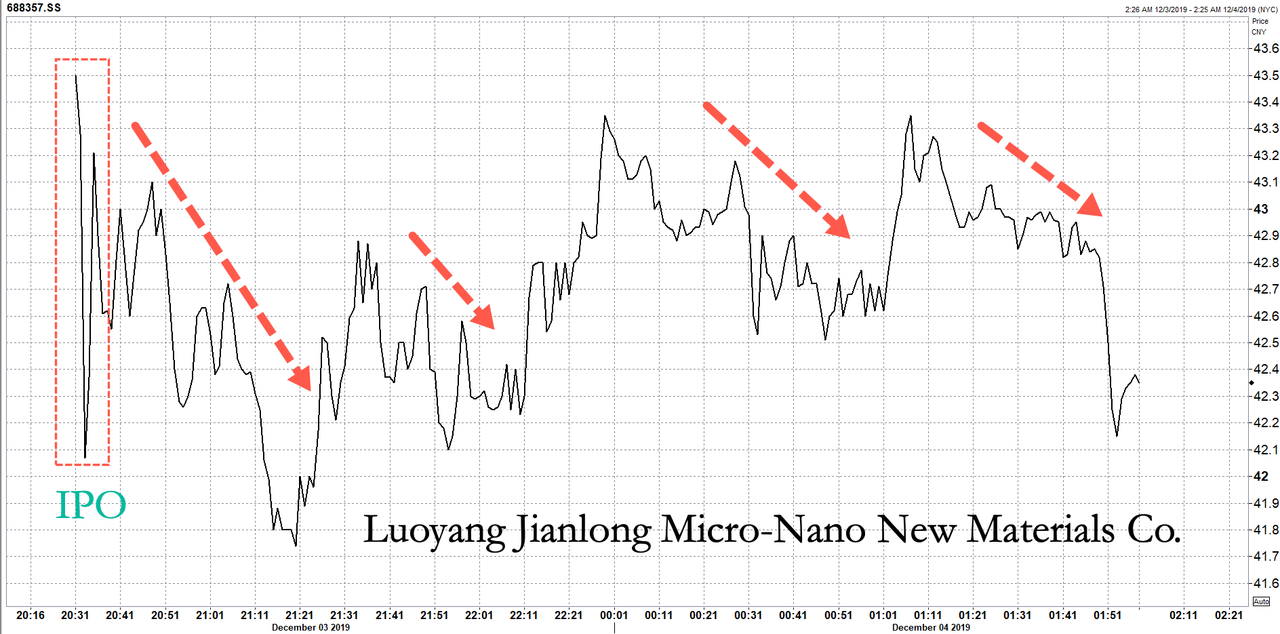

Luoyang Jianlong Micro-Nano New Materials shares debuted on the Shanghai Stock Exchange on Wednesday. The stock immediately dropped 7% in the first hour of trading, closing down 2% on the session.

Luoyang Jianlong’s disastrous IPO debut was the first time a mainland Chinese stock closed below its listing price since 2012. The last time this happened, Haixin Foods plunged 8% below its first day listing price in 4Q12.

“Luoyang Jianlong’s debut flop sends a clear signal to the market that buying into IPOs has become more and more risky,” said Jiang Liangqing, a money manager at Ruisen Capital Management in Beijing.

“It will become more difficult for companies to raise money from the capital market as the deteriorating performances of new listings will deter investors,” he said. “On the other hand, it shows that things are becoming increasingly market-driven.”

For at least a decade, China’s IPO market has been one of the strongest in the world, with every newly public stock closing at or near limit-up. Though now it seems large-cap IPOs are showing signs of waning interest from investors as the economy continues to decelerate through year-end, and likely to continue slowing into 1H20. To counter the IPO market bust, China has tried to calm markets by increasing domestic firms with more access to credit to keep equity markets humming along.

State-run media outlets have published frontpage stories telling investors not to worry about the IPO market, and enough liquidity will be provided through 2020.

China’s economy is growing at the weakest point in nearly three decades. A massive turn up in growth in China and across the world is unlikely in early 2020, mostly due to China’s credit impulse faltering.

We warned back in September that the global IPO market was going bust, mostly due to the synchronized global slowdown that has deterred investors from buying IPO shares in companies that don’t make money ahead of a recession.

The rebellion against unicorn IPOs in the US in 2019 shows that investors have lost interest in speculative growth companies. Some of the high-profile US IPO flops this year have been Uber and Lyft. In September, the Peloton IPO plunged 7% below its offering price, making it the third-worst trading debut for a large US IPO since 2008.

Tyler Durden

Wed, 12/04/2019 – 18:55

via ZeroHedge News https://ift.tt/2RmmqxU Tyler Durden