“Is Something Going Wrong? Is Something Broken?” Quants Running “Scared” As Nothing Makes Sense

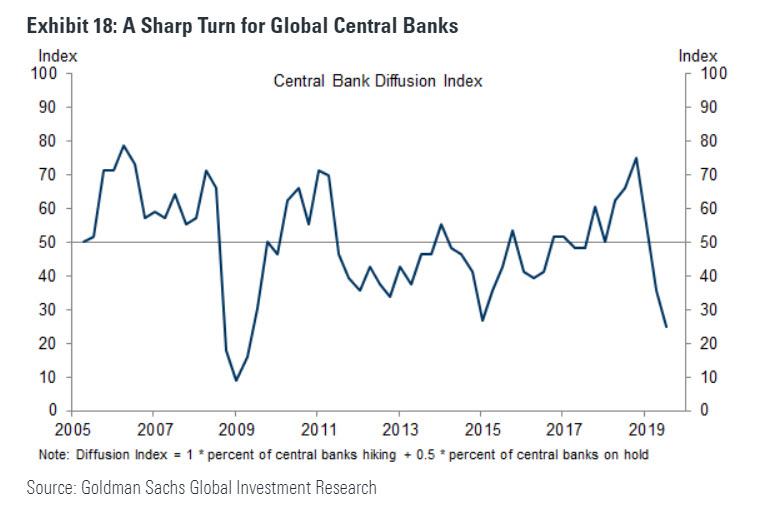

It was a year where the S&P put the mini bear market of December 2018 in the dust, and after a dramatic reversal which saw most central banks flip from hawkish to dovish throughout the year…

… the MSCI World index is just shy of its January 2018 highs, and the S&P has returned an impressive 24% (despite the jittery start to December), and stands at all time record highs, despite, paradoxically, a year of record equity fund outflow.

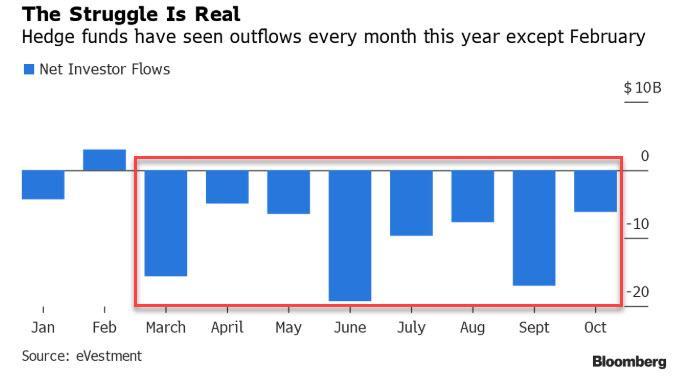

On paper, this should have been a great year for investors after a dismal 2018. In reality, however, 2019 has been just as painful for not just for hedge funds, which have substantially underperformed the S&P again and in October saw a record 8 consecutive months of outflows, the most since the financial crisis…

… but especially for quants, which after a relatively solid year, suffered the September quant crash that destroyed most of their YTD gains, and have generally been unable to find their bearings in a year in which nothing seemed to work.

It’s also Georg Elsaesser, a Frankfurt-based fund manager at Invesco, is trying to calm down his newbie quant clients as choppy stock moves make life difficult for anyone trading factors, which wire up all those systematic portfolios on Wall Street.

“Some of them are kind of scared,” Elsaesser told Bloomberg. “They’re asking the questions: Is something going wrong? Is something broken?”

Well actually, the answer is yes: the market is broken, and you can thank central banks for that.

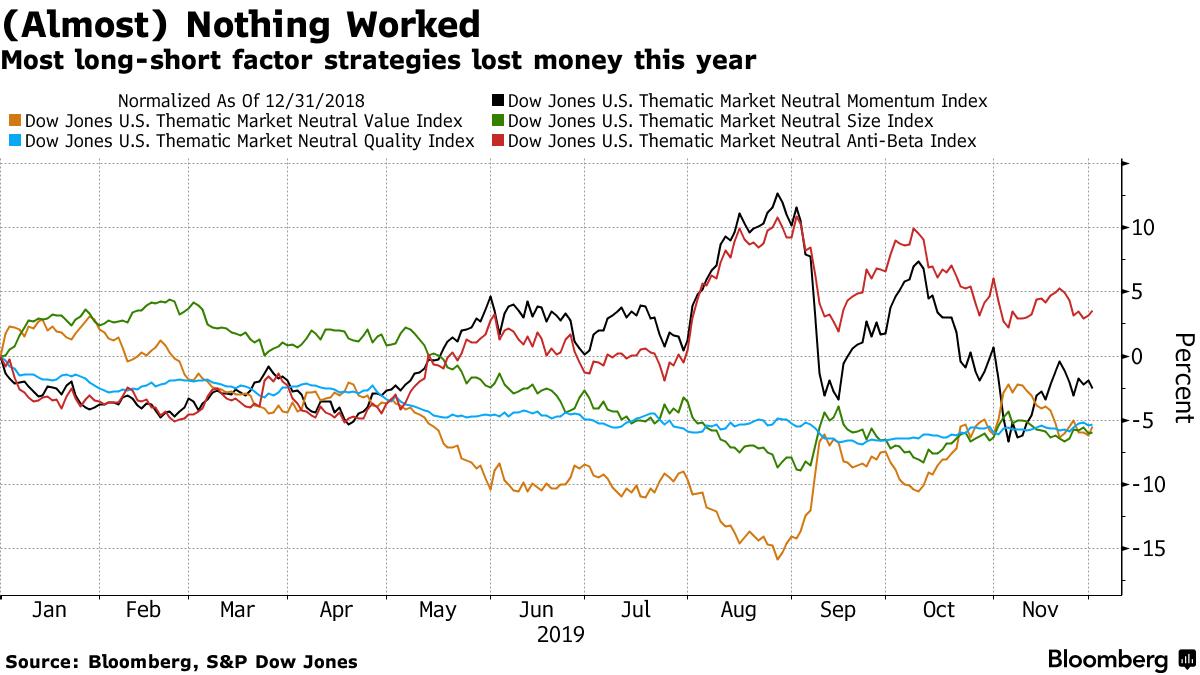

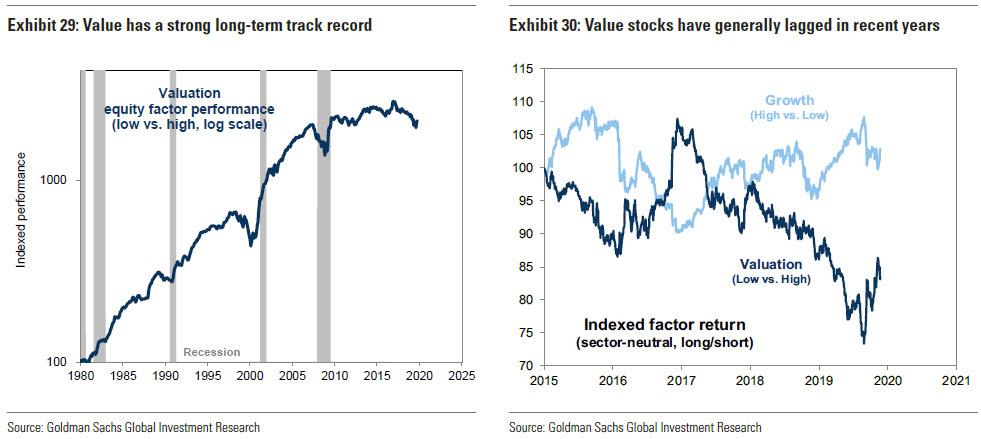

The problem is that the rules-based method of investing based on grouping of stocks by traits like their value, momentum, or balance sheet quality, is misfiring again this year, even more so than it in 2018, when quants suffered their worst year since the financial crisis, and left quant icons such as Cliff Asness’ AQR, suffering its biggest loss since inception.

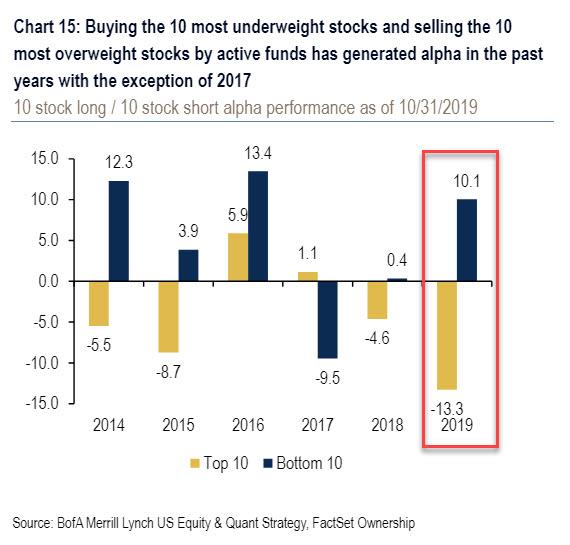

Here is another problem: while the broader stock market, propped up by central bank stimulus, rate cuts and “NOT QE”, has been on a tear, a peek below the calm surface reveals a tempest of position reversals and catastrophic, at time, performance as a slew of traditional long-short styles are in the red. Market-neutral portfolios have lost 1% this year, according to a Hedge Fund Research index.

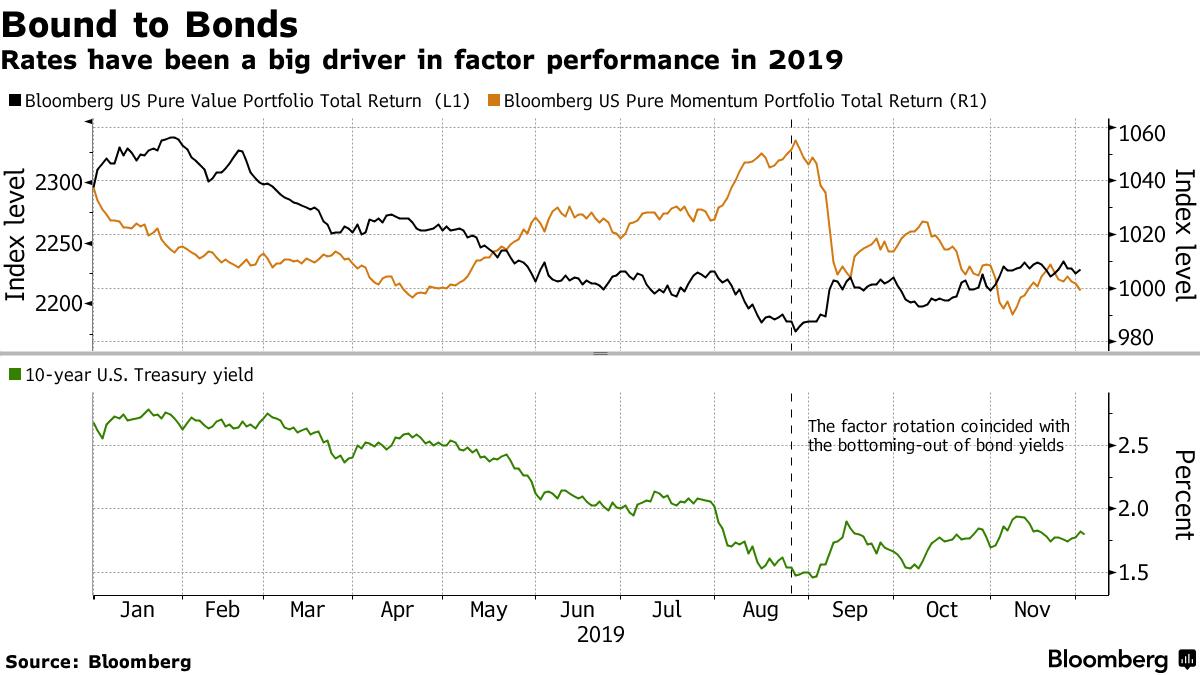

While there are numerous, often conflicting, explanations why factor portfolios disappointed in 2019, one can offer some generalizations. Persistent caution over the growth outlook whipsawed riskier trades like value and small caps which slumped all year then soared at the start of September, momentum trades worked all year then got crushed in September, the most shorted stocks soared, and the most heavily owned stocks barely outperformed.

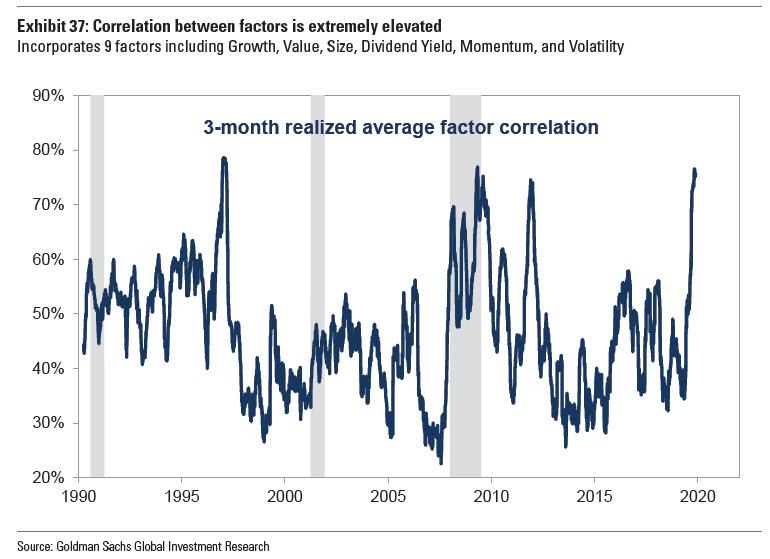

Another, more practical explanation, is that in a world where factors are supposed to offer diversification of risk, they did just the opposite, and the correlation between the most popular factors such as growth, value, size, dividend yield, momentum and volatility exploded. As Goldman wrote in its 2020 year ahead outlook, the average realized pairwise correlation of our factors has reached levels only achieved twice in the last 30 years: in 2Q 2009 as the equity market bottomed in the Financial Crisis and in 1Q 1997 as the Tech Bubble began to build. These elevated correlations underscore the importance that risk sentiment in driving recent market rotations, but more importantly explain why, well, nothing worked, as all of these often conflicting strategies eventually ended up offsetting each other.

The soaring correlations can also be explained by the bond market: as interest rates dominated factor returns this year, diversification benefits weakened according to analysts at Nomura Instinet.

In light of this dismal repeat performance, it is easy to see why Elsaesser is on the defensive: he is one of many in the systematic community trying to win back hearts with the pitch that factors are time-tested, designed for the long haul and backed by some of the smartest folk in finance and academia (so was LTCM). But as the investing style closes a year to forget, patience is wearing thin among the market-neutral crowd, which plight Bloomberg covered in an article this morning.

“The experienced investors say it’s normal noise in the long run,” Elsaesser said. “But it certainly means we need to explain more.”

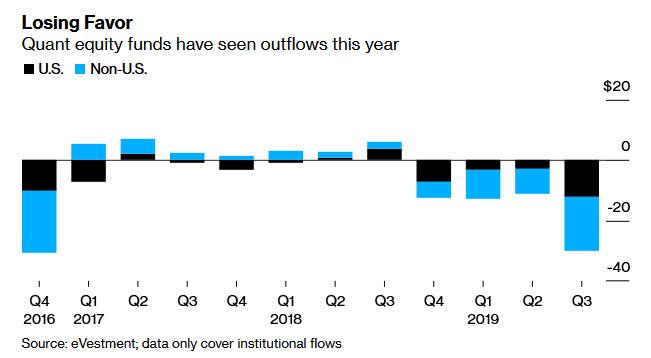

You certainly do: after yet another year of carnage for quants, billions of dollars are fleeing the industry which as recently as a few years ago was considered the “next big thing” on Wall Street, now that fundamental analysis no longer matters (again, thanks to central banks).

Sure enough, outflows have soared, and may also have hit industry performance. Market-neutral equity hedge funds lost nearly $4 billion YTD, according to Eurekahedge. Institutions even redeemed $54 billion from long-only quantitative stock funds in the first three quarters, according to eVestment.

However, outflows will continue as long as days like Sept 9 occasionally emerge out of the blue.

On that day, the S&P 500 Index closed flat, equity volatility cruised around its five-year average and commodities were unexciting. Yet factor investors experienced the biggest rotation in a decade after value briefly broke out of its funk at the expense of high-flying momentum stocks. As we showed then, that one day was the most painful for quant funds since the great quant crash of August 2007! And worst of all, nobody knew just why it happened as swiftly as it did.

As a result, Bloomberg writes that quants who failed to diversify into winners like low volatility – which until the September shock would be most of them – are in “soul-searching mode.” Are factors like value structurally broken? Can market-neutral styles roar back to life over the long haul?

The best summary of how nothing for quants has worked this year (and last year) came from Ian Heslop, London-based head of global equities at Merian Global Investors, who did his best LTCM impression: “Some of the themes we expected to diversify our returns in a period of underperformance of value haven’t worked as well.”

That said, it’s not been all gloom. A handful of long-only factor strategies are posting 20%-plus gains this year. But they’re still lagging cap-weighted indexes. Sanford C. Bernstein estimates systematic long-only managers have lagged their benchmark by 2% points on average.

The pain is most acute for market-neutral quants, whose strategies including factor styles gained a paltry 1.2% this year as of Nov. 26 compared with 9.8% for equity long-short funds and 8.7% for discretionary macro funds, according to Credit Suisse data. Recent research by Robeco showed that it was the short legs of factor strategies that have been a drag on performance this year, arguing the value of the investing style mostly comes from the long leg.

Well yes: this is another way of saying that in a manipulated, centrally-planned market, there is no need for short pair trades, i.e., there is no need to hedge. Incidentally, this is precisely what we said all the way back in 2013 when we wrote that the only alpha-generating strategy in a broken market is to go short the most held names and go long the most shorted ones. 6 years later, Bank of America is writing just how correct we were, pointing out that going against the Wall Street crowd has never been more profitable…

And yet, even though we write about this year after year, there will always be those who could never have possibly anticipated this:

“Whether this has been driven by flow events or not, it is finite, it’s very unusual,” said Heslop. His $4.5 billion Merian Global Equity Absolute Return Fund has seen its assets shrink by more than half this year.

Then there are those who have been betting – year after year – on mean reversion, certain that value was poised for a rebound. They too were left disappointed. As Bloomberg notes, and as we cautioned, since reviving briefly in September, the factor has flatlined since despite JPM’s Marko Kolanovic predicting the value to momentum rotation is a “once in a decade opportunity.” Here, as Bloomberg accurately notes, its outlook continues to divide quant land between bears citing low yields and weak growth, and bulls touting cheap relative valuations.

Alas, neither strategy is beating the S&P500 which is the one asset class directly propped up by central banks.

So where do we stand now?

Well, after another disastrous year for the sector, some quants are revamping strategies. At Merian, Bloomberg notes that Heslop’s team this year tweaked models to penalize exposure to highly correlated factors and to make allocations more defensive against downside risks; it is now on the hunt for smarter definitions of value. The irony, of course, is that most of Heslop’s peers are also doing precisely the same thing, and the outcome will be yet another year of underperformance for quants who are not only fighting themselves, but are also locked in a fight for survival against central banks who have turned the logic of investing and Finance 101 on its head.

Some funds are also deploying alternative data and machine learning in a bid to re-invent now widely known factor strategies. That said, such newfangled methods are a contentious move for a community that’s netted billions riding established factors back-tested over decades. Invesco’s Elsaesser for one is skeptical.

“It’s like a perfect storm for factors at the moment, but they have done what you would expect them to do,” he said. “We’ve seen these drawdowns; we’ve seen them recover. We know the essence of them is the very strong factor logic.”

There is just one problem: when you have a centrally planned market, you don’t have logic. We wonder just how many more year it will take the best and the brightest to finally grasp this simple observation which we have been pounding the table on since our inception in 2009…

Tyler Durden

Wed, 12/04/2019 – 19:35

via ZeroHedge News https://ift.tt/2DNasVY Tyler Durden