November Payrolls Preview: This May Actually Matter

With the Fed now on hold well into 2020 (by which we mean no rates hikes ever and a rate cut as soon as the S&P drops more than 10%), Powell’s reaction function is once again data-dependent, which is why tomorrow’s payrolls report might actually matter to markets: if very strong, it may just skewer stocks as the odds of a rate hike, improbable as they may be, will rise; if ugly – which is far more likely after our analysis over the weekend and yesterday’s disastrous ADP – it could send the S&P to new all time highs as traders anticipate another rate cut in the coming months.

With that in mind, here’s what consensus expects the BLS to release tomorrow at 8:30am ET: An above trend 180k in November; The unemployment rate is seen unchanged, though some gauges suggest the jobless rate could be subject to upside risk. The pace of wage growth is seen rising a touch in the month. Other indicators have been mixed; the ADP gauge of payrolls missed expectations, but did not contain the positive impact from GM workers returning from strikes; jobless claims data surged to a five-month high in the survey week, though has subsequently fallen towards the low end of its recent range, providing a mixed signal. The ISM manufacturing survey’s employment sub index was weak, though the services gauge, which is more representative of the US economy, ticked up slightly. Meanwhile, announced job cuts are down on a monthly and yearly basis, though the YTD measure in November was the highest since 2015.

Here is a summary of the key expectations, courtesy of RanSquawk

- Non-farm Payrolls: Exp. 180k, Prev. 128k.

- Private Payrolls: Exp. 175k, Prev. 131k.

- Manufacturing Payrolls: Exp. 38k, Prev. -36k.

- Government Payrolls: Prev. -3k.

- Avg. Earnings M/M: Exp. 0.3%, Prev. 0.2%.

- Avg. Earnings Y/Y: Exp. 3.0%, Prev. 3.0%.

- Avg. Work Week Hours: Exp. 34.4hrs, Prev. 34.4hrs.

- Unemployment Rate: Exp. 3.6%, Prev. 3.6%. (FOMC currently projects 3.7% at end-2019, and 4.2% in the long run).

- U6 Unemployment Rate: Prev. 7.0%.

- Labour Force Participation: Exp. 63.3%, Prev. 63.3%.

TREND RATES: The street looks for 180k nonfarm payrolls to be added to the US economy in November, slightly above recent trend rates (3-month average 176k, 6-month average 156k, 12-month average 174k). While the jobless rate is seen remaining at 3.6%, analysts note that the differential between jobs ‘plentiful’ and jobs ‘hard-to-get’ in the CB consumer confidence data narrowed from 35.1 to 32.1, leaving some risk of a rise in the unemployment rate. Consumers are seemingly optimistic on wage growth, with the latest confidence data showing the anticipation of an improvement in future wages rising slightly in the month (from 21.4 to 21.8), while those expecting a decrease declined slightly (6.9 to 6.2).

INITIAL JOBLESS CLAIMS: In the payroll survey week, initial jobless claims printed 228k, the highest weekly print since May, with the four-week moving average rising to 221.25k (compared to 213k weekly print in the October survey week, where the four-week moving average was 215.25k). Pantheon Macroeconomics said that the data got its attention, given it has printed five-month highs in two consecutive weeks. Its economists, however, said that at this point, it cannot be sure if it was a real sign of a change in the labour market, not least because some of the increase appeared to be due to the California wildfires. “We need to see more data before making any sort of macro call, but a clear and sustained increase in claims would be a real warning sign,” Pantheon writes, “so far, all the downshift in job gains has been due to slower hiring; if layoffs rise too, payroll growth will weaken substantially further.”

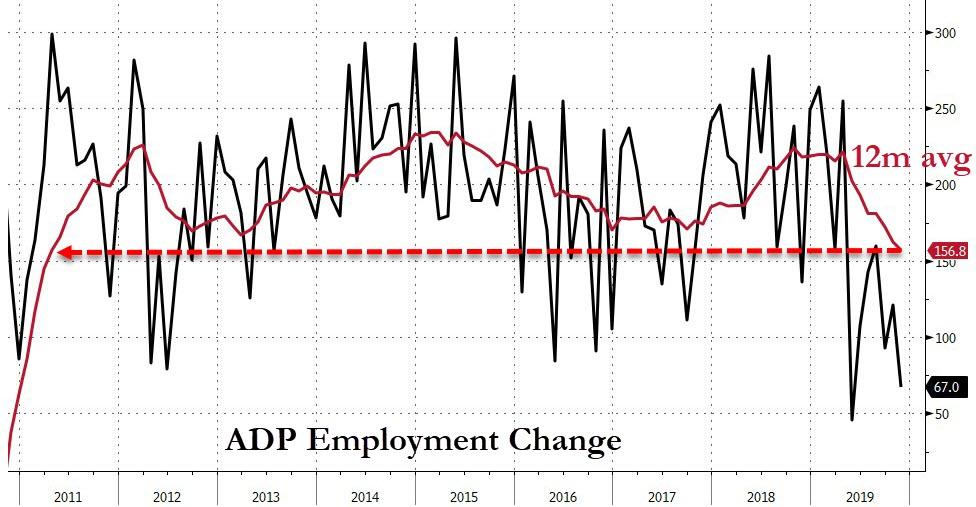

ADP: According to the ADP’s measure of payrolls, 67k jobs were added to the US economy in November – short of the 145k consensus, and missing even the most pessimistic forecast (range was between 120-188k); Capital Economics says the data presents downside risks to its 170k forecast, though does note that the official payrolls data will be boosted by an approximately 50k rise in auto sector employment after GM workers returned from strike — the ADP’s data did not include this effect. “This report adds to signs that the labour market is still losing momentum, suggesting that income growth and thus real consumption growth will slow a little further in the near term,” Capital Economics writes, “but it would take a much sharper downturn in employment growth to raise recession fears and prompt the Fed into additional rate cuts.”

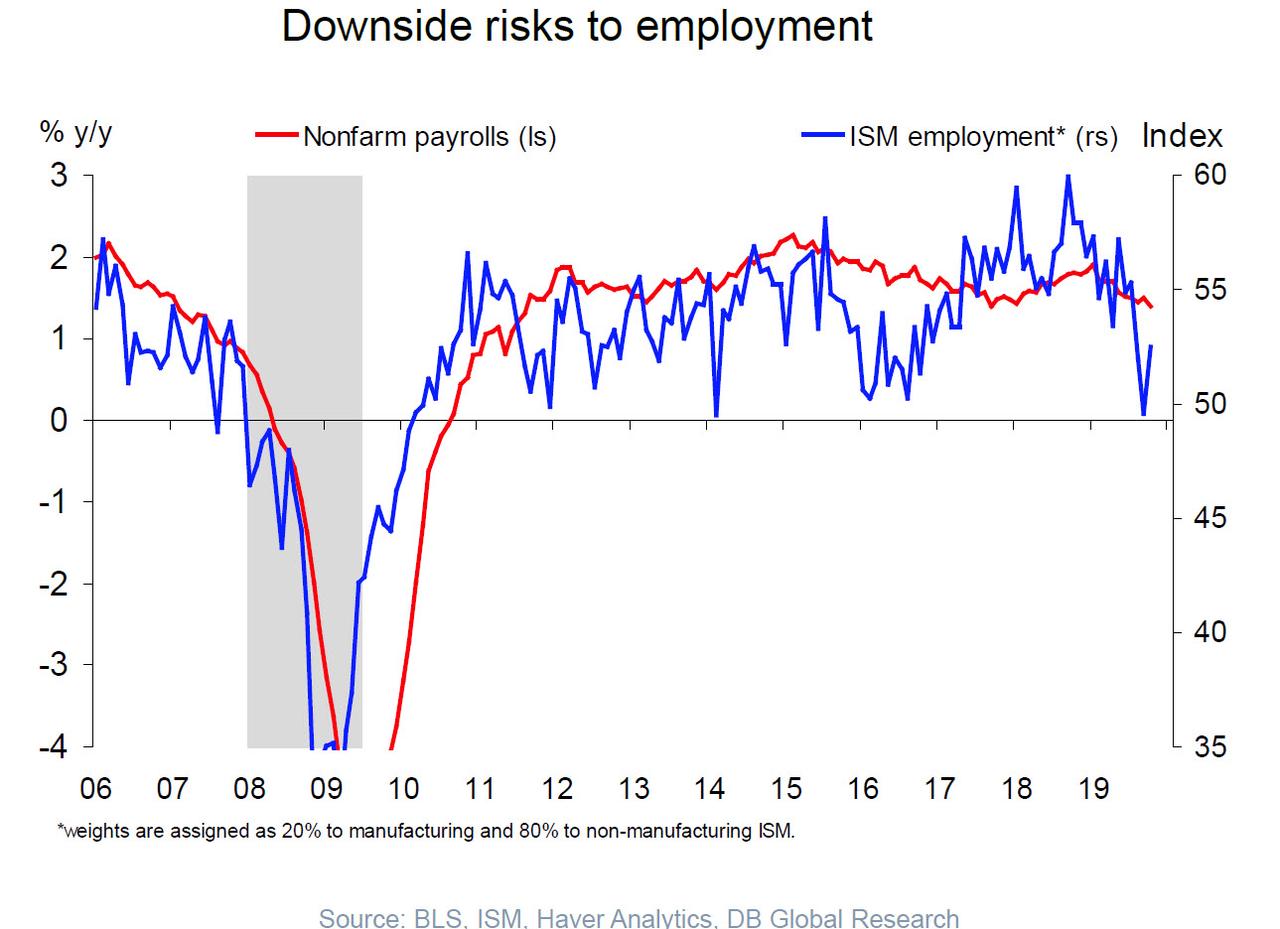

ISM: The ISM manufacturing survey saw the employment subindex fall by 1.1 points in the month, taking it to 46.6 points, with the contraction extending to four months. ISM said that three of the six big industry sectors expanded employment, and three contracted during the period, an improvement from the previous month, and also said that labour force-reduction concerns remained generally constant. (NOTE: ISM says that an employment sub-index above 50.8, over time, is generally consistent with an increase in the BLS data on manufacturing employment (you have to go back to the July data for the latest print above that level). The employment sub index within the non-manufacturing ISM told a better story, rising 1.8 points in November to 55.5, with respondents stating “we are in a workforce crisis, unable to attract and/or retain workers” and “hiring more personnel to support operations.

CHALLENGER JOB CUTS: Challenger announced job cut announcements by US firms fell to a rate of 44,569 in November, from 50,275 in October – – down 11% M/M and down 16% Y/Y; however, the YTD figure is higher, with employers announcing plans to cut 559,713 jobs, which is 13.1% higher than the 494,775 cuts announced through November 2018, and the highest January-November total since 2015, when 574,888 cuts were announced. Challenger also said that job cuts announced in 2019 have already surpassed the full-year total in 2018, when 538,659 cuts were announced. The report said “employers did not make large-scale job cut plans in November. While concerns of a downturn may linger, consumer confidence is strong and companies are holding on to their employees in a tight labour market.” On a more optimistic note, the report noted that hiring plans by US companies were at a record high, and that through October, companies announced 1,181,438 hiring plans, 564,781 of which are for the holiday season.

Arguing for a Weaker Report:

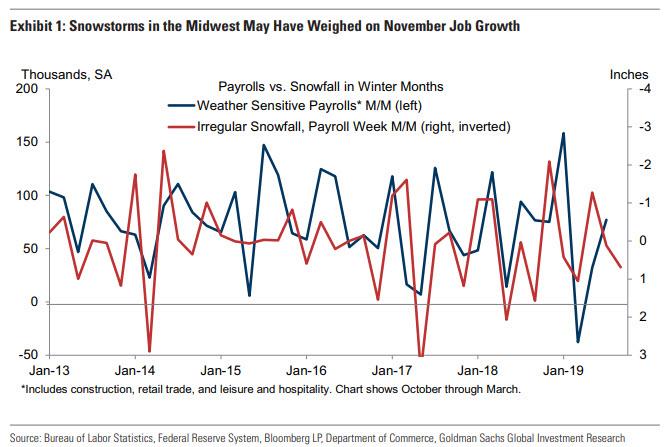

- Winter weather. Snowstorms during the survey period in Chicago and other parts of the Midwest may have weighed on November payroll growth. As shown in Exhibit 1, our population-weighted snowfall dataset was above average during the November survey week. While the impact is uncertain, we are assuming a weather impact of around -10k in tomorrow’s report.

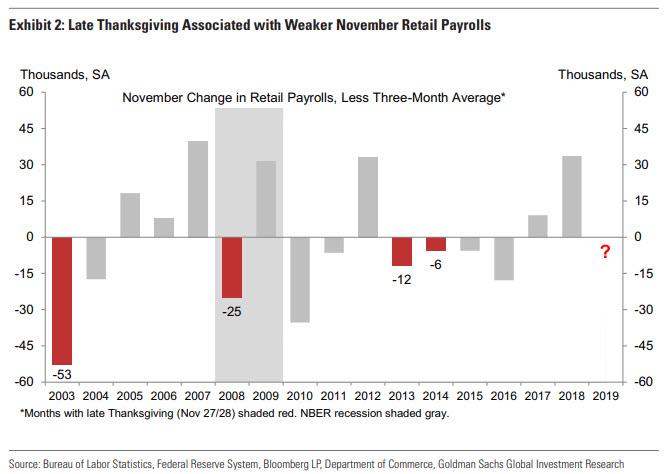

- Holiday retail hiring. Thanksgiving was relatively late this year (November 28th n ) and this could reduce the number of holiday retail employees reflected in the November survey period. As shown in Exhibit 2, retail job growth tends to be weak in similar calendar configurations, decelerating relative to the 3-month average in each of the last four instances (though the magnitude of this drag may be waning over time).

- ADP. The payroll-processing firm ADP reported a 67k increase in November private employment, 68k below consensus and well below the 135k average pace over the three prior months. While the inputs to the ADP model argued for a weak reading, the shortfall was considerably larger than expected. The fact that job creation slowed “across all company sizes” in the ADP panel also indicates some legitimate weakness in November job growth.

- Job availability. The Conference Board labor market differential—the difference between the percent of respondents saying jobs are plentiful and those saying jobs are hard to get—retrenched by 4.0pt to +32.1 in November. Other job availability readings were similarly softer: JOLTS job openings declined to their lowest level since early 2018 (-277k to 7,024k in September) and the Conference Board’s Help Wanted Online index fell (-3.0pt to 100.5 in October)

Arguing for a Stronger Report:

- End of GM Strike. As indicated in the BLS strike report, 46k General Motors employees did not work during the October payroll period due to a United Auto Workers strike. The return of these workers is set to boost tomorrow’s manufacturing growth reading by 46k (a 2k metalworkers strike will provide a slight offset to the overall payroll impact).

- Labor market slack. With the labor market somewhat beyond full employment, we see the dwindling availability of workers as one factor weighing on job growth this year. However, as shown in Exhibit 3, first-print November job growth often accelerates when the labor market is tight—for example in 1988, 1989, 1997, 1998, 2000, and 2006. We believe some firms may have pulled forward hiring or reduced year-end layoff activity, anticipating a shortage of applicants in future months.

- Employer surveys. Business activity surveys were mixed in November (roughly unchanged on net for headline manufacturing surveys but somewhat stronger for services). While the employment components generally declined for the manufacturing sector (tracker -0.7 to 52.8), they improved for the much larger services sector (+1.0 to 52.4). Service-sector job growth was 157k in October and averaged 136k over the last six months, while manufacturing payroll employment contracted by 36k in October, below its +3k average over the prior six months but quite strong given the 46k drag from the GM strike.

- Job cuts. Announced layoffs reported by Challenger, Gray & Christmas declined by 6k in November to 46k (SA by GS), and were 10k below their November 2018 level. The sequential decline in announced layoffs primarily reflects a reversal in the technology (-8k) sector.

- Census hiring. Temporary employment related to the 2020 Census declined 19k in October as address-canvassing operations wound down. There were still 9k Census employees in the October payroll counts, and we expect a further modest drop in November (we assume -5k)

Source: RanSquawk, Goldman

Tyler Durden

Thu, 12/05/2019 – 22:24

via ZeroHedge News https://ift.tt/33WaTrs Tyler Durden