2020 – The Year Decennial & Presidential Cycles Collide

Authored by Lance Roberts via RealInvestmentAdvice.com,

Here Comes Santa Claus (Rally)

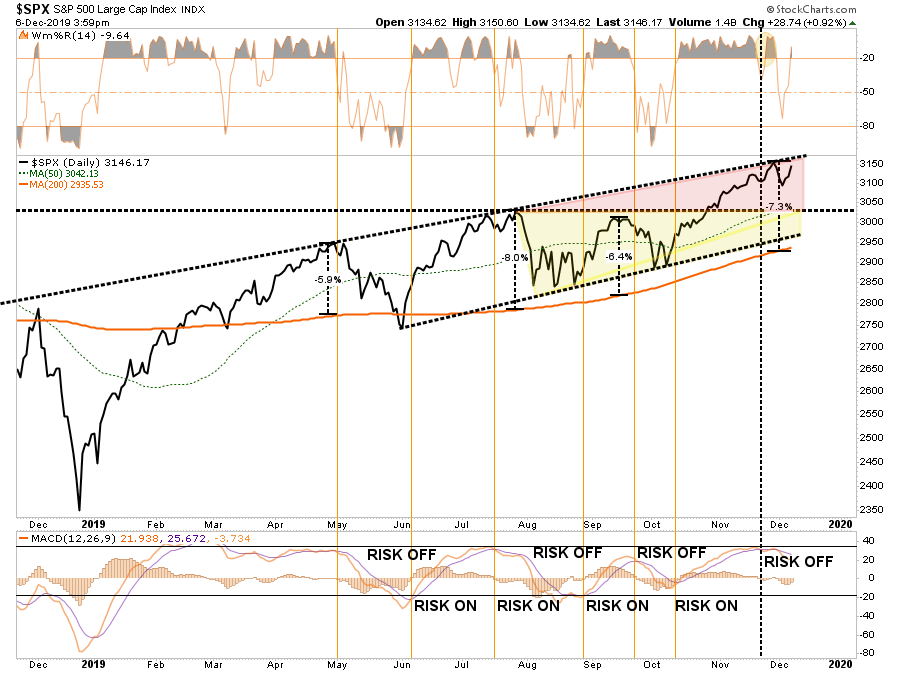

On Friday, the market rallied sharply on the back of a much better than expected employment report and comments from Larry Kudlow that a “trade deal” is near. Given we are now at the last stages of the year where mutual, pension, and hedge funds need to “window dress” for year-end reporting, we removed our small equity hedge from the portfolio for the time being.

A quick word about that employment report.

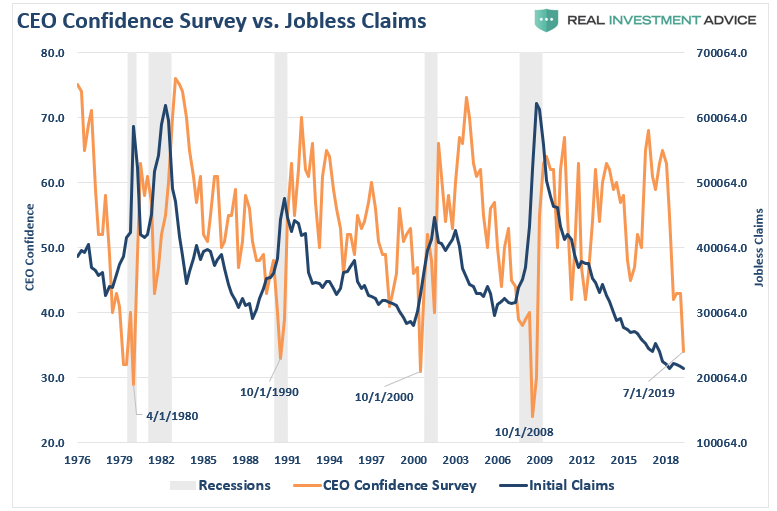

While the headline number was good, it remained primarily a story of auto workers returning to work and continued increases in lower wage-paying jobs and multiple jobholders. Such has been the story of the bulk of this recovery. However, more importantly, the bump did not change the overall dynamics of the job market cycle, which is clearly deteriorating as shown in the chart below.

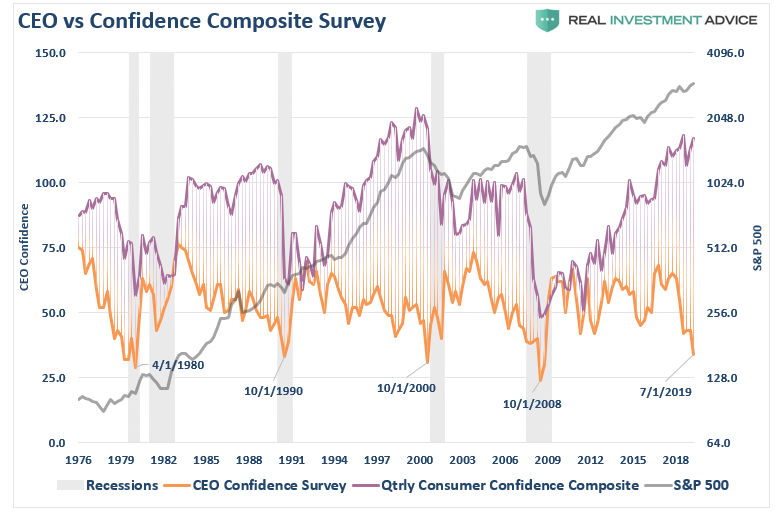

The key to trend change is CEO confidence which is extremely negative and coincident with employment cycle turns. Note that the end of employment cycles, when compared to CEO confidence, looks very similar at the end of each decade.

Nonetheless, in the short-term, the market dynamics are positive suggesting the market can indeed rally into the end of the year. As noted above, we have removed our equity hedge for now to allow our long-positions to fully benefit from the expected “Santa Claus” rally. (Or if you prefer the more PC version then it would be the expected “Jovial Full-Figured Holiday Person” rally.)

With the market back to short-term overbought, and the short-term “sell signal” still in place, it is possible we could see a bit of a correction next week. However, as we head into the last week of the year, a retest of highs is quite likely.

In the longer-term, as we will discuss more in a moment, the risk remains to the downside. It is highly unlikely there will be a “trade deal” anytime soon, and with the upcoming election, there will likely be increased volatility going into 2020.

From a purely technical perspective, on a monthly basis, the market is exceedingly overbought and at the top of the long-term trend channel. When these two conditions have been filled previously, we have seen fairly sharp corrections within the confines of the bullish trend.

With QE-4 in play, the bias remains to the upside keeping our target of 3300 on the S&P 500 in place. This is particularly the case as we head further into the seasonally strong period combined with an election year cycle.

Currently, we are exploring the energy space in particular where there is value being generated after the long drought of interest in energy-related stocks.

We have just released a research report for our RIAPro Subscribers (30-Day Free Trial) where we are looking for an opportunity. Here is a snippet:

“A decline in the dividend yield to the norm, assuming the dividend payout is unchanged, would result in a price increase of 13.17% for AMLP. Alternatively, if oil declined about 20% in value, the current AMLP dividend yield would then be fairly priced. We consider this a significant margin of safety should the price of oil fall, as it likely would if the U.S. enters a recession in the near future.”

When Presidential & Decennial Cycle Collide

There have been quite a few articles out lately suggesting that in 2020 the 10-year bull market is set to continue because it is a presidential election year. This sounds great in theory, but Wall Street and the financial media always suggest that next year is going to be another bullish year.

However, there are a lot of things that will need to go “right” next year from:

-

Avoidance of a recession

-

A rebound in global economic growth

-

The consumer will need to expand their current debt-driven consumption

-

A marked improvement in both corporate earnings and corporate profitability

-

A reduction or removal in current tariffs, and;

-

The Fed continues to remain ultra-accommodative to the markets.

These are all certainly possible, but given we are currently into both the longest, and weakest, economic expansion in history, and the longest bull market in history, the risks of something going wrong have certainly risen.

(While most financial media types present bull and bear markets in percentages, which is deceiving because a 100% gain and a 50% loss are the same thing, it worth noting what happens to investors by viewing cumulative point gains and losses. In every case the majority of the previous point gain is lost.)

However, what about the election coming up in less than a year?

Presidential Cycle

With “hope” running high that things can continue going into 2020, the question becomes whether or not the Presidential election cycle can hold its performance precedent. Since 1871, markets have gained in 35 of those years, with losses in only 11.

Since 1948, there have only been two losses during presidential election years which were 2000 and 2008. In fact, stocks have, on average, put in their second-best performance in the fourth year of a president’s term. (The third year has been best as we are seeing currently.)

With a “win ratio” of 76%, the media has been quick to assume the bull market will continue unabated. However, there is a 24% chance a bear market will occur which is not entirely insignificant. Furthermore, given the duration, magnitude, and valuation issues associated with the market currently, a “Vegas handicapper” might increase those odds just a bit.

One thing to remember about all of this is that while the odds are weighted in favor of a positive 2020 from an election cycle standpoint – there have been NO cycles in history when the majority of the industrialized world was on the brink of a debt crisis all at the same time.

While the election of the next President will impact the market’s view towards policy stability; it is the world stage that will drive investor sentiment over the coming months and years. The biggest of those drivers is employment which has been weakening as of late. Importantly, there is an important correlation between consumer/investor sentiment, CEO confidence, and employment as noted above.

“Take a closer look at the chart above.

Notice that CEO confidence leads consumer confidence by a wide margin. This lures bullish investors, and the media, into believing that CEO’s really don’t know what they are doing. Unfortunately, consumer confidence tends to crash as it catches up with what CEO’s were already telling them.

What were CEO’s telling consumers that crushed their confidence?

‘I’m sorry, we think you are really great, but I have to let you go.’”

“It is hard for consumers to remain ‘confident,’ and continue spending, when they have lost their source of income. This is why consumer confidence doesn’t ‘go gently into night,’ but rather ‘screaming into the abyss.’”

But there is another cycle that we need to consider which is colliding with the Presdential election cycle, and that is the 10-year or decennial cycle.

Decennial Cycle

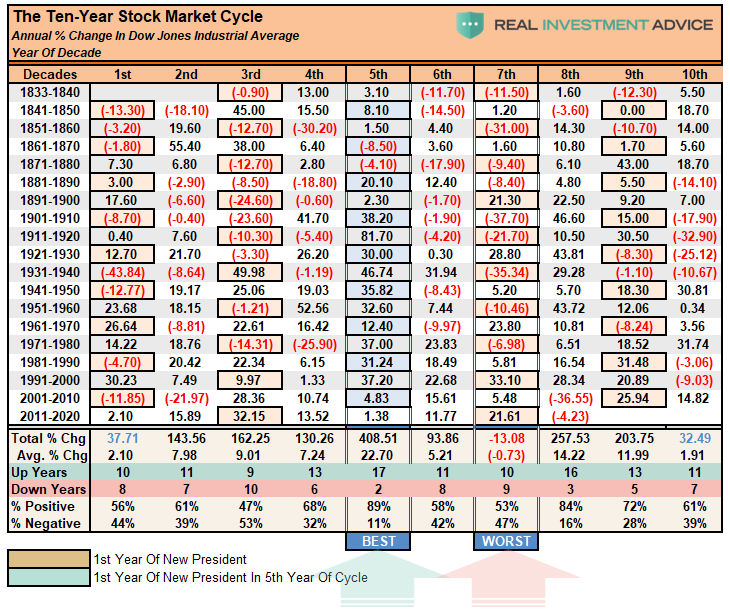

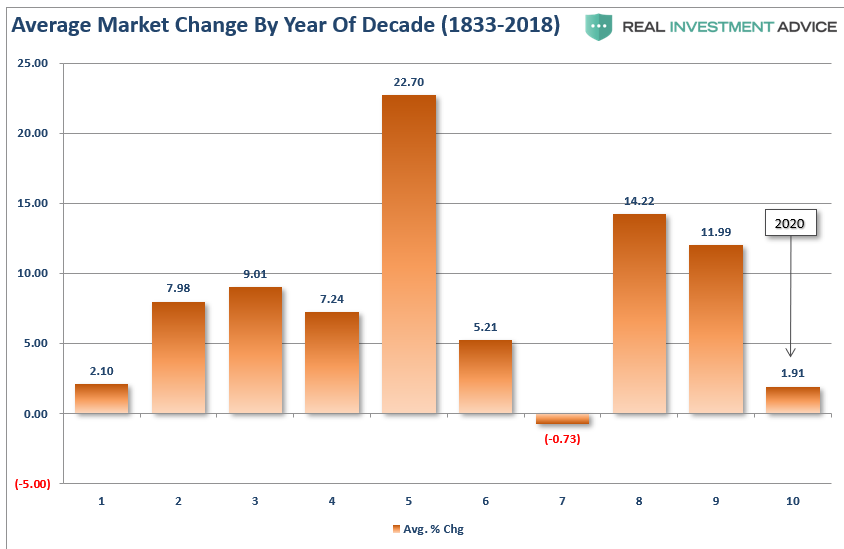

Using the same data set going back to 1833 we find a little different outlook. While the 10th year of the decade (2020) is on average slightly positive, it’s win/loss ratio is only 56%, or not much better than a coin toss.

Furthermore, while presidential election years have a near 10% average annual return profile, the 10th-year of the decennial cycle is markedly weaker at just 1.91% on average.

The best year of the decade is the 5th which has been positive 79% of the time with an average return of 22%. The worst year is the 7th with only a 53% win rate but a negative average annual return. As noted, 2020 comes in as the second place for the worst of the annual returns.

With a win/loss record of 11-7 an investor betting heavily on a positive outcome for 2020 may be left short changed given the current political, economic, fundamental, and financial environment.

I have also overlaid the 1st-year of the new presidential cycle with the “orange boxes” above. You will notice that again, return parameters and win/loss percentages are low. This should suggest some caution for investors over the next 24-months given the length of the current bull market advance.

A Lot Of If’s

All of this analysis is fine but whether the market is positive or negative in 2020 comes down to a laundry list of assumptions:

-

If we can avoid a recession in the U.S.

-

If we can avoid a recession in Europe.

-

If corporate earnings can strengthen.

-

If the consumer can remain strong.

-

Etc.

Those are some pretty broad “if’s” and given the weakness is imports, which suggests a weakening domestic consumer, and struggling manufacturing, the risk of something going wrong is elevated.

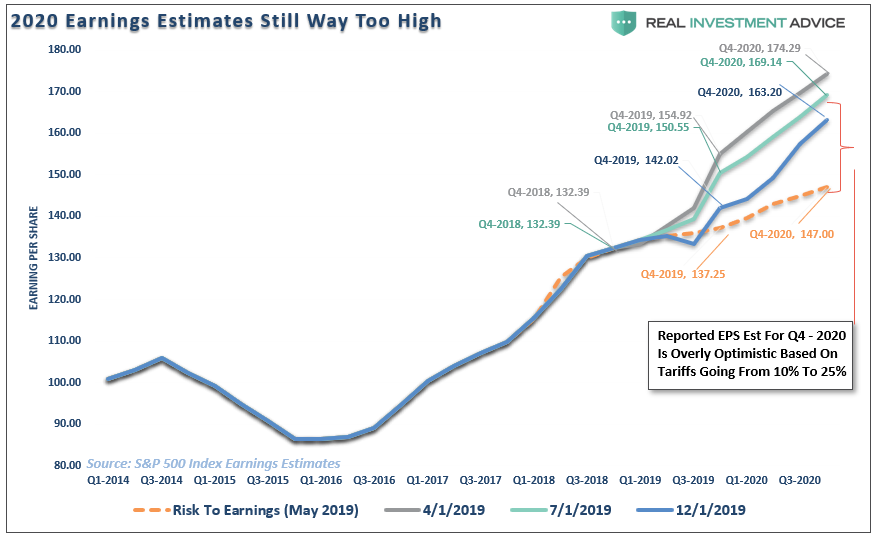

As far as corporate earnings go – they peaked this year as the tax cut stimulus ran its course, and forward expectations are being sharply ratcheted lower. As we discussed on Tuesday:

“Since April, forward expectations have fallen by more than $11/share as economic realities continue to impale overly optimistic projections.”

This earnings boom cycle was skewed heavily by accounting rule changes, loan loss provisioning, tax breaks, massive layoffs, extreme cost cutting, suppression of wages and benefits, longer work hours, and massive share buybacks along with extraordinary government stimulus.

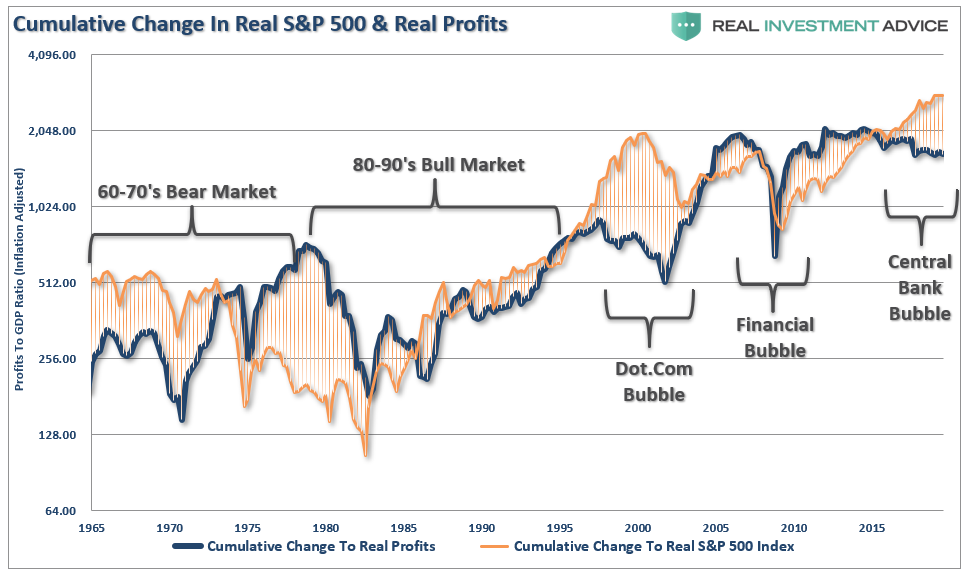

But when it comes to actual reported “profits,” which is what companies actually earned, reported, and paid taxes on, it is a vastly different story.

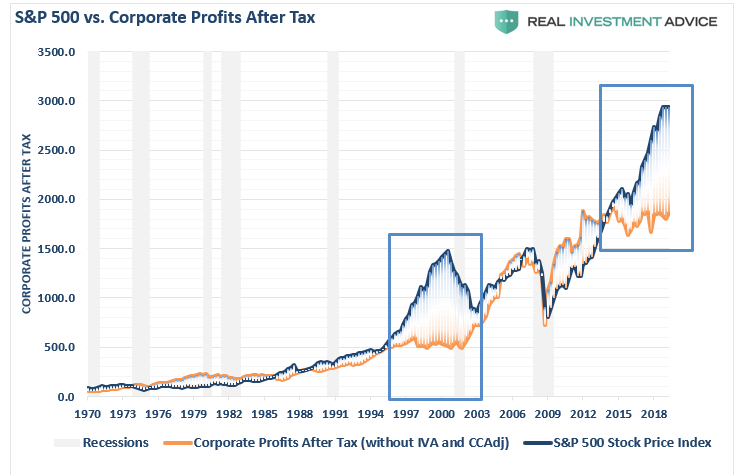

“Many are dismissing currently high valuations under the guise of ‘low interest rates,’ however, the one thing you should not dismiss, and cannot make an excuse for, is the massive deviation between the market and corporate profits after tax. The only other time in history the difference was this great was in 1999.”

The chart below shows the real, inflation-adjusted, profits after-tax versus the cumulative change to the S&P 500. Here is the important point – when markets grow faster than profitability, which it can do for a while; eventually a reversion occurs. This is simply the case that all excesses must eventually be cleared before the next growth cycle can occur. Currently, we are once again trading a fairly substantial premium to corporate profit growth.

So, if, somehow, maybe, possibly, all these things can be sustained we should be just fine.

The problem is, however, all of the pillars that supported the earnings boom are now going away beginning next year, each of them to some degree, which throws into question the sustainability going into 2020-2021.

While doing statistical analysis on the Presidential and Decennial cycles certainly make for interesting articles, it is crucially important to remember what drives the financial markets the short-term which is psychology and sentiment.

In the next 12-18 months, there will be more than enough event risks to skew the potential outcomes of the markets. This doesn’t mean that you should go and hide all in cash or gold. It does suggest you need to actively pay attention to your money.

This idea plays into our allocation theme of higher quality income, hedged investments and precious metals as an alternative to direct market risk. With expectations of lower economic growth in the coming quarters, reduced earnings, and pressure on the consumer, the markets are likely to remain highly volatile with little overall progress.

While we are in the midst of prognostications, it has also been predicted the world will end in 2020, so anything other than that will be a “win.”

Tyler Durden

Sun, 12/08/2019 – 14:45

via ZeroHedge News https://ift.tt/2LB4OKL Tyler Durden