Trapped (When Will We Know ‘They’ Lost Control?)

Authored by Sven Henrich via NorthmanTrader.com,

What? You thought a 850+ point drop in the $DJIA would result in a down week? No Sir. The unholy alliance has struck again. Massive jawboning by multiple administration officials about how well the China trade deal was going, a favorable jobs report and above all, the US Federal Reserve, all contributed to a furious rally to make markets green for the week on (when else?) magic risk free Friday.

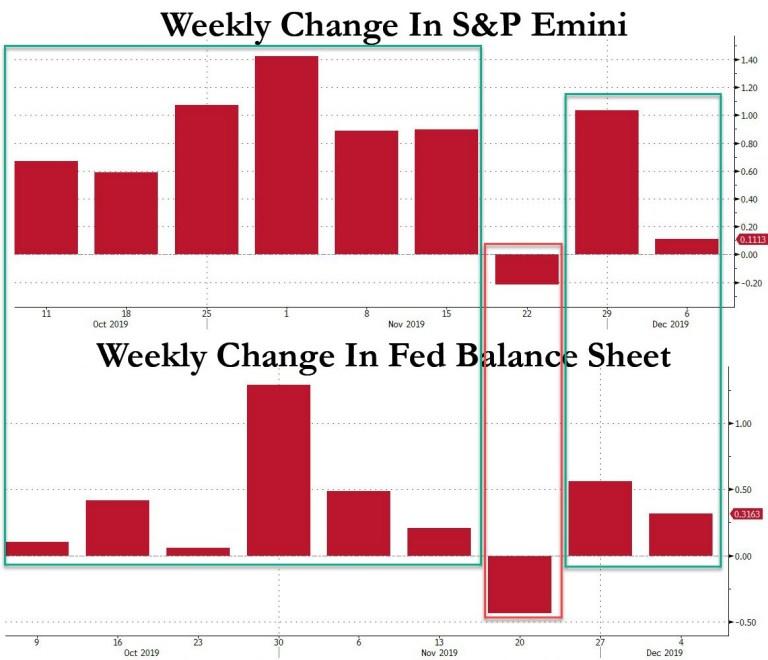

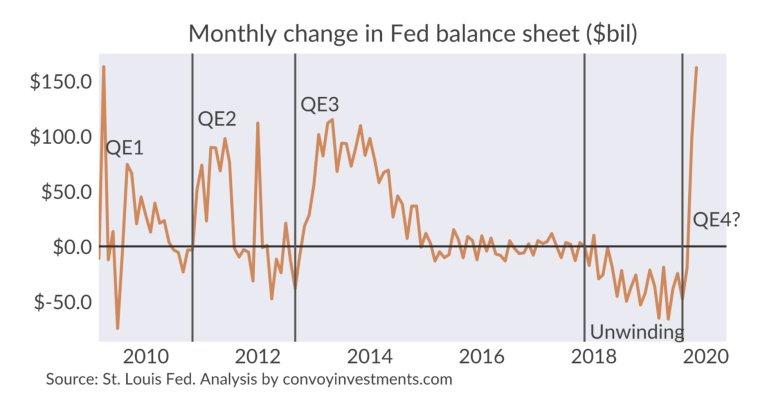

What was the tell? The same tell it’s been every week since the beginning of October. When the Fed’s balance sheet rises so does the market. One down week in the Fed’s balance sheet coincided with the only down week in markets since then.

Before you know it you have a trend (via zerohedge):

This is how predictable our markets have become. Tell me the size of Fed’s balance sheet next week and I’ll tell you what markets will do next week. Is it really this farcical? It appears so.

By that measure of course we can presume markets will just keep rising until next June as the Fed has indicated “not QE” will continue until then and their daily repo operations are now the ones on autopilot.

Investors are rightfully cheering gains having now realized that nothing matters but the Fed.

But be careful in cheering too much. All this action hides a rather very uncomfortable fact, a fact that may eventually see the air come out of this ballon faster than it is going in.

And that fact is that the Fed, and all other central banks, are trapped. Trapped in a coming disaster of their own making.

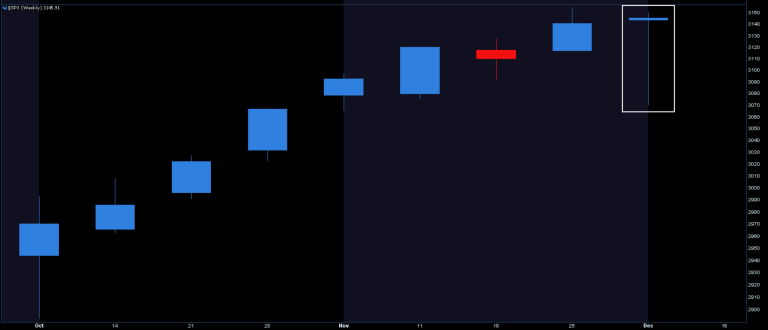

And be clear: As we saw this week again, the air can come out quickly. After all 90% of November gains simply disappeared in a matter of a couple of days. The subsequent furious comeback leaving a rather unusual weekly candle on $SPX (I’ll discuss this separately in an upcoming technical update).

What’s this trap I’m talking about?

Let’s start with the basics well outlined by Mohammed El-Erian in an interview on November 26:

“How do central banks pursue their economic objectives? By pushing up asset prices by hoping that higher asset prices make us feel wealthier & as we feel wealthier we spend more. But guess what? It doesn’t work….but the Fed can’t pull back because it’s worried it will disrupt markets that can be a spillover on the economy. The Fed’s in a lose, lose, lose situation, they can’t stay where they are, they can’t do more, they can’t do less”..

See here’s the thing: The Fed has failed for over 10 years to reach its inflation objectives, but it’s really good at the asset inflation game and so are other central banks, and this is what we’re seeing unfold in 2019. Asset price inflation to make us feel wealthier, to make consumers more confident, so they spend more. Nothing more, nothing less. It really is that simple.

But what does it produce?

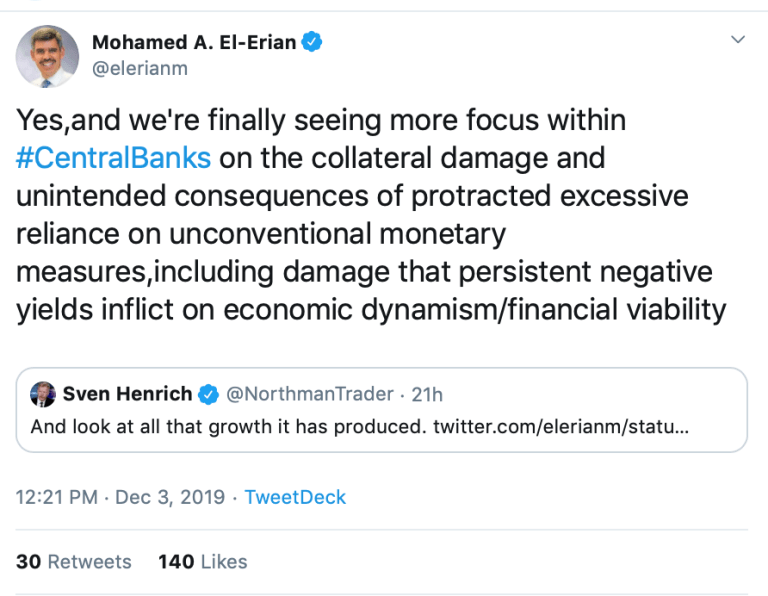

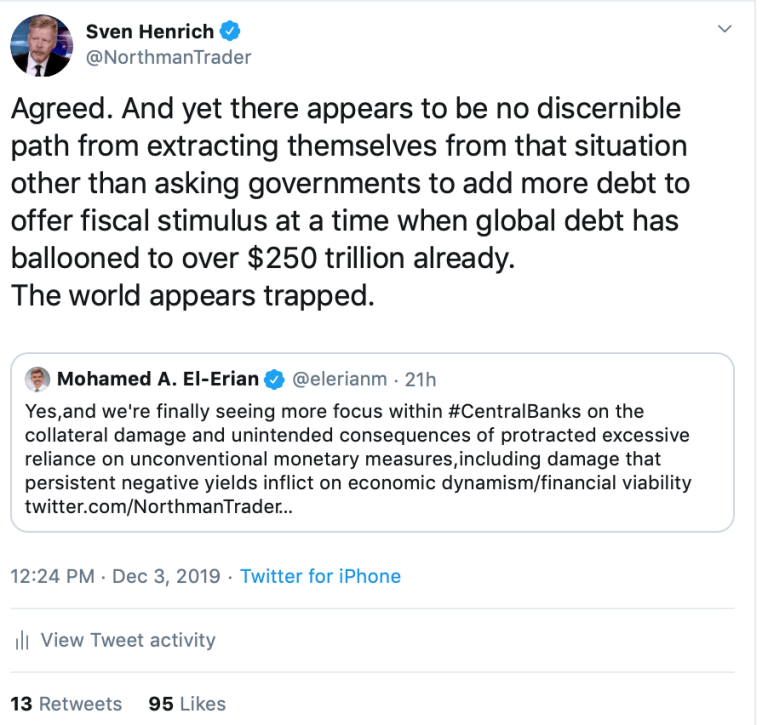

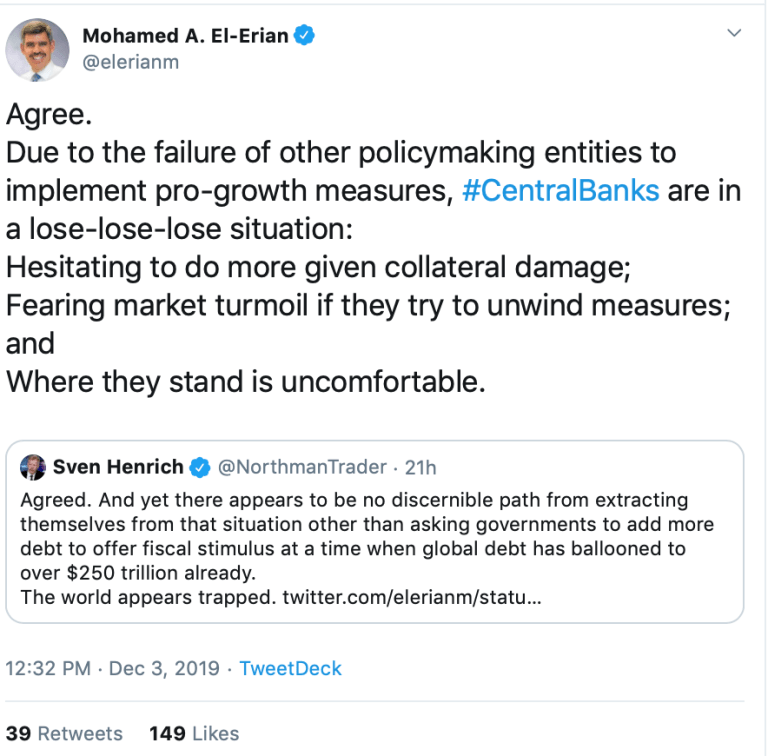

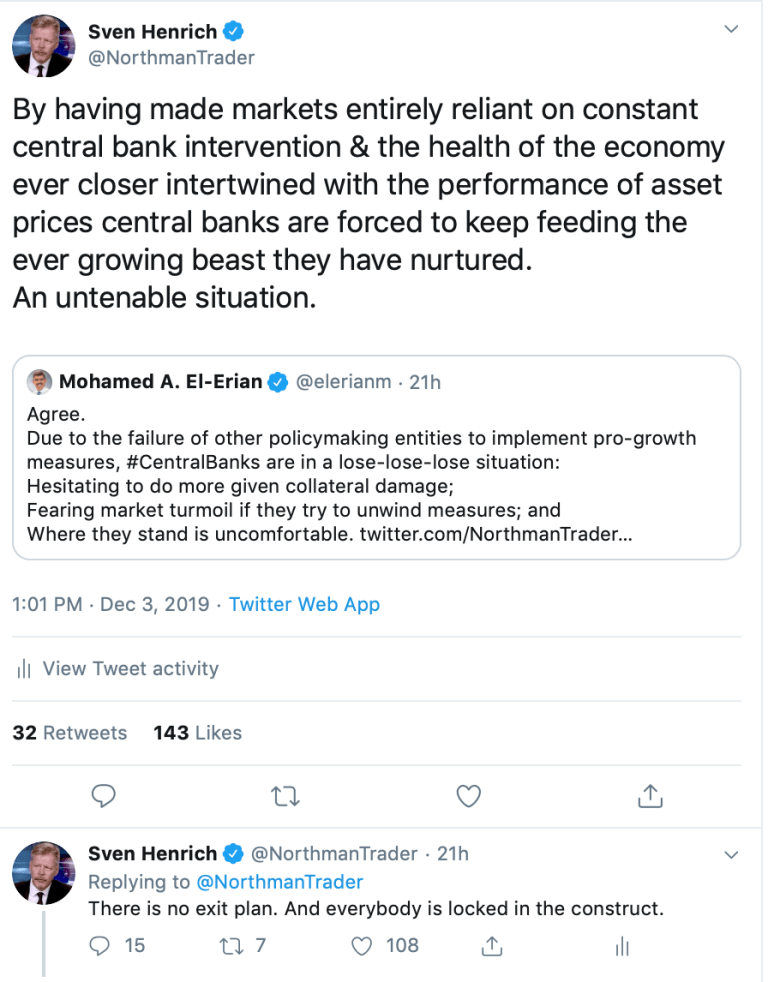

This week I had a twitter conversation with Mohammed El-Erian on that very subject. An industry giant he recognizes and affirms my view that central banks are not only trapped, but their entire construct is based on asset price inflation to stimulate growth but it’s no longer working.

Not sure how to best share the conversation as it was quote tweets back and forth so below are the self-explanatory screenshots and it started off with a dose of sarcasm from yours truly as it relates to the negative rates in place around the world as outlined by Mohammed El-Erian:

I suppose it all speaks for itself, but collateral damage, excessive reliance, fear of market sell-offs, fear of unwinding. All phrases that speak to the big trap we’re all in and a clear recognition of the artificiality of these markets.

Fear of market turmoil. And that describes the last 10 years, the constant interventions, the low rates, the QE, the not QE, the repos, everything. With no end in sight as our markets have devolved into this:

How markets work:

Incoming = Bad news

Leaves = Stocks

Net = Fedpic.twitter.com/eGNsMiaHfE— Sven Henrich (@NorthmanTrader) December 7, 2019

There is no escape from this. I keep making the point that the ECB can’t even raise rates to zero for fear of a meltdown.

Hence I keep mentioning how fragile this all must be underneath. What would markets and economies look like without the constant interventions? We get the occasional glimpses like December 2018, and they illustrate the potential power of the barbarians at the gate.

No wonder we see daily jawboning and interference at the slightest sign of trouble.

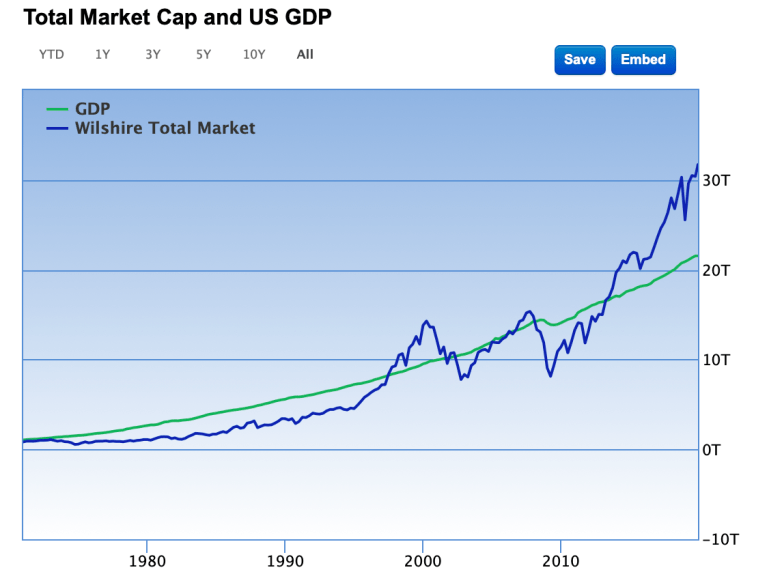

And hence everything keeps disconnecting from fundamental reality, be it market capitalization from GDP:

Or the corporate debt ticking time bomb disconnecting from the underlying earnings picture:

The last time corporate profits stagnated while corporate debt accelerated higher was during 2000 just before the recession in 2001. pic.twitter.com/W11DQQ4dJY

— Sven Henrich (@NorthmanTrader) December 7, 2019

If you are afraid of market sell-offs and aim to prevent markets from cleansing themselves you end up with an every further disconnected spiral. And this is what we’re seeing unfold.

The Fed is acting like we’re in a massive crisis, no really, they are:

So what’s the endgame here? This?

As the decade is coming to a close here’s a trend based forecast for the next decade. pic.twitter.com/PKmqvmAJhF

— Sven Henrich (@NorthmanTrader) December 6, 2019

It must be, as I’ve seen no central bank outline how they will ever normalize. Ever. They can’t. And in process they are exacerbating this asset bubble with potentially unfathomable consequences as it also relates to the trade war with China, a case well outlined by Andy Xie a former Managing Director with Morgan Stanley and a China expert:

“The Federal Reserve is prolonging the trade war, keeping the biggest financial bubble in history going – and risking the entire global system. The US economy is based on debt-financed overconsumption, while China’s is based on debt-financed overinvestment. They lean on each other for balance, like two one-legged men walking along with interlocking arms. The renminbi’s peg to the dollar is both the symbol and substance of this mutual dependence. If this relationship breaks, the world is likely to go into a prolonged adjustment to reach a new equilibrium.

The uncertainty in the world order is occurring amid the biggest bubble ever in the global financial world. Quantitative easing by China and the US in response to the 2008 crisis led to massive debt build-up and asset appreciation along the way.

As asset markets have become so large, relative to the real economy, their turbulence determines the economic outlook and not, as is normally the case, the other way around. This is why the Fed has cut interest rates during the trade war, even with unemployment at historic lows. It views the ensuing market turbulence as a threat to the economy. The Fed has gone from the financial bubble’s hostage to its guardian.”

And there you go, Xie in essence echoing what I’ve been saying as well. And yes, cutting rates at such low levels is a historic abomination:

If the Fed cuts rates 3 times and adds $300B to their balance sheet with unemployment at 3.5% imagine what they’ll do when it goes to 4%, 5%, 6%..or beyond…

That does happen on occasion you know.. pic.twitter.com/cWjg9abtIX

— Sven Henrich (@NorthmanTrader) December 6, 2019

No, enjoy this melt-up, but know it is a bubble and bubbles are dangerous when they pop so know when to get out.

Maintaining and expanding this bubble is now a matter of national security and it is directly managed by the Fed. But know they, and other central banks, have no other choice and no other solutions. They are trapped, and have trapped all of us, in a never ending cycle of debt expansion and ever lower rates.

As of now they maintain full control over the price narrative. But note the feverish pitch of their interventions, consider all that it takes to keep markets from selling off. “Fearing market turmoil”, desperate to keep things calm, it all reeks of the Fed being one sell off away from losing control.

When will we know they lose control? When they can’t stop a dip, when any bounces fail to make or sustain new highs, for then we may be faced with the great, and potentially sudden, unwind the Fed and all other central banks are so afraid of.

* * *

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

Tyler Durden

Sun, 12/08/2019 – 10:45

via ZeroHedge News https://ift.tt/38ladPN Tyler Durden