“A Crush Of Events”: Here Are The Top Highlights In This Juggernaut Of A Week

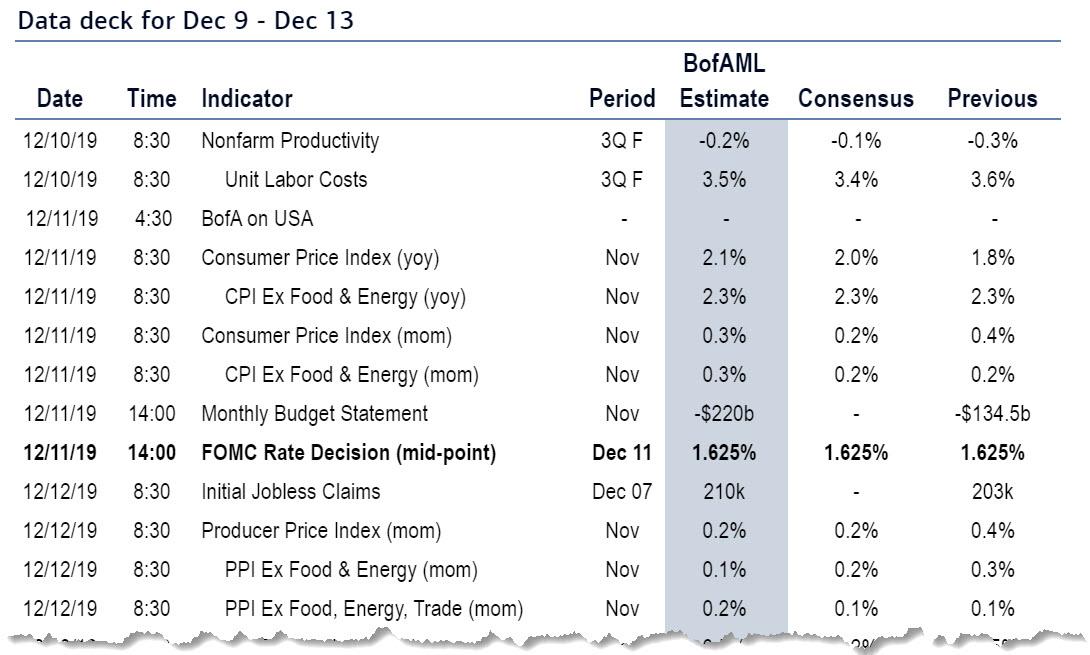

We have an action-packed week ahead, or as Bloomberg put it a “crush of events“, with the Trump impeachment entering its final phase, together with the U.K. election on Thursday. Central banks will also take center stage with a number of monetary policy meetings, most notably from the Fed (Wednesday conclusion) and the ECB (Thursday) where we will welcome convicted criminal Christine Lagarde to the stage for the first time. There is also a barrage of data releases to watch out for including US CPI (Wednesday) and retail sales (Friday), but trade might end up trumping (no pun intended) everything else as we build to Sunday’s, Dec 15, tariff escalation deadline.

Reviewing these in more detail now and first the U.K., DB’s Jim Reid notes that the weekend polls showed a wide spread of Tory leads from 6pts to 15pts but with the average edging back above 10pts after recently dipping below. A reminder that anything below a 6-7 point lead is around hung parliament territory. The bank’s UK team put out a note towards the end of last week in which they assess the policy stances of the parties in terms of the challenges facing the UK economy. They analyze the market implications of the different elections scenarios, ranging from a sizeable Conservative majority to a Labour majority, with various scenarios for a hung parliament in between. With cable soaring to the highest level since May, consensus is of a blowout Tory victory.

With regards to the FOMC mid week, the Fed are not expected to move policy by anyone but the meeting won’t be without interest as they will release the latest Summary of Economic Projections, with market participants focusing on the dot plot as usual for clues as to whether member’s rate biases are changing. Last Friday’s blockbuster payrolls number will likely give them some confidence in the outlook. While the data may fall short of alarming the Fed’s inflation hawks, it’s clear from Chairman Jerome Powell’s recent statements that his view of the economy is biased toward optimism – as a glass “more than half full.” There hasn’t been much in comments from Fed speakers to suggest they’ve downgraded projections for interest rates – which will be updated Wednesday – since September. At the time, the “dot plot” of policy makers’ views suggested that the majority see the next move as a hike rather than a cut, and most expect rates to remain on hold or move higher in 2020.

Regarding the ECB a day later on Thursday, although the market is similarly expecting no changes in interest rates, the meeting will be closely watched as it’s the first monetary policy decision since President Lagarde came to office. It’ll be interesting to see what she says in the subsequent press conference, and whether there are any updates on the upcoming strategic review. Deutsche Bank’s European economists write that they expect the Governing Council “will likely remain cautious and view the balance of risks as still tilted to the downside.” Yet they also say that they think Lagarde will make an immediate change, and they say that “we expect the willingness to use “all instruments” to be conditioned on an assessment of the possible side effects of policy.” Lastly on central banks, next week also sees monetary policy decisions from Brazil on Wednesday, Switzerland and Turkey on Thursday, and Russia on Friday.

Looking at the week’s key data releases, the main highlights comes from the CPI release on Wednesday and the retail sales figures on Friday. For the CPI, the consensus reading is expecting a +0.2% mom increase in both the main CPI and core CPI, while for retail sales a +0.4% mom increase is expected. DB economists suggest the gap between trimmed mean CPI and core CPI was 14bps in October, while the gap between the sticky CPI ex-shelter and core CPI was 19bps. These divergences are in the top 8% and 3% of historical experience, respectively. These gaps can be very useful in predicting the change in the month-over-month core CPI print the following month, implying a strong monthly core CPI print for November. As such, they expect November core CPI to rise +0.26% month-over-month.

Also don’t forget US politics where we have a barrage of events as follows:

- Monday: House Judiciary presentation of evidence

- Monday: IG report

- Wednesday: Senate Judiciary hearing on IG report

- Wednesday: Schiff/VP letter deadline

- Friday: SCOTUS conference on Trump cert petitions

- Articles of impeachment drafted

From Europe, the highlights include the Euro Area industrial production data on Thursday, which has seen a consistent yoy decline for every month since November 2018. The consensus is actually expecting this will deepen into October, with the yoy number falling to -2.2%, (vs. -1.7% in September). We’ve also got the ZEW survey from Germany tomorrow, which last month showed some signs of stabilisation, as the current situation reading rose to -24.7, having been at a 9-year low the previous month. The expectations reading also rose to a 6-month high. Lastly on Tuesday we’ll get the monthly GDP data from the UK for October.

Back in Germany, the SPD conference over the weekend saw the party’s new leaders strike a more emollient tone on whether or not to stay in the coalition, with co-chairwoman Saskia Esken saying that “if there is a willingness to talk there’s always the chance to keep going”. They have released a list of demands they want to see implemented however, including a €12 per hour minimum wage, further action on climate change, and more investment spending. Whether their coalition partners in the CDU will agree to this is another matter, however, and CDU leader Annegret Kramp-Karrenbauer said that “This coalition is for the country, not trauma therapy for ruling parties”. One opinion poll out from Forsa put the Social Democrats on 11%, at a joint-record low, although an Emnid poll out over the weekend put them up 1pt to 16%

As Bloomberg adds, the events this week will determine the macroeconomic backdrop heading into the new year, but the question for investors is how much of the real action next week is already baked in. For Kathy Jones at Charles Schwab the more pressing issue remains U.S.-China trade talks. The big catalyst for risk appetite and significantly higher yields in one of the last actively traded weeks of the year would be a credible signal that the U.S. will forgo the additional tariffs it’s threatening to impose on Chinese goods on Dec. 15, she said.

“We do have a confluence of things next week and there’s a good likelihood that yields will rise — but will they just rip higher?” said Jones. “You’d need some really surprisingly good news on the trade war.” Global growth headwinds from trade friction have helped pull benchmark U.S. 10-year yields down about 80 basis points in 2019, driving Treasuries to a 7.3% return this year through Dec. 5. It’s shaping up to be the best annual performance since 2011.

Below is a day-by-day calendar of events, courtesy of Bloomberg

Monday

- Data: Germany October trade balance, Canada November housing starts, October building permits

- Politics: French President Macron hosts meeting on Ukraine in Paris with Russian President Putin, German Chancellor Merkel and Ukranian President Zelensky

Tuesday

- Data: China November CPI, PPI, Japan November preliminary machine tool orders, France October industrial production, Italy October industrial production, UK October GDP, industrial production, trade balance, Germany December Zew survey, US NFIB small business optimism index, final Q3 nonfarm productivity, unit labour costs, Japan November PPI

- Central Banks: ECB’s Visco, Perrazzelli speak

- Politics: New Argentinian president Alberto Fernández takes office

Wednesday

- Data: US weekly MBA mortgage applications, November CPI, Core CPI, monthly budget statement, Canada Q3 capacity utilisation rate, Japan October core machine orders

- Central Banks: Federal Reserve decision, Brazil central bank decision

Thursday

- Data: Germany final November CPI, France final November CPI, Italy Q3 unemployment rate, Euro Area October industrial production, US November PPI, weekly initial jobless claims, Canada October new housing price index, Japan Q4 Tankan surveys

- Central Banks: ECB policy decision, Swiss National Bank policy decision, Central Bank of Turkey policy decision, BoJ’s Amamiya and Bank of Canada’s Poloz speak

- Politics: UK General election, European Council summit held

Friday

- Data: Japan final October industrial production, October capacity utilisation, Italy October industrial sales, industrial orders, US November import price index, export price index, retail sales, October business inventories

- Central Banks: Russia central bank decision, ECB’s Holzmann, Fed’s Williams speak

- Politics: European Council summit continues

Finally, looking at just the US, Goldman notes that the key event this week is the December FOMC meeting with the release of the statement and Summary of Economic Projections at 2:00PM ET on Wednesday, followed by Chair Powell’s press conference at 2:30 PM. The key economic data releases this week are the CPI report on Wednesday and the retail sales report on Friday.

Monday, December 9

- There are no major economic data releases scheduled today.

Tuesday, December 10

- 06:00 AM NFIB small business optimism, November (consensus 103.0, last 102.4)

- 08:30 AM Nonfarm productivity, Q3 final (GS -0.1%, consensus -0.1%, last -0.3%); Unit labor costs, Q3 final (GS +3.0%, consensus +3.4%, last +3.6%): We estimate nonfarm productivity was revised up by two tenths to -0.1% in Q3. We estimate growth in Q3 unit labor costs – compensation per hour divided by output per hour – was revised down to +3.0% in Q3 reflecting a downward revision to employee compensation.

Wednesday, December 11

- 08:30 AM CPI (mom), November (GS +0.23%, consensus +0.2%, last +0.4%); Core CPI (mom), November (GS +0.22%, consensus +0.2%, last +0.2%); CPI (yoy), November (GS +2.01%, consensus +2.0%, last +1.8%); Core CPI (yoy), November (GS +2.30%, consensus +2.3%, last +2.3%): We estimate a 0.22% increase in November core CPI (mom sa), which would leave the year-on-year rate unchanged at 2.3%. Our monthly core inflation forecast reflects another strong used car reading, a modest boost from tariffs, and a partial rebound in the apparel category reflecting the unwind of residual seasonality. We also expect a pickup in shelter inflation, as the four-year-low pace in October is at odds with the message from alternative rent sources. We estimate a 0.23% increase in headline CPI (mom sa), reflecting higher energy prices.

- 02:00 PM FOMC statement, December 10-11 meeting: As discussed in our FOMC preview, we do not expect any change in the funds rate. We expect the statement to signal that the current stance of policy is “likely to remain appropriate,” and we also look for a vast majority of the 2020 dots to show a stable policy rate. In the press conference, we expect Chair Powell to project a vigilant and data-dependent view on the outlook, while emphasizing that the bar for a policy move in either direction is high.

Thursday, December 12

- 08:30 AM PPI final demand, November (GS +0.2%, consensus +0.2%, last +0.4%); PPI ex-food and energy, November (GS +0.1%, consensus +0.2%, last +0.3%); PPI ex-food, energy, and trade, November (GS +0.1%, consensus +0.2%, last +0.1%): We estimate that headline PPI increased 0.2% in November, reflecting stronger energy prices and somewhat softer core prices. We expect a 0.1% increase in the core measure excluding food and energy, and also a 0.1% increase in the core measure excluding food, energy, and trade.

- 08:30 AM Initial jobless claims, week ended December 7 (GS 215k, consensus 212k, last 203k); Continuing jobless claims, week ended November 30 (consensus 1,677k, last 1,693k): We estimate jobless claims rebounded by 12k to 215k in the week ended December 7, following a cumulative 25k decline in the prior two weeks.

Friday, December 13

- 08:30 AM Retail sales, November (GS +0.7%, consensus +0.4%, last +0.3%); Retail sales ex-auto, November (GS +0.5%, consensus +0.3%, last +0.2%); Retail sales ex-auto & gas, November (GS +0.4%, consensus +0.4%, last +0.1%); Core retail sales, November (GS +0.4%, consensus +0.3%, last +0.3%): We estimate that core retail sales (ex-autos, gasoline, and building materials) increased 0.4% in November (mom sa), reflecting solid holiday sales results, particularly online. We also estimate a 0.7% increase in the headline measure, and a 0.5% increase in the ex-auto measure, reflecting a rebound in auto sales and a rise in gas prices.

- 08:30 AM Import price index, November (consensus +0.2%, last -0.5%)

- 10:00 AM Business inventories, October (consensus +0.2%, last flat)

- 11:00 AM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will discuss monetary policy in a student lecture at Borough of Manhattan Community College in New York. Audience Q&A is expected.

Source: Deutsche Bank, BofA, Goldman

Tyler Durden

Mon, 12/09/2019 – 09:39

via ZeroHedge News https://ift.tt/2Rz4WOM Tyler Durden